You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

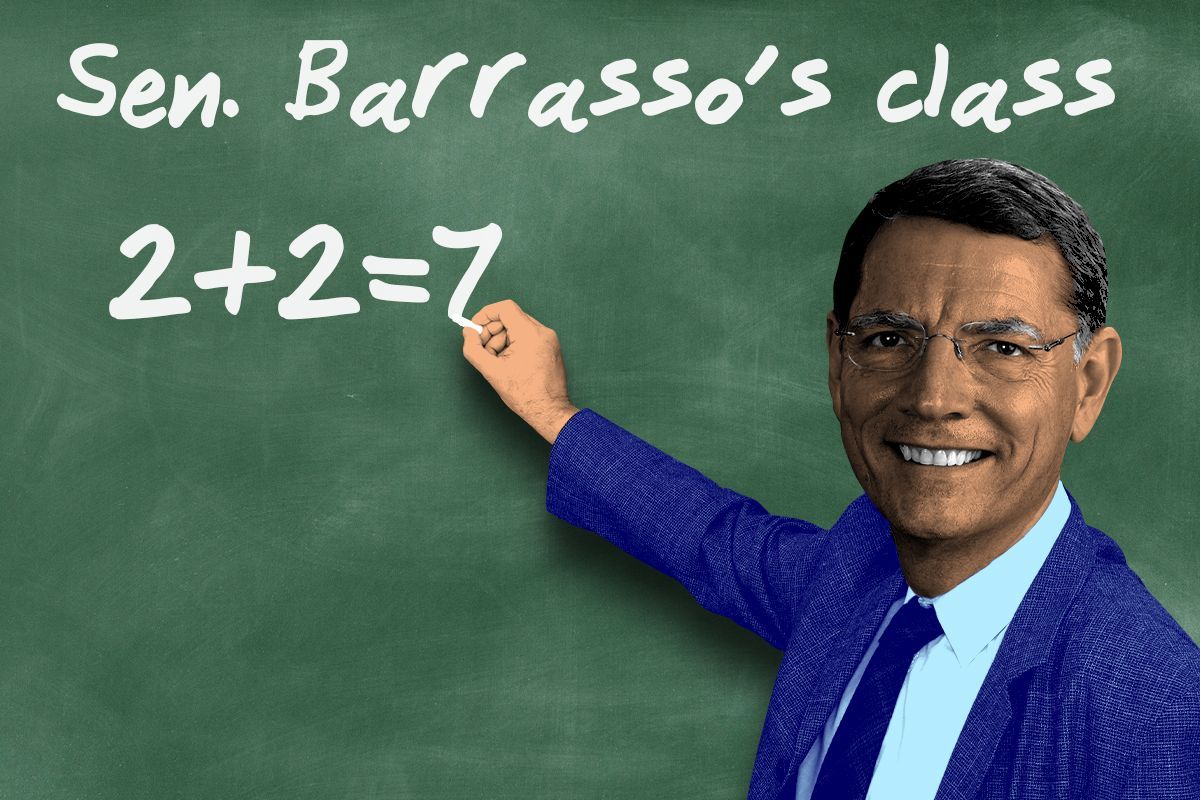

The math behind a $1,000 EV fee is specious to say the least.

When Elon Musk became a major backer of President Trump last year, some in the electric vehicle camp saw a glimmer of hope. Perhaps, with the CEO of the world’s top EV maker in his corner, Trump would soften some of his anti-electric rhetoric and come around on EVs.

Musk has been the most visible member of the new Trump regime during its chaotic first few weeks. Yet even with his outsized role, the new government’s pushback against electric vehicles continues full steam ahead. On Wednesday, Republican senators introduced double-barreled anti-EV legislation: The first bill would kill every kind of tax credit for buying electric, whether new, used, or lease, as well as incentives for charging stations. The second would place an extra tax of $1,000 on all EV purchases.

The first measure is no surprise given that Trump and the GOP have railed against EV incentives for years and promised to take the country back to the good old days of oil drilling. The second is, at least nominally, an attempt to tackle a legitimate question about the transition to electric vehicles — who pays to fix the roads — albeit with a solution that’s clearly meant to punish the kind of people who want to buy an electric car.

A federal gasoline tax of 18.4 cents per gallon helps fund highway maintenance, and states add their own taxes on top of that. But EV owners don’t buy gasoline, which means they don't contribute to road repair in this way. Economists have floated various solutions to make this situation more equitable and see EVs pay their fair share. States have tried more blunt tactics, such as tacking on hundreds of dollars to the cost of an electric car’s annual registration.

