You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

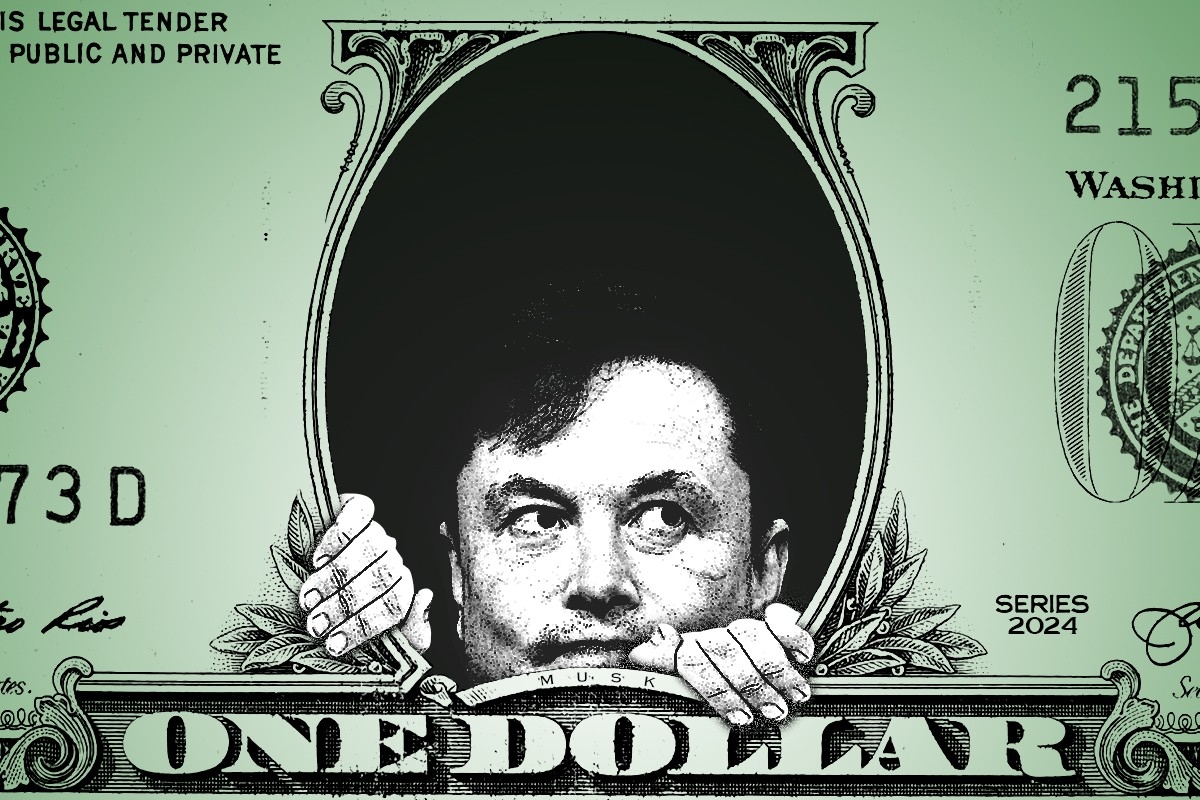

And four more things we learned from Tesla’s Q1 earnings call.

Tesla doesn’t want to talk about its cars — or at least, not about the cars that have steering wheels and human drivers.

Despite weeks of reports about Tesla’s manufacturing and sales woes — price cuts, recalls, and whether a new, cheaper model would ever come to fruition — CEO Elon Musk and other Tesla executives devoted their quarterly earnings call largely to the company's autonomous driving software. Musk promised that the long-awaited program would revolutionize the auto industry (“We’re putting the actual ‘auto’ in automobile,” as he put it) and lead to the “biggest asset appreciation in history” as existing Tesla vehicles got progressively better self-driving capabilities.

