You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

On hydrogen woes, Stegra’s steel costs, and refining vs. mining

Current conditions: The Northeastern U.S. is facing winds of up to 80 miles per hour • The remnants of Typhoon Halong are lashing the Alaskan villages of Kipnuk and Kwigillingok with powerful winds and storm surge • A heat wave in South Korea is bringing higher average temperatures this week than in July.

The United States military is stockpiling up to $1 billion of critical minerals as part of a global effort to counter China’s dominance over the metals necessary for sensitive industries including advanced manufacturing and defense. A Financial Times analysis of public filings from the Pentagon’s Defense Logistics Agency showed that the Trump administration has accelerated procurements in recent months as Beijing has cracked down on exports of rare earths and other metals, over which Chinese companies enjoy a tight grip over global supplies. The Department of Defense is “incredibly focused on the stockpile,” a former agency official told the newspaper. “They’re definitely looking for more, and they’re doing it in a deliberate and expansive way, and looking for new sources of different ores needed for defence products.” Among the companies that received funding from the so-called DLA, as I reported last month, is the Ohio-based startup Xerion, whose pioneering method for processing cobalt is now being applied to gallium.

The Trump administration has been on a partial-nationalization spree in recent months to secure mineral supplies. In July, the U.S. military became the largest shareholder in MP Materials, the lone company producing rare earths in the U.S. Last month, the Department of Energy overhauled a loan to Lithium Americas’ Thacker Pass project to take a stake in what will become one of the world’s biggest lithium mines. Earlier this month, President Donald Trump took a share of the Alaskan mining startup Trilogy Metals, as I reported in this newsletter. Reuters reported that the administration is also considering buying shares in Critical Metals, the company looking to develop rare earths in Greenland.

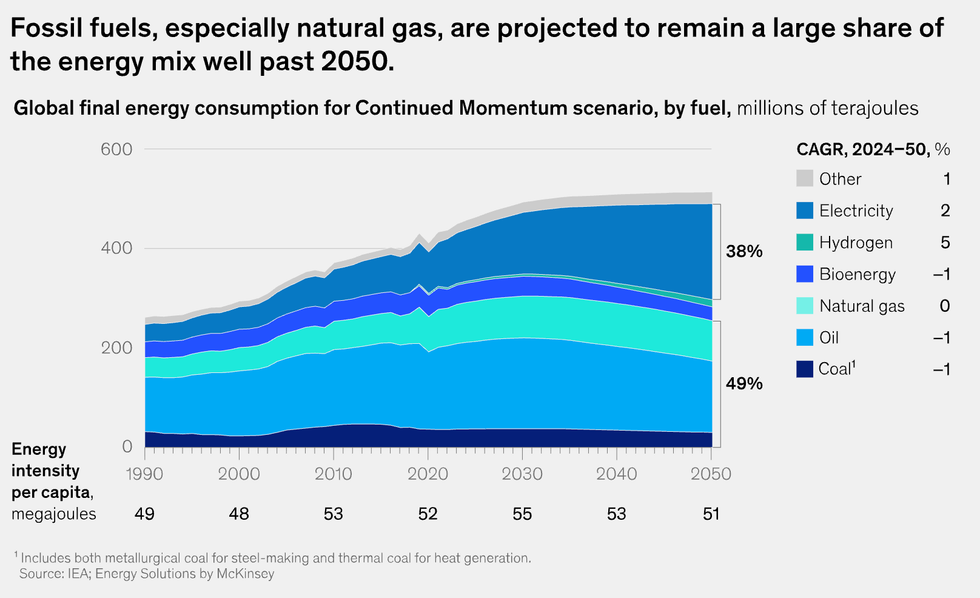

Mega-constulancy McKinsey & Company published a new report on the energy transition Monday, modeling different scenarios for the energy mix of the near-future. None of those scenarios includes clean hydrogen in a significant role. The fuel “is not yet cost competitive at scale, so it is expected to play a limited role in the energy mix,” the report says. Unless governments mandate its use, the analysis found, fuels such as clean hydrogen “are not likely to achieve broad adoption before 2040.” By contrast, fossil fuels are projected to retain between 41% and 55% of the global energy mix by 2050