The senators’ proposed fix is to slap on a $1,000 fee to every electric vehicle purchase at the point of sale. The argument is that people who drive gas cars contribute about $100 in gas taxes annually, so charging EV buyers $1,000 brings in a decade’s worth of what they should be paying.

This is an unsophisticated and antagonistic answer to a serious question. The gas tax, while imperfect, at least has the effect of charging people based on how much they drive, which is correlated with how much wear and tear they cause to the public roads. It has the bonus of incentivizing people to drive lighter and more fuel-efficient vehicles. Charging per mile is trickier to do with EVs. The government could impose some kind of tax per kilowatt-hour at public charging stations, but most owners do most of their charging at home, where there’s no simple way to charge them more for the electricity that powers their car versus the juice that’s used for the refrigerator or the vacuum cleaner.

Charging EV drivers a flat thousand bucks at the point of sale, however, forces them to pay for a decade’s worth of taxes up front, something gasoline drivers would never be asked to do. It also presumes the buyer is going to keep the vehicle for at least 10 years, and includes no provision for any other scenario. (It’s not like the government is going to refund you $500 if you sell the vehicle after five years. You’re footing the bill for the second owner.)

Not that the bill’s proponents have any problem trotting out specious math. Senator Deb Fischer of Nebraska justified the dubious tax by arguing that “EVs can weigh up to three times as much as gas-powered cars, creating more wear and tear on our roads and bridges."

This is bogus. As Heatmap has noted numerous times, EV weight is a serious matter with implications for issues including pedestrian safety and tire wear. But “three times as much” is a reach that rests on an impressive feat of cherry-picking, akin to comparing a monstrous vehicle like the GMC Hummer EV to a Toyota Corolla. Here’s a more accurate comparison: The nation’s and the world’s top-selling EV, Tesla’s Model Y, has a curb weight of around 4,400 pounds. That’s almost exactly the same as the base curb weight of the Ford F-150 — which, by the way, is the most popular vehicle in Senator Fischer’s state of Nebraska.

As usual, the only substance at play is identity politics. There is a grown-up discussion to be had about taxing EVs, and whether they ought to enjoy benefits such as federal incentives and lower taxes because of the public good they create by lowering carbon emissions. What we continue to get instead is a naked attempt to punish the kinds of Americans who want to drive electric.

On some level, it still feels weird that all this is happening alongside Musk’s public turn as de facto U.S. president. But with so much power to influence the federal government, Tesla’s CEO has convinced himself he doesn’t have to care about the state of the EV market and whether ordinary Americans can afford his cars — at least, not while he’s puttering around the Oval Office and his company is reportedly winning $400 million contracts to build armored electric vehicles for Uncle Sam.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The new Nissan Leaf is joining a whole crop of new electric cars in the $30,000 range.

Here is an odd sentence to write in the year 2025: One of the most interesting electric vehicles on the horizon is the Nissan Leaf.

The Japanese automaker last week revealed new images and specs of the redesign it had teased a few months ago. The new Leaf, which will arrive in 2026, is a small crossover that’s sleeker than, say, a Tesla Model Y, but more spacious than the previous hatchback versions of the car. Nissan promises it will have a max range above 300 miles, while industry experts expect the company to target a starting price not too far above $30,000.

The updated Leaf won’t be one of those EVs that smokes a gas-powered sports car in a drag race, not with the 214 horsepower from that debut version and certainly not with the 174 horsepower from the cheaper version that will arrive later on. Its 150-kilowatt max charging speed lags far behind the blazing fast 350-kilowatt charging capability Hyundai is building into its Ioniq electric vehicles. But because it lacks some of these refinements, the new Nissan may arrive as one of the most compelling of the “affordable” EVs that are, finally, coming to drivers.

Not bad for a car that had become an electric afterthought.

The original Nissan Leaf was a revelation merely for its existence. Never mind that it was a lumpy potato derived from the uninspired Nissan Versa — here was the first mass-market electric car, heralding the age of the EV and welcomed with plenty of “car of the year” laurels at the dawn of the 2010s. Its luster would not last, however, as the arrival of the Tesla Model S a couple of years later stole the world’s attention. The second-generation Leaf that arrived in 2017 was an aesthetic and technological leap forward from its predecessor, with a range that topped 200 miles in its most advanced form. It was, for the time, a pretty good EV. Almost immediately, it was overshadowed by the introduction of Tesla’s Model 3 and Model Y, which catapulted Elon Musk’s company into complete dominance of the global EV market.