In other Tesla news, car sales are falling, and a new, cheaper vehicle will not be constructed on an all-new platform and manufacturing line, which would instead by reserved for a from-the-ground-up autonomous vehicle.

Here are five big takeaways from the company's earnings and conference call.

The company reported that its “total automotive revenues” came in at $17.4 billion in the first quarter, down 13% from a year ago. Its overall revenues of $21.3 billion, meanwhile, were down 9% from a year ago. The earnings announcement included a number of explanations for the slowdown, which was even worse than Wall Street analysts had expected.

Among the reasons Tesla cited for the disappointing results were arson at its Berlin factory, the obstruction to Red Sea shipping due to Houthi attacks from Yemen, plus a global slowdown in electric vehicle sales “as many carmakers prioritize hybrids over EVs.” The combined effects of these unfortunate events led the company to undertake a well-publicized series of price cuts and other sweeteners for buyers, which dug further into Tesla’s bottom line. Tesla’s chief financial officer, Vaibhav Taneja, said that the company’s free cash flow was negative more than $2 billion, largely due to a “mismatch” between its manufacturing and actual sales, which led to a buildup of car inventory.

The bad news was largely expected — the company’s shares had fallen 40% so far this year leading up to the first quarter earnings, and the past few weeks have featured a steady drumbeat of bad news from the automaker, including layoffs and a major recall. The company’s profits of $1.1 billion were down by more than 50%, short of Wall Street’s expectations — and yet still, Tesla shares were up more than 10% in after-hours trading following the shareholder update and earnings call.

The strange thing about Tesla is that it makes the overwhelming majority of its money from selling cars, but has become the world’s most valuable car company thanks to investors thinking that it’s more of an artificial intelligence company. It’s not uncommon for Tesla CEO Elon Musk and his executives to start talking about their Full Self-Driving technology and autonomous driving goals when the company’s existing business has hit a rough patch, and today was no exception.

Tesla’s value per share was about 33 times its earnings per share by the end of trading on Monday, comparable to how investors evaluate software companies that they expect to grow quickly and expand profitability in the future. Car companies, on the other hand, tend to have much lower valuations compared to their earnings — Ford’s multiple is 12, for instance, and GM’s is 6.

Musk addressed this gap directly on the company’s earnings call. He said that Tesla “should be thought of as an AI/robotics company,” and that “if you value Tesla as an auto company, that’s the wrong framework.” To emphasize just how much the company is pivoting around its self-driving technology, Musk said that “if somebody believes Tesla is not going to solve autonomy they should not be an investor in the company.”

One reason investors value Tesla so differently relative to its peers is that they do, actually, expect the company will make a lot of money using artificial intelligence. No doubt with that in mind, executives made sure to let everyone know that its artificial intelligence spending was immense: The company’s free cash flow may have been negative more than $2 billion, but $1 billion of that was in spending on AI infrastructure. The company also said that it had “increased AI training compute by more than 130%” in the first quarter.

“The future is not only electric, but also autonomous,” the company’s investor update said. “We believe scaled autonomy is only possible with data from millions of vehicles and an immense AI training cluster. We have, and continue to expand, both.”

Musk described the company’s FSD 12 self-driving software as “profound” and said that “it’s only a matter of time before we exceed the reliability of humans, and not much time at that.”

The biggest open question about Tesla is what would happen with its long-promised Model 2, a sub-$30,000 EV that would, in theory, have mass appeal. Reuters reported that the project had been cancelled and that Tesla was instead devoting its resources to another long-promised project, a self-driving ride-hailing vehicle called the “robotaxi.”

Musk tweeted that Reuters was “lying” but never directly denied the report or identified what was wrong with it, instead saying that the robotaxi would be unveiled in August. He later followed up to say that “going balls to the wall for autonomy is a blindingly obvious move. Everything else is like variations on a horse carriage.”

Before the call, Wall Street analysts were begging for a confirmation that newer, cheaper models besides a robotaxi were coming.