In a sign of where hydrogen may be in its development, another report published Tuesday morning by the California Hydrogen Business Council listed “raising awareness” and “understanding hydrogen” as the first two steps in laying the groundwork for the safe usage of the fuel. The trade group’s 66-page analysis concluded that, while hydrogen “is a hazardous material,” it “can also be used safely” and that “safety should not be viewed as a barrier, but as a catalyst for innovation and acceptance.”

Stegra, the Swedish low-carbon steel startup that aims to use clean hydrogen in its production process, is “scrambling to survive as it struggles to resolve a growing funding gap,” the Financial Times reported Monday. One of Europe’s highest-profile green industrial projects, the company was founded by the same Swedish financiers as the bankrupt battery maker Northvolt. Stegra now needs to raise more than $1.7 billion to build its plant as costs tripled in the past three months, unnamed sources familiar with the financing told the newspaper. Northvolt went under in March despite raising $15 billion in debt, equity, and government funds, signaling how quickly costs can cripple a company’s capacity to continue operating.

While the U.S. steel industry is already cleaner than many countries’ due to its dependence on scrap material rather than iron produced with coal, the Trump administration has slashed funding for green steel, including Cleveland-Cliffs nation-leading effort to produce green steel with clean hydrogen. Yet the “golden share” President Donald Trump claimed for the U.S. Government in U.S. Steel as part of his approval for Japanese rival Nippon Steel’s takeover deal this summer could give a future administration the legal grounds to require the American steelmaker to go green, as Heatmap’s Matthew Zeitlin reported.

Commodities trading giant Trafigura, the world’s largest metals dealer, issued a stark warning to Western countries looking to dig new ores out of the Earth to compete with China. “Mining is not critical,” Trafigura CEO Richard Holtum said in London on Monday, according to Mining Journal. “ True supply chain security comes from processing investment, not just extraction.” China refines roughly 65% of the world’s copper, 70% of its lithium, and 90% of its rare earths. “Western nations are fighting the wrong battle,” Giacomo Prandelli, a commodities trader and analyst, wrote in a post on LinkedIn in response to Holtum’s speech. “They obsess over mining permits while China and Indonesia dominate the midstream, turning raw ore into refined metals that power the global energy transition.”

Investments in refining minerals, however, are costly. While the Pentagon’s purchases of metals guarantees at least one buyer, the Trump administration’s elimination of tax credits for electric vehicles eliminated a key source of demand that would have promised more offtakers for refined metals, representing what Matthew called “the paradox Trump’s critical minerals crusade” back in January.

After raising $78 million in a Series C round last April, sodium-ion battery startup Alsym Energy has rolled out its first battery designed for stationary storage that the company says will be cheaper than lithium-ion systems from day one, Heatmap’s Katie Brigham reported this morning. “I believe we are farthest ahead than anyone else in that space today in the United States,” Alsym’s co-founder and CEO Mukesh Chatter told her. Since the U.S. has vast sodium reserves, Chatter said the company’s America-made batteries will be cheaper than anywhere else. But either way, the company’s cells “will be cost-competitive with the leading lithium-ion chemistry right off the bat,” Katie wrote, with the overall system 30% cheaper because the battery’s thermal stability and ability to perform at high temperatures makes costly cooling systems moot. While sodium-ion cells are less energy dense than lithium-ion, getting rid of the entire HVAC system makes the batteries can operate in “space-constrained environments such as commercial or residential buildings.”

In California, zero-emission vehicles represented 29.1% of new car sales in the third quarter of 2025, the highest quarterly sales ever recorded in the state, Governor Gavin Newsom’s press office announced Monday. “This comes despite the efforts by the Trump administration to derail the ZEV industry and raise the cost of a clean car.” The spike could also be a result of it. Across the country, Americans scrambled to buy electric vehicles at a record clip to secure federal tax credits before the September 30 expiration date set under Trump’s landmark tax law.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The state is poised to join a chorus of states with BYO energy policies.