It took nearly a decade for Nissan (which fell into corporate mismanagement and outright crisis in the meantime) to update the stale and outdated Leaf. As a result, you might think the new version of the OG EV will arrive just in time to be outshone again. Yet the peculiar nature of the evolving electric car market has created an opportunity for the Leaf to finally grow and thrive.

There was a time when the mythical affordable Tesla could have taken the brand into the entry-level car market, and perhaps below the magic starting price of $30,000. But that has turned out to be a distraction dangled in front of fanboys and investors. In reality, Musk effectively killed the idea as he instead rolled out the Cybertruck and pivoted the company toward the dream of total vehicle autonomy.

Thanks to Tesla’s refusal to act like a normal car company, the affordable EV market is still there for the taking. Some are already in the game: Hyundai’s little Kona Electric starts at $33,000, and I’ve lauded Chevrolet for building a base version of the Equinox EV that starts around $35,000. In the next year or so, an influx of EVs in the $30,000 to $35,000 range might really change the game for electric-curious buyers.

The new Leaf is suddenly a big part of that mix. No, it won’t compete on price with a comparable combustion Nissan like the Kicks crossover that starts in the low $20,000s (not without the $7,500 tax credit, which would have made the new crop of affordable EVs directly cost-competitive with entry-level gas cars). The Leaf is likely to start just above $30,000, with the price creeping higher for buyers who opt for better performance or more range (and as I’ve noted numerous times, you ought to buy all the range you can afford if an EV is going to be your main car).

Arriving next year to compete with the Leaf is the new Chevy Bolt, another revival of an early EV icon. Experts expect a similar price range there. The anticipated Kia EV3 should come to America eventually with a starting cost around $35,000. The Jeff Bezos-backed Slate electric truck shocked the world with its promise of a bare-bones EV in the $20,000s — but, by the time the average buyer adds enough amenities to make it liveable, most Slate trucks will probably top $30,000.

Elon Musk may have abdicated his role as the Leaf’s antagonist via his refusal to build an affordable car, but erstwhile ally Donald Trump is poised to assume the role. Since the Leaf is slated to be built in Japan, the EV would be subject to whatever tariffs might be in place by the time it goes on sale next year. A 25% tariff, plus the federal government’s flip to punishing EVs with penalties instead of rewarding them with incentives, would kill the car’s value proposition in the U.S. Perhaps, then, it will become the next great affordable EV — for everybody else.

On life-threatening temperatures, New York’s nuclear ambitions, and cancelled clean energy projects

Current conditions: Monsoon conditions are bringing flash floods to New Mexico • A heat warning has been issued in Beijing as temperatures creep toward 100 degrees Fahrenheit • It's hot and dry in Tehran today as a tenuous ceasefire between Iran and Israel comes into effect.

New York Governor Kathy Hochul announced on Monday that she wants to bring new, public nuclear power back to the state. She directed the New York Power Authority, the state power agency, to develop at least 1 gigawatt of new nuclear capacity upstate. Hochul did not specify a design or even a location for the new plant, but based on a few clues in the press release and where Hochul chose to make the announcement, Heatmap’s Matthew Zeitlin speculates that the project could be a small modular reactor, specifically GE Hitachi’s BWRX-300, one of a handful of SMR designs vying for both regulatory approval and commercial viability in the U.S. “Canada’s Ontario Power Generation recently approved a plan to build one,” Zeitlin notes, “with the idea to eventually build three more for a total 1.2 gigawatts of generating capacity, i.e. roughly the amount Hochul’s targeting.”

The announcement comes at a time when the federal regulatory and tax balance is tipping toward nuclear. The Trump administration issued a fleet of executive orders looking to speed up nuclear construction and regulatory approvals, and Senate Republicans’ version of the mega budget reconciliation bill includes far more generous treatment of nuclear development compared to wind and solar.

The heat dome that’s moving slowly across the U.S. is bringing dangerous conditions to millions of Americans. Multiple cities across the Midwest and East Coast felt hotter than 100 degrees Fahrenheit yesterday, including Chicago, Nashville, and Raleigh. Roads buckled in Missouri. In New York’s Staten Island, the heat index hit 113 degrees. “This is life-threatening,” NYC Emergency Management said in a post on X. “At this level, the human body struggles to cool itself. Prolonged exposure or physical activity can quickly lead to heat stroke.” Power outages were reported in parts of the city. New York Mayor Eric Adams urged residents to help relieve the strain on the electric grid by avoiding using large appliances in the middle of the day, turning off lights, and limiting unnecessary air conditioning use. Wholesale energy prices soared as use skyrocketed. According to AccuWeather, more than 160 daily high temperature records could fall this week before things cool down Wednesday. Nearly 150 million people are affected by some kind of heat alert, and about 10% of the nation’s population will endure temperatures at or above 100 degrees today.