“If Tesla does not come out with a Model 2 the next 12 to 18 months, the second growth wave will not come,” Wedbush Securities analyst Dan Ives wrote in a note last week. “Musk needs to recommit to the Model 2 strategy ALONG with robotaxis but it CANNOT be solely replaced by autonomy.”

Anyone who expected to get their answers on today’s call, though, was likely kidding themselves.

Tesla announced today it had updated its planned vehicle line-up to “accelerate the launch of new models ahead of our previously communicated start of production in the second half of 2025,” and that “these new vehicles, including more affordable models, will utilize aspects of the next generation platform as well as aspects of our current platforms.” Musk added on the company’s earnings call that a new model would not be “contingent on any new factory or massive new production line.”

Some analysts attributed the share pricing popping after hours to this line, although it’s unclear just how new this new car would be.

Tesla’s shareholder update indicated that any new, cheaper vehicle would not necessarily be entirely new nor unlock massive new savings through an all-new production process. “This update may result in achieving less cost reduction than previously expected but enables us to prudently grow our vehicle volumes in a more capex efficient manner during uncertain times,” the update said.

Of the robotaxi, meanwhile, the company said it will “continue to pursue a revolutionary ‘unboxed’ manufacturing strategy,” indicating that just the ride-hailing vehicle would be built entirely on a new platform.

Musk also discussed how a robotaxi network could work, saying that it would be a combination of Tesla-operated robotaxis and owners putting their own cars into the ride-hailing fleet. When asked directly about its schedule for a $25,000 car, Musk quickly pivoted to discussing autonomy, saying that when Teslas are able to self-drive without supervision, it will be “the biggest asset appreciation in history,” as existing Teslas became self-driving.

When asked whether any new vehicles would “tweaks” or “new models,” Musk dodged the question, saying that they had said everything they had planned to say on the new cars.

One bright spot on the company’s numbers was the growth in its sales of energy systems, which are tilting more and more toward the company’s battery offerings.

Tesla said it deployed just over 4 gigawatts of energy storage in the first quarter of the year, and that its energy revenue was up 7% from a year ago. Profits from the business more than doubled.

Tesla’s energy business is growing faster than its car business, and Musk said it will continue to grow “significantly faster than the car business” going forward.

Revenues from “services and others,” which includes the company’s charging network, was up by a quarter, as more and more other electric vehicle manufacturers adopt Tesla’s charging standard.

Another speculative Tesla project is Optimus, which the company describes as a “general purpose, bi-pedal, humanoid robot capable of performing tasks that are unsafe, repetitive or boring.” Like many robotics projects, the most the public has seen of Optimus has been intriguing video content, but Musk said that it was doing “factory tasks in the lab” and that it would be in “limited production” in a factory doing “useful tasks” by the end of this year. External sales could begin “by the end of next year,” Musk said.

But as with any new Tesla project, these dates may be aspirational. Musk described them as “just guesses,” but also said that Optimus could “be more valuable than everything else combined.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Pennsylvania is out, Virginia wants in, and New Jersey is treating it like a piggybank.

The Regional Greenhouse Gas Initiative has been quietly accelerating the energy transition in the Mid-Atlantic and Northeast since 2005. Lately, however, the noise around the carbon market has gotten louder as many of the compact’s member states have seen rising energy prices dominate their local politics.

What is RGGI, exactly? How does it work? And what does it have to do with the race for the 2028 Democratic presidential nomination?

Read on:

The Regional Greenhouse Gas Initiative is a cap and trade market with roots in a multistate compact formed in 2005 involving Connecticut, Delaware, Maine, New Hampshire, New Jersey, New York, and Vermont.

The goal was to reduce emissions, and the mechanism would be regular auctions for emissions “allowances,” which large carbon-emitting electricity generators would have to purchase at auction. Over time, the total number of allowances in circulation would shrink, making each one more expensive and encouraging companies to reduce their emissions. The cap started at 188 million short tons of carbon and has been dropping steadily ever since, with an eventual target of under 10 million by 2037.

