You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

Here are three big changes the White House is proposing.

The White House proposed a major overhaul to the country’s guidelines for analyzing regulations and government spending on Thursday. The changes to an incredibly dense, wonky set of documents known as “Circular A-4” and “Circular A-94” would affect how government agencies, like the Environmental Protection Agency, measure the costs and benefits of decisions that have big implications for climate change, like power plant regulations, clean car rules, and highway expansion projects.

It’s hard to overstate the magnitude of the makeover. More than anything, the changes represent a shift in philosophy. The proposed guidelines would change the way the government views and takes into account inequity, not just within the United States but also how U.S. actions affect people in other nations and future generations.

The current documents were also sorely outdated. The government hasn’t updated its instructions for regulatory analysis in 20 years, and the guidance for public investment is more than 30 years old. In the years since, academic thinking on how to conduct cost-benefit analysis has changed, financial markets have changed, and the philosophy of the White House has changed, said Noah Kaufman, a senior research scholar at Columbia University who previously served as a senior economist at the Biden administration’s Council of Economic Advisors.

“There's a lot of disagreement about a lot of what's in here, but pretty much everyone kind of agreed that they needed to be redone,” he said.

The proposal will go through a public comment period before being finalized by the federal Office of Information and Regulatory Affairs.

Cost-benefit analysis is but one consideration in government decision making, and often not the most important one, so Kaufman cautions against reading too much into the changes. Perhaps most significant to him is the overall vibe shift between the old guidance and what the White House released on Thursday. He said the old version reads like it’s written by people who are trying to convince you that there’s a very limited role for the government to play. “The people who worked on this document are far more interested in a more proactive role for how government programs and regulations can help address market failures.”

Here are three big changes the White House is proposing.

The proposed guidance makes a big adjustment to an incredibly complicated, confusing, but consequential number called the discount rate. The discount rate determines how much government analysts weigh distant, future benefits of a policy versus its cost today. A higher discount rate downplays future gains, making it much harder to justify the expense of flood protection infrastructure or rules that limit carbon emissions from power plants.

While the old instructions called for a discount rate between 3% and 7%, the new proposal suggests a dramatically lower rate of 1.7%. This means that when regulators look at the cost to society of putting more carbon in the atmosphere — and they take into account all of the potential future lost lives, reduced crop yields, and damages caused by rising seas — it would look a lot more expensive than it does under the current guidelines. To get a sense of how much more, the Obama administration used a discount rate of 3%, and estimated that the cost of every ton of carbon spewed into the atmosphere was about $51 per ton. The nonprofit research group Resources for the Future estimates that with a 2% discount rate, that number would jump to $185.

The new guidelines encourage agencies to take the global impact of decisions — such as potential lives lost to extreme weather outside the U.S. — into account when conducting a cost-benefit analysis. This is a big deal, according to Paul Kelleher, an associate professor at the University of Wisconsin-Madison who studies the ethics of public policy.

“This probably is an acknowledgement that when Americans emit carbon dioxide, it doesn’t only harm Americans,” Kelleher said. It also incentivizes American policymakers to approach international climate negotiations from a more cooperative standpoint, rather than only being interested in what happens within American borders, he said.

It’s an important, if admittedly wonky, way for the Biden administration to acknowledge the United States’ role in global climate change — suddenly, the lives of billions of people around the world are added to the accounting sheets of government agencies. That means a proposal to, for example, limit tailpipe emissions would appear to have larger financial benefits.

Today, the benefits of a proposed policy are weighed against how much the potential beneficiaries would be willing to pay for it. The problem is the government assumes a dollar means the same thing to everyone. But the value of a dollar to a grocery store clerk is a lot higher than the value of a dollar to, say, Elon Musk.

Under the current system, “climate damages in the poorest parts of the world will be registered as not as serious as climate damages that are much less serious in richer parts, where people’s willingness to pay can be quite high because their ability to pay is higher,” Kelleher said.