Get Heatmap AM directly in your inbox every morning:

About $1.4 billion in clean energy projects were cancelled last month as policy uncertainty mounts and the GOP’s budget reconciliation megabill hacks away at clean energy tax credits and permitting reform. According to a new report from clean energy business group E2, $15.5 billion in new factories and electricity projects have been nixed since the start of 2025, along with the 12,000 new jobs those projects were expected to create. “Republican congressional districts are losing the most,” the report finds. “More than $9 billion in investments and almost 10,000 jobs have been cancelled, delayed, or closed in Republican districts so far in 2025.”

The world added 741 gigawatts of renewable energy capacity last year, according to the new Renewables Global Status Report from Paris-based think tank REN21. That’s a new record, but it still falls far short of the COP28 goal to triple renewables capacity by 2030. In fact, “current trajectories suggest a shortfall of 6.2 terawatts – more than all renewables deployed to date,” the report finds. Here are some other key takeaways:

The Trump administration will roll back protections for nearly 60 million acres of pristine national forest, Agriculture Secretary Brooke Rollins announced Monday. Rescinding the 2001 “Roadless Rule” will open vast swathes of the nation’s forests — including Tongass National Forest in Alaska, which is North America’s largest temperate rainforest — to industrial activities. The administration called the rule “overly restrictive,” and said rolling it back will allow for better fire prevention and “responsible” timber production. The logging industry applauded the announcement; conservation groups condemned it. The rollback is likely to be challenged in court.

“I now believe that cleaning up methane leaks from the production and shipping of oil and gas — one of the most significant sources of these emissions — is the best hope we have to avoid triggering some of the most consequential climate tipping points in the next decade. I think realistically it is our only hope.” –Carl Pope, former executive director of the Sierra Club, on his biggest regrets as an environmentalist.

Reading between the lines of Governor Kathy Hochul’s big nuclear announcement.

With New York City temperatures reaching well into the 90s, the state grid running on almost two-thirds fossil fuels, and the man who was instrumental in shutting down one of the state’s largest sources of carbon-free power vying for a political comeback on Tuesday, New York Governor Kathy Hochul announced on Monday that she wants to bring new, public nuclear power back to the state.

Specifically, Hochul directed the New York Power Authority, the state power agency, to develop at least 1 gigawatt of new nuclear capacity upstate. While the New York City region hasn’t had a nuclear power plant since then-Governor Andrew Cuomo shut down Indian Point in 2021, there are three nuclear power plants currently operating closer to the 49th Parallel: Ginna, FitzPatrick, and Nine Mile Point, which together have almost 3.5 gigawatts of capacity and provide about a fifth of the state’s electric power,according to the nuclear advocacy group Nuclear New York. All three are now owned and operated by Constellation Energy, though FitzPatrick was previously owned by NYPA.

Hochul’s announcement did not specify a design or even a location for the new plant, but there were some hints. The press release describes “at least one new nuclear energy facility with no less than one gigawatt of electricity.” While 1 gigawatt is the capacity of a Westinghouse AP1000, the large, light-water reactor built at Plant Vogtle in Georgia, the explanation seems to leave room for the possibility of multiple, smaller plants.

Then there was where Hochul chose to make the announcement, in front of the monumental Robert Moses Niagara Power Plant, which, when it was built in 1961, was the largest hydropower plant in the western hemisphere. The release includes an intriguing reference to the country just on the other side of the river, saying that the plan “will allow for future collaboration with other states and Ontario, building on regional momentum to strengthen nuclear supply chains, share best practices, and support the responsible deployment of advanced nuclear technologies.”

To me at least, all this points to the possibility that we could actually be talking about a small modular reactor, specifically GE Hitachi’s BWRX-300, one of a handful of SMR designs vying for both regulatory approval and commercial viability in the U.S. Canada’s Ontario Power Generation recently approved a plan to build one, with the idea to eventually build three more for a total 1.2 gigawatts of generating capacity, i.e. roughly the amount Hochul’s targeting. The Tennessee Valley Authority, America’s largest public power provider, is also looking at building a BWRX-300. Whichever is completed first will become the first operating SMR in North America. (A NYPA spokesperson told me there has been “no determination on technology yet,” nor on location.)