By the time of the first auction in 2008, six states were fully participating — Delaware, New Hampshire, New Jersey, and New York were out; Maryland, Massachusetts, and Rhode Island were in — and together they raised almost $39 million. By the second auction later that year, 10 states — the six from the previous auction, plus New York, New Jersey, New Hampshire, and Delaware — were fully participating.

Membership has grown and shrunk over the years (for reasons we’ll cover below) but the current makeup is the same as it was at the end of 2008.

When carbon pricing schemes were first dreamt up by economists, the basic thinking was that by taxing something bad (carbon emissions) you could reduce taxes on something good (like wages or income). Real existing carbon pricing schemes, however, have tended to put their proceeds toward further decarbonization rather than reducing taxes or other costs.

In the case of the RGGI, the bulk of revenue goes to fund state climate programs. About two-thirds of investments from RGGI revenues in 2023 went to energy efficiency programs, which have received 56% of the system’s cumulative investments. By contrast, 15% of the 2023 investments (and 15% of the all-time investments) went to “direct bill assistance,” i.e. lowering utility bills.

Carbon dioxide emissions from the power sector have fallen by 40% to 50% in the RGGI territory since the program began — faster than in the U.S. as a whole.

That’s in part because the areas covered by RGGI have seen some of the sharpest transitions away from coal-fired power. New England, for instance, saw its last coal plant shut down late last year.

But it’s not always easy to figure out what was the effect of RGGI versus broader shifts in the energy industry. In the emissions-trading system’s early years, allowance prices were very low, and actual emissions fell well below the cap. That was largely due to factors affecting the country as a whole, including sluggish demand growth for electricity. The fracking boom also sent natural gas prices plunging, accelerating the switch from coal to gas and decelerating carbon dioxide emissions from the power sector (although this effect may have been more limited in the RGGI region, much of which has insufficient natural gas pipeline capacity).

That said, RGGI still might have helped tip the scales, Dallas Burtraw, a senior fellow at Resources for the Future, told me.

“It takes only a modest carbon price to really push out coal,” he said, pointing to the experience of RGGI and arguing that it could be replicated in other states. A 2016 paper by Man-Kuen Kim and Taehoo kim published in Energy Economics found “strong evidence that coal to gas switching has been actually accelerated by RGGI implementation.”

That trick doesn’t work as well now as it used to, though. “For the first 10 years or so, the primary margin for achieving emission reductions was substitution from coal to gas,” Burtraw told me. Then renewables prices began to drop “precipitously” in the early 2010s, opening up the opportunity for more thoroughgoing decarbonization beyond just getting rid of coal. “Going forward, I think program advocates would say that now you’re seeing the move from gas to renewables with storage,” he said.

When RGGI went through its regular program review in 2012 (these happen every few years; the third was completed last year), the target had to be wrenched downward to account for the actual path of emissions, which had dropped far more quickly than the cap.

“Soon after the start of RGGI, it became apparent that the number of allowances in the emissions budget was higher than actual emissions. Allowance prices consequently dropped, making it particularly inexpensive to purchase allowances and bank them for use in later periods,” a case study published by the Environmental Defense Fund found. In other words, because there was such a gap between the proscribed cap and actual emissions, generators had been able to squirrel away enough allowances to make future caps ineffective.

The arguments against the RGGI have been relatively constant and will be familiar to anyone following debates over energy and climate policy: RGGI raises prices for consumers, its opponents say. It pushes out reliable and cheaper energy sources, and thereby threatens jobs in fossil fuel generation and infrastructure. Also the particulars of how a state joins or exits the group have often come up for debate.

Three states have proved troublesome, including one original member and two later joiners: New Jersey, Virginia, and Pennsylvania. All three states are sizable energy consumers, and Virginia and Pennsylvania have substantial fossil fuel infrastructure and production.