The new guidelines allows agencies to use an approach known as “equity-weighting,” or to account for the differential impacts of a given regulation or investment. “Now, instead of just counting up the dollars that people are willing to pay to avoid damages, you try to account for the real effect on wellbeing,” said Kelleher.

Take, for example, a new rule to reduce pollution from power plants, which low-income communities are disproportionately affected by. Under the new system, the financial benefits of such a regulation would appear much higher than they currently do, because more weight would be given to the health rewards and other gains the community would see from that regulation. And because the new guidelines allow analysts to look beyond U.S. borders, the practice of equity-weighting could also account for the disproportionate harms that a poorer country like Bangladesh would face from a warmer planet, significantly raising the cost of emissions.

If this approach is finalized, “it would be a titanic shift in the federal cost-benefit analysis framework,” Kelleher said.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

CarbonPlan has a new tool to measure climate risk that comes with full transparency.

On a warming planet, knowing whether the home you’re about to invest your life savings in is at risk of being wiped out by a wildfire or drowned in a flood becomes paramount. And yet public data is almost nonexistent. While private companies offer property-level climate risk assessments — usually for a fee — it’s hard to know which to trust or how they should be used. Companies feed different datasets into their models and make different assumptions, and often don’t share all the details. The models have been shown to predict disparate outcomes for the same locations.

For a measure of the gap between where climate risk models are and where consumers want them to be, look no further than Zillow. The real estate website added a “climate risk” section to its property listings in 2024 in response to customer demand — only to axe the feature a year later at the behest of an industry group that questioned the accuracy of its risk ratings.

Now, however, a new tool that assesses wildfire risk for every building in the United States aims to advance the field through total transparency. The nonprofit research group CarbonPlan launched the free, user-friendly app called Open Climate Risk on Tuesday. It allows anyone to enter an address and view a wildfire risk score, on a scale of zero to 10, along with an explanation of how it was calculated. The underlying methodology, data, and code are all public. It’s the first fully open platform of its kind, according to CarbonPlan.

“Right now, the way science works in the climate risk space is that every model is independently developed at different companies, and we essentially have no idea what’s happening in them. We have no idea if they’re any good,” Oriana Chegwidden, a research scientist at CarbonPlan who led the creation of the tool, told me. “Our hope is that by opening this up, people will be able to start contributing, to help us learn how we can do it better.” That might mean critiquing CarbonPlan’s methods or code, for example, or re-running the model with additional data.

The score itself doesn’t tell you much other than the relative risk between one building and another. But the platform also breaks out the two inputs behind it: burn probability, or the likelihood a building will catch fire in a given year, and “conditional risk,” an estimate of how much of the building’s value would be lost if it does burn, based on projected fire intensity.

The projections are largely based on a U.S. Forest Service dataset that models fire frequency on wildlands throughout the country. CarbonPlan uses additional data on wind speed and direction to predict how a given fire might spread into an urban area.

Users can toggle between risk under the “current” climate and a “future” climate, which jumps about 20 years out. They can also see the distribution of buildings across the spectrum of risk scores at various geographic scales — by state, county, census tract, or census block.

One of CarbonPlan’s hopes is to help people become more informed consumers of climate risk data by helping them understand how it’s put together and what questions they might want to ask. While its model is more crude than others on the market, the tool is explicit about the factors that are not accounted for in the results. The loss estimates are based on a generic building, for example, and do not recognize specific traits like fire-resistant construction materials or landscaping that could make a home more fire resistant. They also don’t consider building-to-building spread. The underlying U.S. Forest Service data is also limited in that it maps vegetation across the country as it existed at the end of 2020 — any changes since then that could have reduced fire-igniting fuels, such as prescribed burns, are not incorporated.

Right now, there’s no industry standard for calculating or communicating climate risk. The Global Association of Risk Professionals recently asked 13 climate risk companies for data on floods, tropical storms, wildfires, and heat at 100 addresses to compare the outputs. The authors found there were “significant disparities,” between estimates of vulnerability and damages at the same locations. When it came to wildfires, specifically, they were unable to even compare the data, because the companies all conveyed the risk using different benchmarks.