There are a few policy conclusions we can draw from the announcement, as well, one being that Hochul has determined New York’s energy needs do not match up with its current, renewables-heavy energy roadmap set out more than five years ago. The 2019 Climate Leadership and Community Protection Act (signed by Cuomo) set out a goal for New York to supply 70% of its electricity with renewables by 2030; about a year ago, the Hochul administration said that it would likely not meet that target, which has only slipped farther from view under the Trump administration’s assault on the offshore wind industry, which was supposed to anchor the state’s renewables supply — especially near New York City, where land is scarce but shoreline is plentiful.

The new nuclear plan also has a distinctively upstate appeal, which is not surprising considering Hochul’s Buffalo roots. (She said during the announcement that she had visited the Niagara plant, which is just outside Buffalo, “so many times.”) The upstate power grid is less carbon intensive than the downstate grid and is due to receive much of the wind and solar development necessary to meet New York’s climate goals. But the northern reaches of the state are also more politically conservative and more rural, making it both an inviting target for renewables development and a potential wellspring of opposition.

“The fundamental challenge of wind, solar, and storage across upstate is that it’s subject to a lot of local opposition,” Ben Furnas, who served as director of the Mayor’s Office of Climate and Sustainability in New York City, told me. “Something that’s remarkable about nuclear power is that the land footprint is more modest.” (The NYPA spokesperson said that NYPA’s own plans for renewable development were not being altered.)

Nuclear power plants can also be economic lifelines — especially in rural areas — due to the permanent, high-paying jobs they support and direct economic benefits to the surrounding communities.

“There’s a lot of real win-win deals to be struck,” Furnas said. “It’s not an unknown, radical, alien notion. Plenty of people work in those plants and live near them. It’s a very different politics than what was happening in Hudson Valley around Indian Point,” where environmental groups like Riverkeeper (long associated with former Cuomo associate and current Secretary of Health and Human Services Robert F. Kennedy, Jr.), had worked for years to shut down the plant.

Monday’s nuclear announcement included supportive quotes not just from the usual suspects of state energy and environmental officials and union leaders, but also from the chief executive of Micron, which is set to start working on a semiconductor fabrication facility in the central part of the state. “A critical factor in the success of the semiconductor ecosystem is access to affordable, reliable energy. We commend New York State for advancing an all-of-the-above energy strategy — including nuclear power,” Micron CEO Sanjay Mehrotra said in a statement.

“To power this one facility, Micron is going to need so much power — so much incredible power — and there’s only one commercially viable option that can deliver that much clean, renewable, reliable power, and that’s what’s been operating in New York for decades: nuclear energy,” Hochul said Monday. “Harnessing the power of the atom is the best way to generate steady zero-emission electricity, and to help this transition.”

The mainstream environmental groups that supported the renewables-focused 2019 law (many of which either oppose nuclear power or are at best neutral towards it) were nowhere to be found during today’s announcement, however, and the plan has already drawn skepticism from some progressives.

Liz Krueger, a Manhattan Democrat who chairs the New York state senate’s finance committee, said in a statement that she had “significant concerns” about the nuclear plan, including its cost effectiveness, how to dispose of nuclear waste, the time required to site and build the project, whether other renewable options could fill the gap instead, and whether it has the “full informed consent from impacted communities.”

“I have yet to see any real-world examples of new nuclear development” that have met all these concerns, Krueger said. New York has a checkered history of nuclear development: Long Island ratepayers spent decadespaying for the completed but never operational Shoreham nuclear plant, whose costs ballooned by billions of dollars as construction dragged on from 1973 to 1984.

But the announcement comes at a time when the federal regulatory and tax balance is tipping toward nuclear regardless. The Trump administration issued a fleet of executive orders looking to speed up nuclear construction and regulatory approvals, and Senate Republicans’ version of the mega budget reconciliation bill includes far more generous treatment of nuclear development compared to wind and solar.

Public Power NY, an advocacy group that supports renewables development by NYPA, expressed skepticism about the nuclear plan in spite of these supportive signs.

“Hochul’s decision to step in based on promises from Donald Trump shows just how unserious she is about New Yorker’s energy bills and climate future. NYPA should be laser focused on rapidly scaling up their buildout of affordable solar and wind which is the only way to meet the state’s science-based climate goals and lower energy bills,” the group said in a statement.

For his part, Furnas was more pragmatic. “It’s really good that Governor Hochul is putting everything on the table when it comes to ensuring reliable generation for New York State and to meet clean air and carbon emission goals,” he said. “It would be foolish and unfortunate to not look at everything she can.”

Hochul herself appears determined to push through.

During the announcement, referring to the buzzing power plant behind her, Hochul said that “belief in sometimes impossible ideas” can bring people together. The power plant currently standing on that site was built in less than three years after an earlier plant on the Niagara collapsed. New nuclear power in New York may have seemed impossible, but it might still happen.