New Jersey quickly expressed its discontent. In 2011, New Jersey’s Republican Governor Chris Christie decided to take the state out of the market, saying that it was unnecessary and costly. Democrat Phil Murphy, Christie’s successor, brought it back in 2020 as part of a broader agenda to decarbonize New Jersey’s economy.

Pennsylvania attempted to join next, in 2019, but ran into legal hurdles almost immediately. Governor Tom Wolf, a Democrat, issued an executive order in 2019 to set up carbon trading in the state, and state regulators got to work drawing up rules to allow Pennsylvania to link up with RGGI, formally joining in 2022.

But the following year, a Pennsylvania court ruled that the state was not able to participate because the regulatory work ordered by Wolf had been approved by the legislature. The case worked its way up to the state’s highest court last spring, but got tossed in January after Governor Josh Shapiro, a Democrat, made a budget deal with the state legislature late last year removing Pennsylvania from RGGI once and for all — more on that below.

Virginia was the last new state to join in 2020, under Democratic Governor Ralph Northam, who said that by joining, Virginia was “sending a powerful signal that our commonwealth is committed to fighting climate change and securing a clean energy future.” A year later, however, Northam lost the governorship to Republican Glenn Youngkin, who removed Virginia from RGGI at the end of 2023.

Youngkin described the exit — technically a choice made by state regulators — as a “commonsense decision by the Air Board to repeal RGGI protects Virginians from the failed program that is not only a regressive tax on families and businesses across the Commonwealth, but also does nothing to reduce pollution.”

Pennsylvania fits uneasily into the Northeastern–blue hue of the RGGI’s core states. It’s larger than any state in the system besides New York, right down the center politically, and is a substantial producer and exporter of electricity, much of it coming from fossil fuels (and nuclear power). It also has lower electricity costs than its neighbors to the east.

Pennsylvania’s governor, Josh Shapiro, is widely expected to run for the Democratic presidential nomination in 2028, and has put reining in electricity costs at the center of his messaging of late. He sued PJM, the mid-Atlantic electricity market at the end of 2024, and won a settlement to cap costs in the system’s capacity auctions. He also helped negotiate a “statement of principles” with the White House in order to potentially get those caps extended. And earlier this month, he met with utility executives “to discuss steps they can take to lower utility costs and protect consumers,” Will Simons, a spokesperson for the governor, said.

Pennsylvania’s permanent and undisputed inclusion in the RGGI system would be a coup. Unlike its neighbor RGGI states, including Maryland, Delaware, New Jersey, and New York, Pennsylvania still has a meaningful coal industry, meaning that its emissions could potentially fall substantially with a modest carbon price. It would also provide some relief to the rest of the system by notching significant emissions reductions at lower cost, meaning that electricity prices would likely be minimally affected or even go down, according to research done in 2023 by Burtraw, Angela Pachon, and Maya Domeshek.

“Pennsylvania is the source of a lot of low-cost emission reductions precisely because it still retains that coal-to-gas margin,” Burtraw said. “It looks the way the Northeastern states looked 15 years ago.”

But alas, it won’t happen. As part of a budget deal with Republicans reached late last year, Pennsylvania exited RGGI. That Shapiro would be willing to sacrifice RGGI isn’t shocking considering his record — when he ran for governor in 2021, he often put more emphasis on investing in clean energy than restricting fossil fuels. As governor, he has pushed for regulatory reforms, and even a Pennsylvania-specific cap and trade program, but Senate Republicans made RGGI exit the price of any energy policy talks.

Virginia may be ready to return to the fold.

