You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

On vulnerable batteries, Canada’s about face, and France’s double down

Current conditions: New York City is digging out from upward of six inches of snow • Storm Emilia is deluging Spain with as much as 10 inches of rain • South Africa and Southern Australia are both at high risk of wildfires.

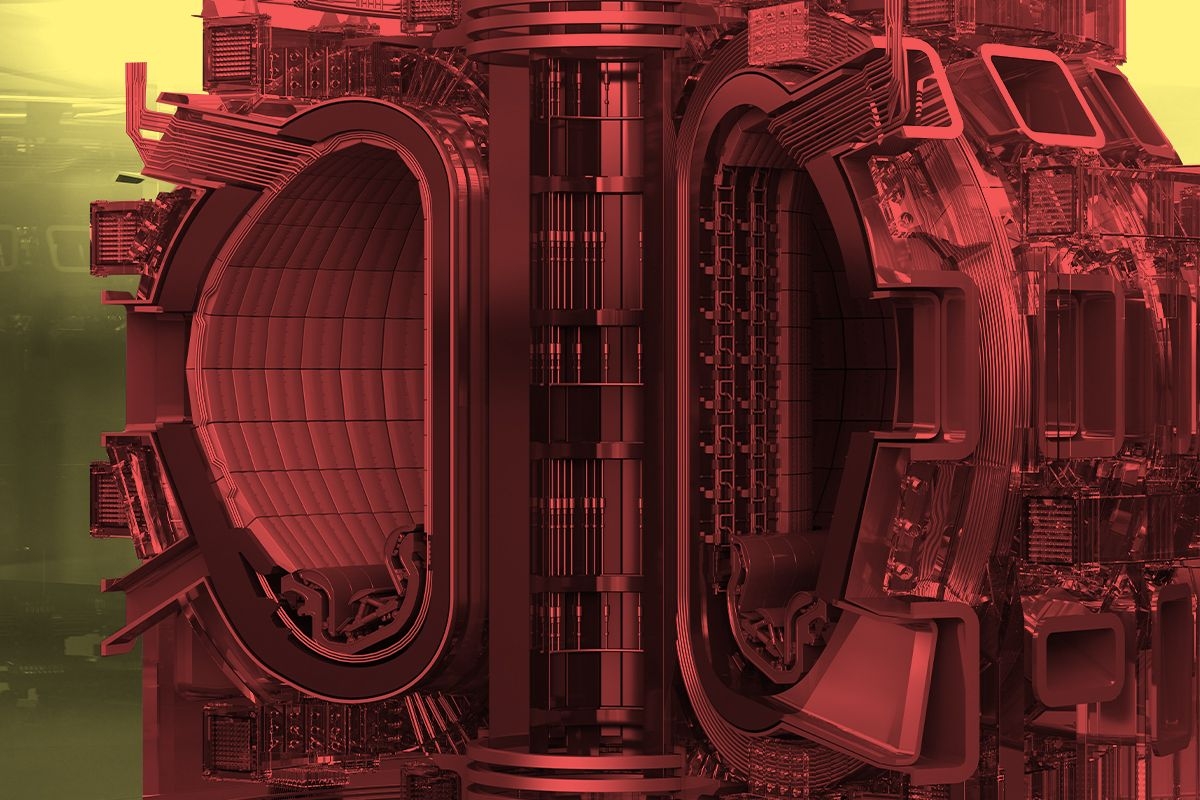

Last month, I told you about China’s latest attempt at fusion diplomacy, uniting more than 10 countries including France and the United Kingdom in an alliance to work together on the holy grail energy source. Over the weekend, The New York Times published a sweeping feature on China’s domestic fusion efforts, highlighting just how much Beijing is outspending the West on making the technology long mocked as “the energy source of tomorrow that always will be” a reality today. China went from spending nothing on fusion energy in 2021 to making investments this year that outmatch the rest of the world’s efforts combined. Consider this point of comparison: The Chinese government and private investors poured $2.1 billion into a new state-owned fusion company just the summer. That investment alone, the Times noted, is two and half times the U.S. Department of Energy’s annual fusion budget.