The implications of having so many diverging methods and results extend beyond individual homebuying decisions. Insurance companies use climate risk data to set rates; publicly-traded companies use it to make disclosures to investors; policymakers use it to guide community planning and investments in adaptation. Some products might be better suited to one task or another.

Katherine Mach, an environmental science and policy professor at the University of Miami, told me the next step for the field is to have more systematic reporting requirements that help people understand how accurate the data are and what types of decisions they can be used for.

“It’s almost like we need the equivalent of industry standards,” she said. “You’re going to release a climate product? Here’s what you need to clearly communicate.”

CarbonPlan collected feedback from various likely users of the tool throughout the development process, including municipal planners, climate scientists, and consumer advocates. The group also hopes to foster an “iterative cycle of community-driven model development,” spurring other researchers to inspect the data, critique it, add to it, and spin out new versions. This is common practice in other areas of climate science, like Earth system modeling and economic modeling, and has been instrumental in advancing those fields. “There’s nothing like that for climate risk right now,” Chegwidden said.

The first step will be raising more money to support further work, but the goal is to partner with outside researchers on comparative analyses and case studies. Tracy Aquino Anderson, CarbonPlan’s interim executive director, told me they have already heard from one researcher who has a fire risk dataset that could be added to the platform. The group has also been invited to present the platform to two academic climate research groups later this spring.

The problem of black box models exists not just because the field is full of private companies that don’t want to share their code. A study published earlier this month found that only 4% of the most-cited peer-reviewed climate risk studies have made their data and code public, despite journal standards that require transparency.

“When you’re working with climate data, you’re dealing with all of these uncertainties,” Adam Pollack, an assistant professor at the University of Iowa who researches flood risk and the lead author of the paper, told me. “Researchers don’t always understand all of the assumptions that are implicit in choices that they make. That’s fine — we have methods for dealing with that. We do model intercomparisons, we do these synthesis studies as a field. The foundation of that is openness and reusability.”

Though he was not involved in the CarbonPlan project, he said it was exactly what his paper was calling for. For example, CarbonPlan’s “future” calculations are based on an extreme warming scenario that has become controversial among climate scientists. CarbonPlan didn’t choose this scenario — it’s what the Forest Service’s dataset used, and that was the only off-the-shelf data available for the entire United States. But because the underlying code is open-source, critics are free to swap it out for other data they may have access to.

“That’s what’s so great about this,” Pollack said. “People who have different values, assumptions, and expertise, can get new estimates and build a shared understanding.”

On BYD’s lawsuit, Fervo’s hottest well, and China’s geologic hydrogen

Current conditions: A midweek clipper storm is poised to bring as much as six more inches of snow to parts of the Great Lakes and Northeast • American Samoa is halfway through three days of fierce thunderstorms and temperatures above 80 degrees Fahrenheit • Northern Portugal is bracing for up to four inches more of rain after three deadly storms in just two weeks.

The Environmental Protection Agency is preparing this week to repeal the Obama-era scientific finding that provides the legal basis for virtually all federal regulations of planet-heating emissions, marking what The Wall Street Journal called “the most far-reaching rollback of U.S. climate policy to date.” The 2009 “endangerment finding” concluded that greenhouse gases pose a threat to public health and welfare, calling for cuts to emissions from power plants and vehicle tailpipes. EPA Administrator Lee Zeldin told the newspaper the move “amounts to the largest act of deregulation in the history of the United States.” In an interview with my colleague Emily Pontecorvo last year, Harvard Law School’s Jody Freeman said rescinding the endangerment finding would do “more serious and more long term damage” and “could knock out a future administration from trying to” bring back climate policy. But that, Freeman said, would depend on the Supreme Court backing the administration. “I don’t think that’s likely, but it’s possible,” she said.

