You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

The U.S. is burning through forests, and replanting them is expensive.

Wildfires are razing U.S. forests faster than either natural regrowth or active replanting can restore them. There’s a nearly 4 million-acre backlog in the western U.S. of forests that have burned and not been re-seeded. That’s slightly larger than the size of Connecticut. And unless we pick up the pace, the shortfall could increase two to three times over by 2050 as wildfires get worse under a warming climate.

These are the findings of a study published last week on the yawning gap between reforestation needs and reforestation capacity in the western U.S. Trees are still the country’s most important resource to counteract climate change, offsetting more than 12% of annual greenhouse gas emissions as of 2021. But in some areas like in the fire-ravaged Rocky Mountain region, forests have become a net source of carbon to the atmosphere, releasing more than they draw down. To prevent the reforestation gap from widening, the new study warns, we have to fix the “reforestation pipeline” — our capacity to collect seeds, grow seedlings, and plant them.

It also highlights solutions. The research was primarily funded by a company that finances tree-planting efforts by selling credits to carbon-emitting businesses based on the amount of carbon the trees suck up, allowing those businesses to offset their own emissions. To rebuild the country’s reforestation capacity, the study recommends — surprise, surprise — expanding the role of forest carbon offsets, among other ideas.

Some might look at this paper and dismiss it as biased science, but it got me thinking about the long-running debate in the climate community over trees. Should companies be allowed to offset their emissions from burning fossil fuel by planting carbon-sucking forests? It’s easy to say no. Too many forest-related carbon offset projects have come under fire for using faulty accounting methods or for “protecting” forests that were at no risk of being felled. Plus, there’s the larger risk that offsets provide a license to emit.

But when you contemplate the chasm between the funding and infrastructure required to restore forests and current capacity and incentives — not just in the U.S., but also globally — it’s easy to see why so many people ignore these realities and say we must finance reforestation through carbon markets. The new study spells out the predicament quite clearly.

Solomon Dobrowski, the lead author and a professor of landscape ecology at the University of Montana, was quick to tell me that these numbers were a rough estimate. “I'm not so hung up on the absolute number,” he said. “We can increase the precision of that number. But the take-home message here is that the needs are rapidly outstripping our capacity to fill them.”

Dobrowski studies how forests grow back after a disturbance like a wildfire, and he’s been documenting a concerning trend. Larger, more severe fires are “punching these big holes into landscapes,” he told me. A severe burn might leave a mile-long stretch between nearest living trees, making it impossible for the forest to regenerate through natural seed dispersal.

At the same time, the government is struggling to pick up the slack. Due to funding shortfalls, the U.S. Forest Service has managed to address “just 6% of post-wildfire replanting needs” per year over the last decade.

The average area burned in the U.S. more than doubled from 2000 to 2017 compared to the preceding 17-year period. But the uptick in severe fires is not the only reason we’ve fallen so far behind on reforestation. At the same time fires have increased, both public and private forestry shops have collapsed. Ironically, the decline of an ecologically destructive industry — logging — also gutted the potential for an ecologically regenerative forestry industry to thrive.

Previously, most of the Forest Service’s reforestation work was funded by the agency’s timber sales. But beginning in the 1990s, logging on public lands sharply declined due to a confluence of factors, including over-harvesting in previous decades and the listing of the northern spotted owl as protected under the Endangered Species Act. The agency’s non-fire workforce has decreased by 40% over the past two decades. It also shut down more than half its nurseries, leaving just six remaining. Many state-owned nurseries have also closed due to budget cuts and reduced demand for seedlings.

Today, the reforestation supply chain is mostly sustained by private companies serving what’s left of the wood product and fiber industry. State and local regulations require companies to replant in the areas they harvest. But since the industry is concentrated on the west coast, so is the supply chain — 95% of seedling production in the western U.S. occurs in Washington, Oregon, and California. That means interior states like Montana, Colorado, Arizona, and New Mexico, which are seeing increasingly large fires, have no mature supply chain to support reforestation.