Still, the race between the two countries is heating up. Cumulative investment in fusion energy soared 30% between June and September to $15 billion, up from a little over $11 billion, according to a report by the European Union’s F4E Fusion Observatory written up by NucNet. That fusion is, as Heatmap's Katie Brigham has written, “finally, possibly, almost” arriving at the same time that data centers to power artificial intelligence are driving up electricity demand is fortuitous. Or, it would be, if AI doesn’t end up proving to be inflated by hype. On Friday, Wall Street showed jitters over the possibility that the bubble may burst, sending shares of companies such as Oracle and Nvidia plunging. It begs the question Katie raised in another story in September: What if we get fusion, but we don’t need it?

The South Korean battery manufacturer SK On canceled its partnership to work on electric vehicles with the Ford Motor Company, throwing the fate of the two companies’ three factories in the American Southeast into jeopardy. The announcement, E&E News reported, also casts doubt over the $9.6 billion loan the Biden administration gave the joint venture, known as Blue Oval SK. The collaboration came as American automakers teamed up with Korean battery companies to hasten the establishment of an EV supply chain. General Motors inked a deal with LG Energy Solution and Ford with SK On. But as sales of EVs flatline — due in part to President Donald Trump axing the federal tax credit for purchases of new electric vehicles — the nascent supply networks are withering on the vine. Ford isn’t down for the count, however. In August, as I wrote in the newsletter at the time, the company unveiled what it billed as its “Model T moment” for EVs, a whole new assembly line structure meant to scale up and iron out production of battery-powered cars.

Prime Minister Mark Carney has scrapped Canada’s carbon tax, inked major oil and gas deals, and pumped the brakes on a scheme to boost electric vehicle sales. Now the leader of the Liberal Party is facing blowback from allies and sustainability-minded executives who say the reversals put Canada’s net-zero goals out of reach. The former environment minister, Steven Guilbeault, quit the cabinet in protest, as have two founding members of the federal government’s Net Zero Advisory Body. “From a climate-science standpoint, this risks undermining the urgency of emissions reduction,” Paul Polman, the former chief executive of home-goods giant Unilever and a campaigner for sustainable capitalism, told the Financial Times. “Betting heavily on unproven massive-scale CCS [carbon capture and storage] and a cleaner-oil narrative while accelerating production ... seems like a gamble with global emissions targets, and with the credibility of net zero by 2050. Gambling with firm science does not seem smart to me.”

Sign up to receive Heatmap AM in your inbox every morning:

Utility-scale battery storage systems are facing increased risk of cyberattack from hackers working either for governments or criminal groups. That’s according to a white paper from the consultancies Brattle Group and Dragos. Battery deployments are expected to grow by as much as 45% in the next five years, raising the need for new protections against digital meddling. “Battery storage systems are being used across the grid to enable the deployment of variable demand sources such as solar and wind,” Phil Tonkin, field chief technology officer at Dragos, told Utility Dive’s sister publication Cybersecurity Dive. “This growing dependence makes them an attractive target.” Even relatively small-scale attacks can have devastating consequences. A single outage involving a 100-megawatt system for four hours in the U.S. would cost up to $1.2 million in revenue, the report found. A large-scale cyber attack that takes out 3,000 megawatts for a day would take a $39 million toll on the economy. Dragos is currently tracking as many as 18 groups that “are known to pose a threat to the electrical grid.”

Canada may be taking a U turn on climate policy, but France just updated its National Low-Carbon Strategy with an end date for using fossil fuels. The document “foresees the end of oil use between 2040 and 2045,” France24 reported, with natural gas phasing out by 2050. France is far ahead of most developed countries toward decarbonizing its power system since the nation has generated the majority of its electricity from nuclear reactors since the late 20th century. Under the plan, the French government expected electricity consumption to increase as heat pumps replace furnaces and electric vehicles swap in for diesel cars. Renewables are expected to cover the increase in electricity production.