At issue is the 2007 case Massachusetts v. EPA, which determined that greenhouse gases qualified as pollutants under the Clean Air Act. As Emily wrote last week, “the agency claims that its previous read of Massachusetts v. EPA was wrong, especially in light of subsequent Supreme Court decisions, such as West Virginia v. EPA and Loper Bright v. Raimondo. The former limited the EPA's toolbox for regulating power plants, and the latter ended a requirement that courts defer to agency expertise in cases where the law is vague.” An earlier report in The Washington Post questioned whether the agency would proceed with the repeal at all, fearing these arguments would pass muster in the nation’s highest court.

BYD has sued the United States government over the 100% tariff on Chinese electrics that serves as an effective ban on Beijing’s booming auto exports. Four U.S.-based subsidiaries of the world’s largest manufacturer of electric vehicles filed a lawsuit in the U.S. Court of International Trade challenging the legality of the Trump administration’s trade levies. The litigation marks what the state-backed tabloid Global Times called “the first instance of a Chinese automaker directly and actively challenging U.S. tariffs, setting a precedent and carrying significance for Chinese enterprises to protect their legitimate rights and interests through legal means.”

Outside the U.S., BYD is booming. China’s cheap electric cars are popular all over the world, as Heatmap’s Shift Key podcast covered in December. Canadian Prime Minister Mark Carney’s deal to increase trade with China will bring the battery-powered vehicles to North American roads. And the Chinese edition of the trade publication Automotive News just reported that BYD is planning a factory expansion in Europe and Canada.

Hot off last month’s news that it plans to go public, Fervo Energy has drilled its highest-temperature well yet. The drilling results confirm that the next-generation geothermal startup tapped into a resource with temperatures above 555 degrees Fahrenheit at approximately 11,200 feet deep. The company announced the findings Monday of an independent assessment using appraisal data from the drilling. The analysis found that the Project Blanford site in Millard County, Utah, has multiple gigawatts of heat that can be harnessed. Its completion will be a breakthrough for enhanced geothermal systems, one of two leading approaches to the next-generation geothermal sector that Heatmap’s Matthew Zeitlin outlined here. “This latest ultra-high temperature discovery highlights our team’s ability to detect and develop EGS sweet spots using AI-enhanced geophysical techniques,” Jack Norbeck, Fervo’s co-founder and chief technology officer, said in a statement.

Sign up to receive Heatmap AM in your inbox every morning:

Chinese scientists have for the first time discovered natural hydrogen sealed in microscopic inclusions near Tibet. The finding, which the Xinhua news agency called “groundbreaking,” fills what the China Hydrogen Bulletin called “a major domestic research gap and points to a new geological pathway for identifying China’s next generation of clean energy resources.” Natural, or geological, hydrogen could provide a cheap source of the zero-carbon fuel and give oil and gas drillers a natural foothold in a new, clean industry. In the color spectrum associated with hydrogen, the rare, naturally formed stuff is called white hydrogen. But as Heatmap’s Katie Brigham wrote in December, a new color has joined the rainbow. Orange hydrogen refers to a family of technologies that naturally spur production of the gas, as the startup Vema is now attempting to do.

China’s coal-fired power generation decreased 1.9% last year, marking what the consultancy Wood Mackenzie called “a historic shift driven by new non-fossil generation that has finally outpaced demand growth.” Power demand surged 5% in China last year, but for the first time in a decade that wasn’t propelled by coal plants. Instead, that new demand was supplied by renewables, nuclear, and hydro, all of which Beijing has rapidly deployed. Over that time, the levelized cost of energy — a widely used though, as Matthew wrote last year, far-from-perfect metric — fell 77% for utility-scale solar and 73% for onshore wind. “At the heart of this transformation is the unprecedented expansion of renewable energy capacity,” Sharon Feng, a senior research analyst for Wood Mackenzie, said in a statement. “China’s wind and solar capacity had risen more than ten-fold to 1,842 gigawatts over the past decade.”