The New Mexico Natural Resources Department, for example, estimates it needs 150 million to 390 million seedlings to replant the acres burned in the past 20 years. But the only big nursery in the state, a research center at New Mexico State University, can supply just 300,000 seedlings per year. The nearest U.S. Forest Service nursery serving the region is in Boise, Idaho, more than 700 miles away. Matthew Hurteau, a forest ecologist at the University of New Mexico who is a co-author on the reforestation study, told me he has been working with the state to develop a new nursery capable of producing 5 million seedlings a year. The project has received some funding from the U.S. Department of Agriculture and the state government, but still needs to raise roughly $60 million more, Hurteau said.

Nurseries aren’t the only bottleneck. Hurteau has also been working to build the state’s seedbank, a time-consuming process that requires going out into the field and collecting seeds one by one. Another piece of the puzzle is workforce development. Dowbrowski pointed out that the majority of tree planting today is not done by government workers but rather by private contractors that hire H2B guest workers. Due to federal limits on immigration, reforestation contractors haven’t even been able to hire enough to meet current planting demand.

The new paper is far from the first to highlight these issues, and policymakers are beginning to address the problem. In 2021, the Forest Service got a major infusion of cash from the Bipartisan Infrastructure Law, which lifted the cap on its annual budget for reforestation from $30 million to at least $140 million with the directive to clear its backlog.

But Dobrowski said this is a far cry from all that’s needed. In the study, he and his co-authors estimated that clearing the existing backlog in the West alone could cost at least $3.6 billion. And that’s a conservative estimate — it doesn’t include the cost of building more greenhouses or expanding the workforce. “The reality is that the feds don’t have the infrastructure and workforce to address this at scale,” he told me. The Forest Service budget also won’t address reforestation needs on private lands, which account for about 30% of forested land in the western U.S.

After establishing the scale of the problem, the paper raises a followup question: How can we scale the reforestation supply chain? There, it pivots to argue that “new economic drivers” — like carbon markets — “can modernize the reforestation pipeline and align tree planting efforts with broader ecosystem resilience and climate mitigation goals.”

This is precisely what Mast Reforestation, the company that funded the research, is trying to do. Mast is vertically integrated — it collects seeds, grows seedlings, and plants them. The company has developed software to improve the efficiency of each of these steps and increase the chances of success, i.e. to minimize tree deaths. To fund its tree-planting efforts, Mast sells carbon credits based on the amount of CO2 the trees will remove from the atmosphere over their lifetimes. It only plants on privately owned, previously burned land that wouldn’t have otherwise been replanted (because the owner couldn’t afford it) or regenerated (because the burn was so severe). The idea is to create a more stable source of financing for reforestation not subject to the whims of congressional appropriations.

Matthew Aghai, an ecologist who works as the chief science officer at Mast and another of the study’s co-authors, told me there’s a misunderstanding among policymakers and the general public that when forests burn, the government is ready to step in, and all that’s needed is more funding for seedling production. Aghai hopes the new paper illuminates the truth, and how risky it is to wait for state backing that may never arrive. He told me that he sought out Dobrowski to work with him because he knew, as a former academic himself, that if he had written the paper on his own, there would have been a stigma attached to it. “I think the best way for me to get those ideas out was actually something that needs to happen in our broader market, which is a lot more collaboration,” he said.

There are many climate advocates who believe the problems with carbon offsets can be fixed, that the markets can be reformed, and that “high quality” nature-based credits are possible. Indeed, many consider restoring trust in nature-based carbon credits an imperative if we are to fund reforestation at the level that tackling climate change requires. A few weeks ago, Google, Meta, Microsoft, and Salesforce announced a new coalition called Symbiosis that will purchase up to 20 million tons of carbon removal credits from nature-based projects that “meet the highest quality bar” and “reflect the latest and greatest science.” Then, last Tuesday, the Biden administration followed up with a show of support for fixing the voluntary carbon market, because it can “deliver steady, reliable revenue streams to a range of decarbonization projects, programs, and practices, including nature-based solutions.”

But there is one fundamental problem with selling carbon credits based on trees, which no amount of reform or commitment to high integrity can solve. Fossil fuel CO2 emissions are essentially permanent — they stay in the atmosphere for upward of a thousand years. The CO2 sequestered by forests is not. Trees die. In a warming world, with worsening pest outbreaks, drought, and wildfires, the chances of a tree making it to a thousand years without releasing at least some of its stored carbon are slimmer than ever.