Conspiracy theorists who think condensation trails from airplanes are some kind of population-control chemical may have their hands full with the paranoia fodder that geoengineering efforts represent. But actual scientists at Leipzig University have made a discovery about contrails’ effect on warming. The researchers found that “hidden” contrails within naturally forming cirrus clouds — previously not factored into assessments — contribute up to 10% of the warming all contrails cause. “We now know that not only the visible contrails we see in the sky but also those that form within clouds need to be taken into account when assessing the impact of aviation on the climate,” Torsten Seelig, the study's lead author, said in a statement.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The FREEDOM Act aims to protect energy developments from changing political winds.

A specter is haunting permitting reform talks — the specter of regulatory uncertainty. That seemingly anodyne two-word term has become Beltway shorthand for President Donald Trump’s unrelenting campaign to rescind federal permits for offshore wind projects. The repeated failure of the administration’s anti-wind policies to hold up in court aside, the precedent the president is setting has spooked oil and gas executives, who warn that a future Democratic government could try to yank back fossil fuel projects’ permits.

A new bipartisan bill set to be introduced in the House Tuesday morning seeks to curb the executive branch’s power to claw back previously-granted permits, protecting energy projects of all kinds from whiplash every time the political winds change.

Dubbed the FREEDOM Act, the legislation — a copy of which Heatmap obtained exclusively — is the latest attempt by Congress to speed up construction of major energy and mining projects as the United States’ electricity demand rapidly eclipses new supply and Chinese export controls send the price of key critical minerals skyrocketing.

Two California Democrats, Representatives Josh Harder and Adam Gray, joined three Republicans, Representatives Mike Lawler of New York, Don Bacon of Nebraska, and Chuck Edwards of North Carolina, to sponsor the bill.

While green groups have criticized past proposals to reform federal permitting as a way to further entrench fossil fuels by allowing oil and gas to qualify for the new shortcuts, Harder pitched the bill as relief to ratepayers who “are facing soaring energy prices because we’ve made it too hard to build new energy projects.”

“The FREEDOM Act delivers the smart, pro-growth certainty that critical energy projects desperately need by cutting delays, fast-tracking approvals, and holding federal agencies accountable,” he told me in a statement. “This is a common sense solution that will mean more energy projects being brought online in the short term and lower energy costs for our families for the long run.”

The most significant clause in the 77-page proposal lands on page 59. The legislation prohibits federal agencies and officials from issuing “any order or directive terminating the construction or operation of a fully permitted project, revoke any permit or authorization for a fully permitted project, or take any other action to halt, suspend, delay, or terminate an authorized activity carried out to support a fully permitted project.”

There are, of course, exceptions. Permits could still be pulled if a project poses “a clear, immediate, and substantiated harm for which the federal order, directive, or action is required to prevent, mitigate, or repair.” But there must be “no other viable alternative.”

Such a law on the books would not have prevented the Trump administration from de-designating millions of acres of federal waters to offshore wind development, to pick just one example. But the legislation would explicitly bar Trump’s various attempts to halt individual projects with stop work orders. Even the sweeping order the Department of the Interior issued in December that tried to stop work on all offshore wind turbines currently under construction on the grounds of national security would have needed to prove that the administration exhausted all other avenues first before taking such a step.

Had the administration attempted something similar anyway, the legislation has a mechanism to compensate companies for the costs racked up by delays. The so-called De-Risking Compensation Fund, which the bill would establish at the Treasury Department, would kick in if the government revoked a permit, canceled a project, failed to meet deadlines set out in the law for timely responses to applications, or ran out the clock on a project such that it’s rendered commercially unviable.

The maximum payout is equal to the company’s capital contribution, with a $5 million minimum threshold, according to a fact-sheet summarizing the bill for other lawmakers who might consider joining as co-sponsors. “Claims cannot be denied based on project permits or energy technology type,” the document reads. A company that would have benefited from a payout, for example, would be TC Energy, the developer behind the Keystone XL oil pipeline the Biden administration canceled shortly after taking office.