Gone are the days when the oil industry seemed to be on track for a lucrative decline. Demand for crude will take longer to peak than previously estimated as governments prioritize growth and energy security over efforts to curb consumption. That’s according to a report issued Sunday by Vitol Group, the world’s largest independent oil trader. “Over the past year, decarbonisation policies have become a less decisive driver of efforts to curb oil consumption and reduce carbon dioxide emissions,” the report stated, according to Bloomberg. “Policy priorities have increasingly been reframed around economic competitiveness and geopolitical strategy.”

The race for a long-duration energy storage solution has a new competitor. The Dutch startup Ore Energy has deployed its iron-air storage technology successfully on the grid for a technical pilot of its system that can store for 100 hours of power. The pilot, the first of its kind in Europe, demonstrated that the company’s technology can store and discharge energy for up to four days. “This pilot allowed us to evaluate iron-air performance under European operating profiles and real-world grid conditions,” Aytaç Yilmaz, co-founder and CEO of Ore Energy, said in a statement.

Wildfires are moving east.

There were 77,850 wildfires in the United States in 2025, and nearly half of those — 49% — ignited east of the Mississippi River, according to statistics released last week by the National Interagency Fire Center. That might come as a surprise to some in the West, who tend to believe they hold the monopoly on conflagrations (along with earthquakes, tsunamis, and megalomaniac tech billionaires).

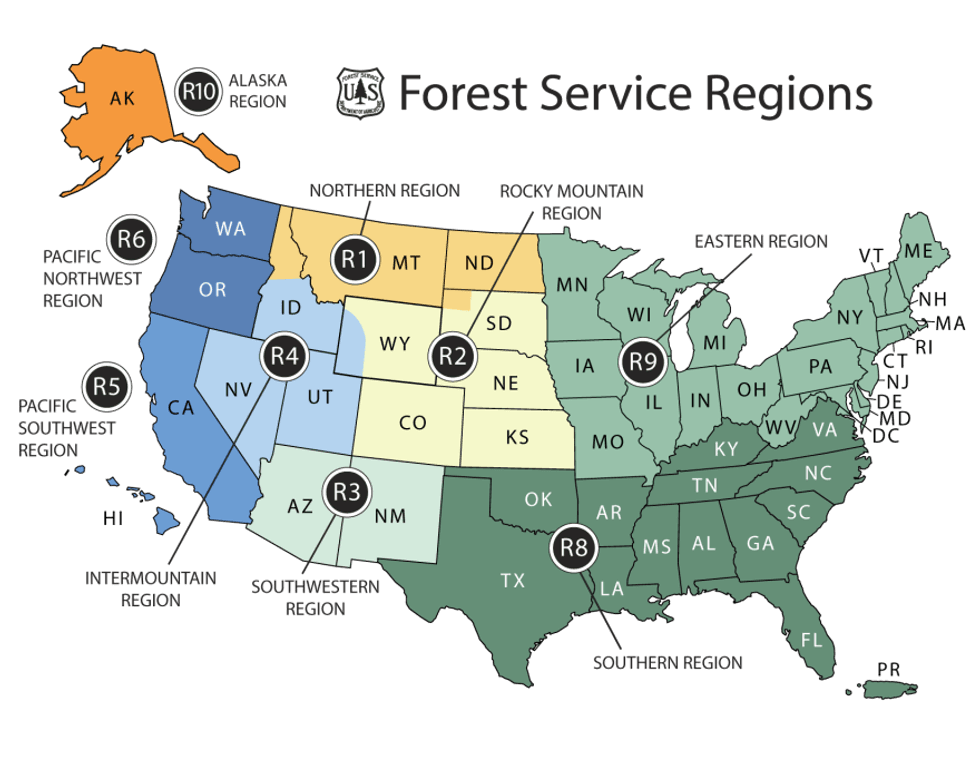

But if you lump the Central Plains and Midwest states of Minnesota, Iowa, Missouri, Arkansas, Oklahoma, and Texas along with everything to their east — the swath of the nation collectively designated as the Eastern and Southern Regions by the U.S. Forest Service — the wildfires in the area made up more than two-thirds of total ignitions last year.