“For me, this is about cost savings,” newly installed governor Abigail Spanberger said in her inaugural address. “RGGI generated hundreds of millions of dollars for Virginia — dollars that went directly to flood mitigation, energy efficiency programs, and lowering bills for families who need help most.” Furthermore, “withdrawing from RGGI did not lower energy costs,” she said. “In fact, the opposite happened — it just took money out of Virginia’s pocket,” referring to lost gains from RGGI auctions. (Research by Burtraw, Maya Domeshek, and Karen Palmer found that RGGI participation was the “lowest-cost way” of achieving the state’s statutory emissions reductions goals and that the funded investment investments in efficiency will likely drive down household costs.)

Virginia’s newly elected Attorney General Jay Jones also reversed the position of his Republican predecessor, signing on to litigation against Youngkin’s withdrawal from the program, arguing that the governor lacked the legal authority to withdraw from the program in the first place —the inverse of Pennsylvania’s legal tangle over RGGI.

New Jersey, too, has a new governor, Democrat Mikie Sherrill. In a set of executive orders, signed before she had even finished her inaugural address, Sherrill directed New Jersey economic, environment, and utility regulatory officials to “confer about the use of Regional Greenhouse Gas Initiative … proceeds for ratepayer relief,” and “include an explanation of how they intend to address ratepayer relief in the 2026-2028 RGGI Strategic Funding Plan.”

Ratepayers are already due to receive RGGI funding under New Jersey’s current strategic funding plan, as are environmental protection and energy efficiency programs, renewable and transmission investments, and a grab-bag of other climate related projects. New Jersey utility regulators last fall made a $430 million distribution to ratepayers in the form of two $50 bill credits, with additional $25 a month credits for low-income ratepayers.

The evolution of RGGI — and its use by New Jersey to reduce electricity bills in particular — shows how carbon mitigation programs have had to adapt to political realities.

“In the political context of the moment, I think it’s totally fair,” Burtraw told me of Sherrill’s plan. “It’s the worst good idea of what you can do with the carbon proceeds. Everybody in the room can come up with better ideas: Oh, we should be doing this investment, or we should be doing energy efficiency, or we should subsidize renewables. Show me that those ideas are a higher value use for that money and I’m all in. But we could at least be doing this.”

What remains to be seen is whether other states pick up the torch from Sherrill and start using RGGI as a way to more directly combat electricity price hikes. Her actions “could create ripple effects for other states that may face similar concerns,” Olivia Windorf, U.S. policy fellow at the Center for Climate and Energy Solutions, told me.

While RGGI tends to be in the news in the individual states only when there’s some controversy about entering or exiting the program, “the focus on electricity prices and affordability is putting a new spotlight on it,” Windorf said.

More aggressive or creative uses of the proceeds would put RGGI closer to the center of debates around affordability. “I think it will help address affordability concerns in a way that's really tangible,” Windorf said. “So it's not abstract how carbon markets and RGGI can help through this time of load growth and energy transition. It can be a tool rather than a burden.”

The Army Corps of Engineers is out to protect “the beauty of the Nation’s natural landscape.”

A new Trump administration policy is indefinitely delaying necessary water permits for solar and wind projects across the country, including those located entirely on private land.

The Army Corps of Engineers published a brief notice to its website in September stating that Adam Telle, the Assistant Secretary of the Army for Civil Works, had directed the agency to consider whether it should weigh a project’s “energy density” – as in the ratio of acres used for a project compared to its power generation capacity – when issuing permits and approvals. The notice ended on a vague note, stating that the Corps would also consider whether the projects “denigrate the aesthetics of America’s natural landscape.”

Prioritizing the amount of energy generation per acre will naturally benefit fossil fuel projects and diminish renewable energy, which requires larger amounts of land to provide the same level of power. The Department of the Interior used this same tactic earlier in the year to delay permits.

Now we know the full extent of the delays wrought by that notice thanks to a copy of the Army Corps’ formal guidance on issuing permits under the Clean Water Act or approvals related to the Rivers and Harbors Act, a 1899 law governing discharges into navigable waters. That guidance was made public for the first time in a lawsuit filed in December by renewable trade associations against Trump’s actions to delay, pause, or deny renewables permits.