Like other permitting reform legislation, the FREEDOM Act sets new rules to keep applications moving through the federal bureaucracy. Specifically, it gives courts the right to decide whether agencies that miss deadlines should have to pay for companies to hire qualified contractors to complete review work.

The FREEDOM Act also learned an important lesson from the SPEED Act, another bipartisan bill to overhaul federal permitting that passed the House in December but has since become mired in the Senate. The SPEED Act lost Democratic support — ultimately passing the House with just 11 Democratic votes — after far-right Republicans and opponents of offshore wind leveraged a special carveout to continue allowing the administration to commence its attacks on seaborne turbine projects.

The amendment was a poison pill. In the Senate, a trio of key Democrats pushing for permitting reform, Senate Energy and Natural Resources ranking member Martin Heinrich, Environment and Public Works ranking member Sheldon Whitehouse, and Hawaii senator Brian Schatz, previously told Heatmap’s Jael Holzman that their support hinged on curbing Trump’s offshore wind blitz.

Those Senate Democrats “have made it clear that they expect protections against permitting abuses as part of this deal — the FREEDOM Act looks to provide that protection,” Thomas Hochman, the director of energy and infrastructure policy at the Foundation for American Innovation, told me. A go-to policy expert on clearing permitting blockages for energy projects, Hochman and his center-right think tank have been in talks with the lawmakers who drafted the bill.

A handful of clean-energy trade groups I contacted did not get back to me before publication time. But American Clean Power, one of the industry’s dominant associations, withdrew its support for the SPEED Act after Republicans won their carveout. The FREEDOM Act would solve for that objection.

The proponents of the FREEDOM Act aim for the bill to restart the debate and potentially merge with parts of the previous legislation.

“The FREEDOM Act has all the critical elements you’d hope to see in a permitting certainty bill,” Hochman said. “It’s tech-neutral, it covers both fully permitted projects and projects still in the pipeline, and it provides for monetary compensation to help cover losses for developers who have been subject to permitting abuses.”

Maybe utilities’ “natural monopoly” isn’t so natural after all.

Debates over electricity policy usually have a common starting point: the “natural monopoly” of the transmission system, wherein the poles and wires that connect power plants to homes and businesses have exclusive franchises in a certain territory and charge regulated rates to access them.

The thinking is that without a monopoly franchise, no one would make the necessary capital expenditures to build and maintain the power lines and grid infrastructure necessary to connect the whole system, especially if they thought someone would build a new transmission line nearby. So while a government body oversees investment and prices, the utility itself is not subject to market-based competition.

But what if someone really did want to build their own wires?

“There are at least two of us who do not think that electricity is a natural monopoly,” Glen Lyons, the founder of Advocates for Consumer Regulated Electricity, told me.

The other one is Travis Fisher, an energy scholar at the Cato Institute, who corrected his friend and colleague.

“Between me, and Joseph Schumpeter, and Wayne Cruz, and Glen Lyons, there’s at least four of us. Only three of us are alive,” Fisher said, referencing the Austrian economist Schumpeter, who died in 1950, and the libertarian scholar Cruz, who was a critic of the restructuring of the electricity market in the 1990s.

Fisher and Lyons, however, are the team behind a proposal put out on Tuesday by the libertarian Cato Institute calling for “consumer-regulated electricity.” Instead of a transmission system with a monopoly franchise that independent generators can connect to and sell power to utilities in a process regulated by a combination of a public utility commission and regional transmission organization or independent system operators, CRE systems would be physically islanded electricity systems that customers would privately and voluntarily sign up for.

Crucially, CRE would not be regulated under existing federal law, and would have no connection to the existing grid, allowing for novel price structures and even physical set-ups, like running on different frequencies or even direct current, Fisher said.

They would also, Fisher and Lyons argue, help solve the dilemma haunting electricity policymakers: how to bring new load on the grid quickly without saddling existing ratepayers with the cost of paying for utility upgrades.

“If enabled, CRE utilities would generate, transmit, and sell electricity directly to customers under voluntary contracts, without interconnecting to the existing regulated grid or seeking permission from economic regulators at the state or federal level,” the Cato proposal reads.