Like fires in the West, wildfires in the eastern and southeastern U.S. are increasing. Over the past 40 years, the region has seen a 10-fold jump in the frequency of large burns. (Many risk factors contribute to wildfires, including but not limited to climate change.)

What’s exciting to wildfire researchers and managers, though, is the idea that they could catch changes to the Eastern fire regime early, before the situation spirals into a feedback loop or results in a major tragedy. “We have the opportunity to get ahead of the wildfire problem in the East and to learn some of the lessons that we see in the West,” Donovan said.

Now that effort has an organizing body: the Eastern Fire Network. Headed by Erica Smithwick, a professor in Penn State’s geography department, the research group formed late last year with the help of a $1.7 million, three-year grant from the Gordon and Betty Moore Foundation, a partner with the U.S. National Science Foundation, with the goal of creating an informed research agenda for studying fire in the East. “It was a very easy thing to have people buy into because the research questions are still wide open here,” Smithwick told me.

Though the Eastern U.S. is finally exiting a three-week block of sub-freezing temperatures, the hot, dry days of summer are still far from most people’s minds. But the wildland-urban interface — that is, the high-fire-risk communities that abut tracts of undeveloped land — is more extensive in the East than in the West, with up to 72% of the land in some states qualifying as WUI. The region is also much more densely populated, meaning practically every wildfire that ignites has the potential to threaten human property and life.

It’s this density combined with the prevalent WUI that most significantly distinguishes Eastern fires from those in the comparatively rural West. One fire manager warned Smithwick that a worst-case-scenario wildfire could run across the entirety of New Jersey, the most populous state in the nation, in just 48 hours.

Generally speaking, though, wildfires in the East are much smaller than those in the West. The last megafire in the Forest Service’s Southern Region was as far west in its boundaries as you can get: the 2024 Smokehouse Creek fire in Texas and Oklahoma, which burned more than a million acres. The Eastern Region hasn’t had a megafire exceeding 100,000 acres in the modern era. For research purposes, a “large” wildfire in the East is typically defined as being 200 hectares or more in size, the equivalent of about 280 football fields; in the West, a “large” wildfire is twice that, 400 hectares or more.

But what the eastern half of the country lacks in total acres burned (for that statistic, Alaska edges out the Southern Region), it makes up for in the total number of reported ignitions. In 2025, for example, the state of Maine alone recorded 250 fires in August, more than doubling its previous record of just over 100 fires. “The East is highly fragmented,” Donovan, who is contributing to the Eastern Fire Network’s research, told me. “We have a lot of development here compared to the West, and so it’s much more challenging for fires to spread.”

Fires in the West tend to be long-duration events, burning for weeks or even months; fires in the East are often contained within 48 hours. In New Jersey, for example, “smaller, fragmented forests, which are broken up by numerous roads and the built environment, [allow] firefighters to move ahead of a wildfire to improve firebreaks and begin backfiring operations to help slow the forward progression,” a spokesperson for the New Jersey Forest Fire Service told me.

The parcelized nature of the eastern states is also reflected in who is responding to the fires. It is more common for state agencies and local departments — including many volunteer firefighting departments — to be the ones on the scene, Debbie Miley, the executive director of the National Wildfire Suppression Association, a trade group representing private wildland fire service contractors, told me by email. On the one hand, the local response makes sense; smaller fires require smaller teams to fight them. But the lack of a joint effort, even within a single state, means broader takeaways about mitigation and adaptation can be lost.

“Many eastern states have strong state forestry agencies and local departments that handle wildfire as part of an ‘all hazards’ portfolio,” Miley said. “In the West, there’s often a deeper bench of personnel and systems oriented around long-duration wildfire campaigns (though that varies by state).”