With the backlash to data center development growing around the country, some states are launching a preemptive strike to shield residents from higher energy costs and environmental impacts.

A bill wending through the Washington State legislature would require data centers to pick up the tab for all of the costs associated with connecting them to the grid. It echoes laws passed in Oregon and Minnesota last year, and others currently under consideration in Florida, Georgia, Illinois, and Delaware.

Several of these bills, including Washington’s, also seek to protect state climate goals by ensuring that new or expanded data centers are powered by newly built, zero-emissions power plants. It’s a strategy that energy wonks have started referring to as BYONCE — bring your own new clean energy. Almost all of the bills also demand more transparency from data center companies about their energy and water use.

This list of state bills is by no means exhaustive. Governors in New York and Pennsylvania have declared their intent to enact similar policies this year. At least six states, including New York and Georgia, are also considering total moratoria on new data centers while regulators study the potential impacts of a computing boom.

“Potential” is a key word here. One of the main risks lawmakers are trying to circumvent is that utilities might pour money into new infrastructure to power data centers that are never built, built somewhere else, or don’t need as much energy as they initially thought.

“There’s a risk that there’s a lot of speculation driving the AI data center boom,” Emily Moore, the senior director of the climate and energy program at the nonprofit Sightline Institute, told me. “If the load growth projections — which really are projections at this point — don’t materialize, ratepayers could be stuck holding the bag for grid investments that utilities have made to serve data centers.”

Washington State, despite being in the top 10 states for data center concentration, has not exactly been a hotbed of opposition to the industry. According to Heatmap Pro data, there are no moratoria or restrictive ordinances on data centers in the state. Rural communities in Eastern Washington have also benefited enormously from hosting data centers from the earlier tech boom, using the tax revenue to fund schools, hospitals, municipal buildings, and recreation centers.

Still, concern has started to bubble up. A ProPublica report in 2024 suggested that data centers were slowing the state’s clean energy progress. It also described a contentious 2023 utility commission meeting in Grant County, which has the highest concentration of data centers in the state, where farmers and tech workers fought over rising energy costs.

But as with elsewhere in the country, it’s the eye-popping growth forecasts that are scaring people the most. Last year, the Northwest Power and Conservation Council, a group that oversees electricity planning in the region, estimated that data centers and chip fabricators could add somewhere between 1,400 megawatts and 4,500 megawatts of demand by 2030. That’s similar to saying that between one and four cities the size of Seattle will hook up to the region’s grid in the next four years.

In the face of such intimidating demand growth, Washington Governor Bob Ferguson convened a Data Center Working Group last year — made up of state officials as well as advisors from electric utilities, environmental groups, labor, and industry — to help the state formulate a game plan. After meeting for six months, the group published a report in December finding that among other things, the data center boom will challenge the state’s efforts to decarbonize its energy systems.

A supplemental opinion provided by the Washington Department of Ecology also noted that multiple data center developers had submitted proposals to use fossil fuels as their main source of power. While the state’s clean energy law requires all electricity to be carbon neutral by 2030, “very few data center developers are proposing to use clean energy to meet their energy needs over the next five years,” the department said.

The report’s top three recommendations — to maintain the integrity of Washington’s climate laws, strengthen ratepayer protections, and incentivize load flexibility and best practices for energy efficiency — are all incorporated into the bill now under discussion in the legislature. The full list was not approved by unanimous vote, however, and many of the dissenting voices are now opposing the data center bill in the legislature or asking for significant revisions.