This idea has a natural audience among political conservatives, as it’s essentially a bet that more entrepreneurship and less regulation will solve some of our biggest energy system problems. On the other hand, utilities tend to be a powerful force in conservative politics at both the state and federal levels, which is one reason why these kinds of ideas are still marginal.

But less marginal than they have been.

Consumer-regulated electricity is more than just another think tank white paper. It has also won the approval of the influential American Legislative Exchange Council, better known as ALEC, a conservative group that writes model legislation for state legislatures to adopt. Fisher proposed version of the consumer-regulated utilities plan to the network in December of last year, and ALEC approved it in January.

A few days after the group finalized the model policy to allow CRE at the state level, Arkansas Senator Tom Cotton proposed his own version in the form of the DATA Act, which would “amend the Federal Power Act to exempt consumer-regulated electric utilities from Federal regulation.”

While the CRE proposal is a big conceptual departure from about a century of electricity regulation, the actual reform is modest. Fisher and Lyons propose a structure would apply solely to “sophisticated customers … who voluntarily contract for service and can manage their own risks,” i.e. big industrial users like data centers, not your home.

While this sounds like behind the meter generation, whereby large electricity users such as, say, xAI in Memphis, simply set up their own electricity plants, CRE goes further. The idea is to capture the self-regulation benefits of building your own power within a structure that still allows for the economies of scale of a grid. Or in the words of Cato’s proposal, CRE “would enable third-party utilities to serve many customers, resulting in lower costs, higher reliability, and a smaller environmental footprint compared to self-supply options.”

Fisher and Lyons argue that CRE would also have an advantage over so-called co-location, where data centers are built adjacent to generation and share interconnection with the grid, which still requires interacting with public utility commissions and utilities. The pair have also suggested that the Department of Energy and the Federal Energy Regulatory Commission use its existing rulemaking process on data center interconnection to encourage states to pass the necessary laws to allow islanded utility systems.

While allowing totally private utility systems may be a radical — and certainly a libertarian — departure from the utility regulation system as it exists today, proposals are popping up on both the left and the right to try to reduce utility influence over the electricity system.

Tom Steyer, the hedge fund billionaire and climate investor who is running for governor of California, has said that he would “break up the utility monopolies to lower electric bills by 25%.” In a January press conference, Steyer clarified that he “wants to force utility companies to choose cheaper ways of wildfire-proofing their infrastructure and give customers other options for buying power, including making it easier to build neighborhood-level solar projects or allowing more communities to operate their own local grids,” according to CalMatters. California already has some degree of retail choice, although a more expansive version of a retail competition model infamously collapsed during the 2001 rolling blackouts.

To Fisher, while his and Lyons’ proposal is in some ways radical, it is also not a particularly big risk. If there’s truly no demand for private electricity networks, none will be built and nothing will change, even if there’s regulatory reform to allow for it.“I’m not surprised to see it get traction,” Fisher said of the plan, “just because there’s no downside, and the upside could be absolutely nothing — or it could be a breakthrough.”

On offshore wind wins, China’s ‘strong energy nation,’ and Japan’s deep-sea mining

Current conditions: Yet another snow storm is set to powder parts of the Ohio Valley and the Mid-Atlantic • Cyclone Fytia is deluging Madagascar, causing flooding that left at least three dead and 30,000 displaced in a country still reeling from the recent overthrow of its government • Scotland and England are bracing for a gusty 33-hour blizzard, during which temperatures are forecast to drop below freezing.

He’s fashioned the military’s Defense Logistics Agency into a tool to fund mineral refineries. He’s gone on a shopping spree that made Biden administration officials “jealous,” taking strategic equity stakes in more than half a dozen mining companies. Now President Donald Trump is preparing to launch a strategic stockpile for critical minerals in what Bloomberg billed as “a bid to insulate manufacturers from supply shocks as the U.S. works to slash its reliance on Chinese rare earths and other metals.” Dubbed Project Vault, the venture will be seeded with a $10 billion loan from the Export-Import Bank of the U.S. and another $1.67 billion in private capital. More than a dozen companies have committed to work on the stockpile, including General Motors, Stellantis, Boeing, Google, and GE Vernova.