The guidance submitted in court by the trade groups states that the Corps will scrutinize the potential energy generation per acre of any permit request from an energy project developer, as well as whether an “alternative energy generation source can deliver the same amount of generation” while making less of an impact on the “aquatic environment.” The Corps is now also prioritizing permit applications for projects “that would generate the most annual potential energy generation per acre over projects with low potential generation per acre.”

Lastly, the Corps will also scrutinize “whether activities related to the projects denigrate the beauty of the Nation’s natural landscape” when deciding whether to issue these permits. That last factor – aesthetics – is in fact a part of the Army Corps’ permitting regulations, but I have not seen any previous administration halt renewable energy permits because officials think solar farms and wind turbines are an eyesore.

Jennifer Neumann, a former career Justice Department attorney who oversaw the agency’s water-related casework with the Army Corps for a decade, told me she had never seen the Corps cite aesthetics in this way. The issue has “never really been litigated,” she said. “I have never seen a situation where the Corps has applied [this].”

The renewable energy industry’s amended complaint in the lawsuit, which is slowly proceeding in federal court, claims the Corps’ guidance will lead to “many costly project redesigns” and delays, “resulting in contract penalties, cost hikes, and deferred revenue.” Other projects “may never get their Corps individual permits and thus will need to be canceled altogether.”

In addition, executives for the trade associations submitted a sworn declaration laying out how they’re being harmed by the Corps guidance, as well as a host of other federal actions against the renewable energy sector. To illustrate those harms they laid out an example: French energy developer ENGIE, they said, was required to “re-engineer” its Empire Prairie wind and solar farm in Missouri because the guidance “effectively precludes” it from getting a permit from the Army Corps. This cost ENGIE millions of dollars, per the declaration, and extended the construction timeline while ultimately also making the project less efficient.

Notably, Empire Prairie is located entirely on private land. It isn’t entirely clear from the declaration why the project had to be redesigned, and there is scant publicly available information about it aside from a basic website. The area where Empire Prairie is being built, however, is tricky for development; segments of the project are located in counties – DeKalb and Andrew – that have 88 and 99 opposition risk scores, respectively, per Heatmap Pro.

Renewable energy developers require these water permits from the Army Corps when their construction zone includes more than half an acre of federally designated wetlands or bodies of water protected under the Rivers and Harbors Act. Neumann told me that developers with impacts of half an acre or less may skirt the need for a permit application if their project qualifies for what’s known as a “nationwide permit,” which only requires verification from the Corps that a company complies with the requirements.

Even the simple verification process for Corps permits has been short-circuited by other actions from the administration. Developers are currently unable to access a crucial database overseen by the Fish and Wildlife Service to determine whether their projects impacts species protected under the Endangered Species Act, which in turn effectively “prevents wind and solar developers from (among other things) obtaining Corps nationwide permits for their projects,” according to the declaration from trade group executives.

But hey, look on the bright side. At least the Trump administration is in the initial phases of trying to pare back federal wetlands protections. So there’s a chance that eliminating federal environmental protections might benefit some solar and wind companies out there. How many? It’s quite unclear given the ever-changing nature of wetlands designations and opaque data available on how many projects are being built within those areas.

Dane County, Wisconsin – The QTS data center project we’ve been tracking closely is now dead, after town staff in the host community of DeForest declared its plans “unfeasible.”

Marathon County, Wisconsin – Elsewhere in Wisconsin, this county just voted to lobby the state’s association of counties to fight for more local control over renewable energy development.

Huntington County, Indiana – Meanwhile in Indiana, we have yet another loud-and-proud county banning data centers.

DeKalb County, Georgia – This populous Atlanta-adjacent county is also on the precipice of a data center moratorium, but is waiting for pending state legislation before making a move.

New York – Multiple localities in the Empire State are yet again clamping down on battery storage. Let’s go over the damage for the battery bros.