Dan Diorio, the vice president of state policy for the Data Center Coalition, an industry trade group, warned lawmakers during a hearing on the bill that it would “significantly impact the competitiveness and viability of the Washington market,” putting jobs and tax revenue at risk. He argued that the bill inappropriately singles out data centers, when arguably any new facility with significant energy demand poses the same risks and infrastructure challenges. The onshoring of manufacturing facilities, hydrogen production, and the electrification of vehicles, buildings, and industry will have similar impacts. “It does not create a long-term durable policy to protect ratepayers from current and future sources of load growth,” he said.

Another point of contention is whether a top-down mandate from the state is necessary when utility regulators already have the authority to address the risks of growing energy demand through the ratemaking process.

Indeed, regulators all over the country are already working on it. The Smart Electric Power Alliance, a clean energy research and education nonprofit, has been tracking the special rate structures and rules that U.S. utilities have established for data centers, cryptocurrency mining facilities, and other customers with high-density energy needs, many of which are designed to protect other ratepayers from cost shifts. Its database, which was last updated in November, says that 36 such agreements have been approved by state utility regulators, mostly in the past three years, and that another 29 are proposed or pending.

Diario of the Data Center Coalition cited this trend as evidence that the Washington bill was unnecessary. “The data center industry has been an active party in many of those proceedings,” he told me in an email, and “remains committed to paying its full cost of service for the energy it uses.” (The Data Center Coalition opposed a recent utility decision in Ohio that will require data centers to pay for a minimum of 85% of their monthly energy forecast, even if they end up using less.)

One of the data center industry’s favorite counterarguments against the fear of rising electricity is that new large loads actually exert downward pressure on rates by spreading out fixed costs. Jeff Dennis, who is the executive director of the Electricity Customer Alliance and has worked for both the Department of Energy and the Federal Energy Regulatory Commission, told me this is something he worries about — that these potential benefits could be forfeited if data centers are isolated into their own ratemaking class. But, he said, we’re only in “version 1.5 or 2.0” when it comes to special rate structures for big energy users, known as large load tariffs.

“I think they’re going to continue to evolve as everybody learns more about how to integrate large loads, and as the large load customers themselves evolve in their operations,” he said.

The Washington bill passed the Appropriations Committee on Monday and now heads to the Rules Committee for review. A companion bill is moving through the state senate.

Plus more of the week’s top fights in renewable energy.

1. Kent County, Michigan — Yet another Michigan municipality has banned data centers — for the second time in just a few months.

2. Pima County, Arizona — Opposition groups submitted twice the required number of signatures in a petition to put a rezoning proposal for a $3.6 billion data center project on the ballot in November.

3. Columbus, Ohio — A bill proposed in the Ohio Senate could severely restrict renewables throughout the state.

4. Converse and Niobrara Counties, Wyoming — The Wyoming State Board of Land Commissioners last week rescinded the leases for two wind projects in Wyoming after a district court judge ruled against their approval in December.

A conversation with Advanced Energy United’s Trish Demeter about a new report with Synapse Energy Economics.

This week’s conversation is with Trish Demeter, a senior managing director at Advanced Energy United, a national trade group representing energy and transportation businesses. I spoke with Demeter about the group’s new report, produced by Synapse Energy Economics, which found that failing to address local moratoria and restrictive siting ordinances in Indiana could hinder efforts to reduce electricity prices in the state. Given Indiana is one of the fastest growing hubs for data center development, I wanted to talk about what policymakers could do to address this problem — and what it could mean for the rest of the country. Our conversation was edited for length and clarity.

Can you walk readers through what you found in your report on energy development in Indiana?

We started with, “What is the affordability crisis in Indiana?” And we found that between 2024 and 2025, residential consumers paid on average $28 more per month on their electric bill. Depending on their location within the state, those prices could be as much as $49 higher per month. This was a range based on all the different electric utilities in the state and how much residents’ bills are increasing. It’s pretty significant: 18% average across the state, and in some places, as high as 27% higher year over year.

Then Synapse looked into trends of energy deployment and made some assumptions. They used modeling to project what “business as usual” would look like if we continue on our current path and the challenges energy resources face in being built in Indiana. What if those challenges were reduced, streamlined, or alleviated to some degree, and we saw an acceleration in the deployment of wind, solar, and battery energy storage?