The shale industry, meanwhile, showed it’s matured enough to go through some consolidation. Oklahoma City-based gas giant Devon Energy is merging with Houston-headquartered Coterra Energy in an all-stock deal that CNBC said would create “a large-cap producer with a top position in the Permian Basin. The deal would establish a combined company with an enterprise value of $58 billion, marking the largest merger in the sector since Diamondback bought Endeavor Energy Resources for $26 billion in 2024. The deal comes as low prices from the global oil glut squeeze U.S. shale drillers — and as the possibility of more oil from Venezuela threatens the sector with fresh competition.

Offshore wind is now five-for-five in its legal brawls with Trump. With Orsted’s latest victory in the Sunrise Wind case on Monday, I’ll let Heatmap’s Jael Holzman serve as the ring announcer spelling out the stakes of the legal victory: “If the government were to somehow prevail in one or more of these cases, it would potentially allow agencies to shut down any construction project underway using even the vaguest of national security claims. But as I have previously explained, that behavior is often a textbook violation of federal administrative procedure law.”

Germany is set to quadruple its installed solar capacity to 425 gigawatts by 2045, according to a forecast from a trade group representing utilities and grid operators. The projections, Renewables Now reported, mean the country needs to expand its transmission system. Installed onshore wind capacity should triple to around 175 gigawatts by that same year. Battery storage is on track to rise about 68 gigawatts, from roughly 2 gigawatts today. Demand is also set to grow. Data centers, which make up just 2 gigawatts of demand on the grid today, are forecast to balloon to nearly 37 gigawatts in the next 19 years.

Sign up to receive Heatmap AM in your inbox every morning:

In October, the Chinese Communist Party published the framework of its next Five-Year Plan, the 15th such industrial strategy. The National People’s Congress is set to formally approve the proposal next month. But on Monday, the energy analyst John Kemp called the latest five-word phrase, articulated in the form of “formal input” from the party’s Central Committee, “the most succinct statement of China’s energy policy.” Those words: “Building a strong energy nation.” The suggested edits from the committee described “accelerating the construction of a strong energy nation” as “extremely important and timely” and called its “main shortcomings” the ongoing reliance on imported oil and gas.

Unlike in the U.S., where the Trump administration is working to halt construction of renewables, the officials in Beijing boast that China’s “installed capacity of wind and solar has ranked first in the world for many consecutive years.” Like the U.S., the Central Committee pitched the plan as “an urgent requirement” for “gaining the initiative in great power competition.”

Japan is mounting a new push to implement a decade-old plan to extract rare earths from the ocean floor. A state-owned research vessel just completed a test mission to retrieve an initial sample of mineral-rich mud from a location 20,000 feet below the surface, the South China Morning Post reported. The government of Sanae Takaichi wants to start processing metal-bearing mud from the seabed for tests within a year. “It’s about economic security,” Shoichi Ishii, program director for Japan’s National Platform for Innovative Ocean Developments, told Bloomberg. “The country needs to secure a supply chain of rare earths. However expensive they may be, the industry needs them.”

With global negotiations over a licensing framework for legalizing deep sea mining in international waters has stalled, the U.S. just finalized a rule to speed up American permitting for the nascent sector, clearing the way for Washington to fulfill Trump’s pledge to go it alone if the United Nations’ International Seabed Authority didn’t act first.

A week after signing an historic trade agreement with the European Union, India has inked another deal with the U.S. That means the world’s two largest consumer markets are now wide open to Indian industry, which relies heavily on coal. New Delhi isn’t just going to scrap all those coal-fired factories and forges. But the government’s latest budget earmarks about $2.4 billion over five years to speed up deployment of carbon capture equipment across heavy industry, Carbon Herald reported. The plan focuses on steel, cement, power, refining, and chemicals.