All of this feeds into why Smithwick believes the Eastern Fire Network is necessary: because of this “intermingling, at a very fine scale, of different jurisdictional boundaries,” conversations about fire management and the changing regimes in the region happen in parallel, rather than with meaningful coordination. Even within a single state, fire management might be divided between different agencies — such as the Game Commission and the Bureau of Forestry, which share fire management responsibilities in Pennsylvania. Fighting fires also often involves working with private landowners in the East; in the West, on the other hand, roughly two-thirds of wildfires burn on public land, which a single agency — e.g. the Bureau of Land Management, Forest Service, or Park Service — manages.

But “wildfire risk is going to be different than in the West, and maybe more variable,” Smithwick told me. Identifying the appropriate research questions about that risk is one of the most important objectives of the Eastern Fire Network.

Bad wildfires are the result of fuel and weather conditions aligning. “We generally know what the fuels are [in the East] and how well they burn,” Smithwick said. But weather conditions and their variability are a greater question mark.

Nationally, fire and emergency managers rely on indices to predict fire-weather risk based on humidity, temperature, and wind. But while those indices are dialed in for the Western states, they’re less well understood in the East. “We hope to look at case studies of recent fires that have occurred in the 2024 and 2025 window to look at the antecedent conditions and to use those as case studies for better understanding the mechanisms that led to that wildfire,” Smithwick said.

Learning more about the climatological mechanisms driving dry spells in the region is another explicit goal. Knowing how dry spells evolve, and where, will help researchers and eventually policymakers to identify mitigation strategies for locations most at risk. Smithwick also expects to learn that some areas might not be at high risk: “We can tell you that this is not something your community needs to invest in right now,” she told me.

Different management practices, jurisdictions, terrains, and fuel types mean solutions in the East will look different from those in the West, too. As Donovan’s research has found, the unmanaged regrowth of forests in the northeast in particular after centuries of deforestation has led to an increase in trees and shrubs that are prone to wildfires. Due to the smaller forest tracts in the area, mechanical thinning is a more realistic solution in eastern forests than on large, sprawling, remote western lands.

Prescribed burns tend to be more common and more readily accepted practices in the East, too. Florida leads the nation in preventative fires, and the New Jersey Forest Fire Service aims to treat 25,000 acres of forest, grasslands, and marshlands with prescribed fire annually.

The winter storms that swept across the Eastern and Southern regions of the United States last month have the potential to queue up a bad fire season once the land starts to thaw and eventually dry out. Though the picture in the Eastern Region is still coming into focus depending on what happens this spring, in the Southern region the storms have created “potential compaction of the abundant grasses across the Plains, in addition to ice damage in pine-dominant areas farther east,” the National Interagency Fire Center wrote in last Monday’s update to its nationwide fire outlook. (The nearly million-acre Pinelands of New Jersey are similarly a fire-adapted ecosystem and are “comparable in volatility to the chaparral shrublands found in California and southern Oregon,” the spokesperson told me.)

The compaction of grasses is significant because, although they will take longer to dry and become a fuel source, it will ultimately leave the Southern region covered with a dense, flammable fuel when summer is in full swing. Beyond the Plains, in the Southeast’s pine forests, the winter-damaged trees could cast “abundant” pine needles and “other fine debris” that could dry out and become flammable as soon as a few weeks from now. “Increased debris burning will also amplify ignitions and potential escapes, enhancing significant fire potential during warmer and drier weather that will return in short order,” NIFC goes on to warn.

Though the historically wet Northeast and humid Southeast seem like unlikely places to worry about large wildfires, as conditions change, nothing is certain. “If we learned anything from fire science over the past few decades, it’s that anywhere can burn under the right conditions,” Smithwick said. “We are burning in the tundra; we are burning in Canada; we are burning in all of these places that may not have been used to extreme wildfire situations.”

“These fires could have a large economic and social cost,” Smithwick added, “and we have not prepared for them.”