They found that over the next nine years, between now and 2035, consumers could save a total of $3.6 billion on their energy bills. We are truly in a supply-and-demand crunch. In the state of Indiana, there is a lot more demand for electricity than there is available electricity supply. And demand — some of it will come online, some of it won’t, depending on whose projections you’re looking at. But suffice it to say, if we’re able to reduce barriers to build new generation in the state — and the most available generation is wind, solar, and batteries — then we can actually alleviate some of the cost concerns that are falling on consumers.

How do cost concerns become a factor in local siting decisions when it comes to developing renewable energy at the utility scale?

We are focused on state decisionmakers in the legislature, the governor’s administration, and at the Indiana Utility Regulatory Commission, and there’s absolutely a conversation going on there about affordability and the trends that they’re seeing across the state in terms of how much more people are paying on their bills month to month.

But here lies the challenge with a state like Indiana. There are 92 counties in the state, and each has a different set of rules, a different process, and potentially different ways for the local community to weigh in. If you’re a wind, solar, or battery storage developer, you are tracking 92 different sets of rules and regulations. From a state law perspective, there’s little recourse for developers or folks who are proposing projects to work through appeals if their projects are denied. It’s a very risky place to propose a project because there are so many ways it can be rejected or not see action on an application for years at a time. From a business perspective, it’s a challenging place to show that bringing in supply for Indiana’s energy needs can help affordability.

To what extent do you think data centers are playing a role in these local siting conflicts over renewable energy, if any?

There are a lot of similarities with regard to the way that Indiana law is set up. It’s very much a home rule state. When development occurs, there is a complex matrix of decision-making at the local level, between a county council and municipalities with jurisdiction over data centers, renewable energy, and residential development. You also have the land planning commissions that are in every county, and then the boards of zoning appeals.

So in any given county, you have anywhere between three and four different boards or commissions or bodies that have some level of decision-making power over ordinances, over project applications and approvals, over public hearings, over imposing or setting conditions. That gives a local community a lot of levers by which a proposal can get consideration, and also be derailed or rejected.

You even have, in one instance recently, a municipality that disagreed with the county government: The municipality really wanted a solar project, and the county did not. So there can be tension between the local jurisdictions. We’re seeing the same with data centers and other types of development as well — we’ve heard of proposals such as carbon capture and sequestration for wells or test wells, or demonstration projects that have gotten caught up in the same local decision-making matrix.

Where are we at with unifying siting policy in Indiana?

At this time there is no legislative proposal to reform the process for wind, solar, and battery storage developers in Indiana. In the current legislative session, there is what we’re calling an affordability bill, House Bill 1002, that deals with how utilities set rates and how they’re incentivized to address affordability and service restoration. That bill is very much at the center of the state energy debate, and it’s likely to pass.

The biggest feature of a sound siting and permitting policy is a clear, predictable process from the outset for all involved. So whether or not a permit application for a particular project gets reviewed at a local or a state level, or even a combination of both — there should be predictability in what is required of that applicant. What do they need to disclose? When do they need to disclose it? And what is the process for reviewing that? Is there a public hearing that occurs at a certain period of time? And then, when is a decision made within a reasonable timeframe after the application is filed?

I will also mention the appeals processes: What are the steps by which a decision can be appealed, and what are the criteria under which that appeal can occur? What parameters are there around an appeal process? That's what we advocate for.

In Indiana, a tremendous step in the right direction would be to ensure predictability in how this process is handled county to county. If there is greater consistency across those jurisdictions and a way for decisions to at least explain why a proposal is rejected, that would be a great step.

It sounds like the answer, on some level, is that we don’t yet know enough. Is that right?

For us, what we’re looking for is: Let’s come up with a process that seems like it could work in terms of knowing when a community can weigh in, what the different authorities are for who gets to say yes or no to a project, and under what conditions and on what timelines. That will be a huge step in the right direction.