Hurteau, despite contributing to the paper, is deeply skeptical of financing reforestation through the sale of carbon credits. “We need to be making monster investments in maintaining forest cover globally, and I understand why people look at carbon finance to do this,” he said. “But you can't fly in an airplane and pay somebody to plant trees and have it zero out. From an energy balance perspective, for the Earth’s system, that's not real.”

When I raised this with Dobrowski, who endorsed the paper’s conclusions about the potential for carbon markets, he said it’s something he struggles with. He agreed that a ton of fossil fuel emissions is not the same as a ton of carbon sequestered in trees, but comes back to the fact that we need new incentive structures for people to do reforestation and be better stewards of our forests. It’s something I’ve heard echoed many times over in my reporting — the unspoken subtext essentially being, do you have any better ideas to raise the billions of dollars needed to do this?

Aghai had a slightly different take. To him, the one-to-one math isn’t so important “as long as the trajectory is moving forward, we're accumulating carbon, we're protecting watersheds, we're increasing the biodiversity index.” That may sound a bit hand-wavy — and it still gives a pass to polluters. But then he raised an interesting point, one that I don’t think I’ve heard before. The environmental damage caused by fossil fuels is not just the carbon they spew into the atmosphere. And the value forests provide is not just the carbon they sequester.

“Carbon’s our currency right now. It’s the thing that everyone is measuring around,” he said. “But what about all the other destruction that comes with the energy sector? There's cascading effects that impact water, soils, methane. Forests tend to stabilize everything by moving us toward homeostasis at a landscape level. For me, these markets will work when we catalyze them at a regional, dare I say global scale.”

Are these benefits enough to dismiss the incongruity inherent to forest carbon offsets? To say, for example, that trees might not actually offset the full amount of carbon that Google is putting in the atmosphere, but the funding Google is providing to get these trees in the ground makes some greater, unquantifiable progress toward our climate goals?

Some scientists have proposed alternative solutions. Myles Allen, a professor of geosystem science at the University of Oxford, has advocated for “like for like” offsetting, in which companies only buy nature-based carbon credits to offset their emissions from nature-based sources, such as land cleared to grow food. To offset fossil fuel emissions, the logic goes, they could buy other kinds of credits, like those based on carbon captured from the air and sequestered deep underground for millenia. The European Union is currently considering a rule that would require companies adhere to this principle. Others have suggested companies could make “contributions” to climate mitigation through investments in forests, rather than buying offsets.

Both would be significant departures from the way corporate sustainability managers have used carbon markets in the past. But the current system is in crisis. The volume of carbon credits traded declined precipitously in the last two years as buyers were spooked off buying offsets. Forestry-related credits, in particular, contracted from $1.1 billion in sales in 2022 to just $351 million in sales in 2023, a 69% drop. Within that, the vast majority of the credits traded during both years came from forestry projects that reduced emissions, not reforestation projects like Mast’s that remove carbon from the atmosphere.

Even if you agree with Aghai that carbon markets are our best hope at addressing the reforestation gap, gaining the trust of buyers is a prerequisite. That means that scientists, companies, and governance groups like the Integrity Council for the Voluntary Carbon Market first have to converge on what these credits actually mean and how they can be used.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

On a copper mega merger, California’s solar canal, and Bahrain’s deep-sea mining bet

Current conditions: Cooler air is dropping temperatures on the Pacific Coast and Nevada by as much as 20 degrees Fahrenheit • Hurricane Kiko lost intensity and passed north of Hawaii • The volcano Mount Semeru in East Java, Indonesia, is erupting today for the 19th time this week, spewing an ash plume nearly 2,000 feet high.

The Trump administration disbanded a group of five climate contrarians brought together to write the Department of Energy’s controversial report challenging the scientific consensus on the severity of climate change, CNN’s Ella Nilsen reported. In a lawsuit last month, the Environmental Defense Fund and the Union of Concerned Scientists alleged that the formation of the group of researchers — the University of Alabama’s John Christy and Roy Spencer, the Hoover Institution’s Steven Koonin, Georgia Tech professor emeritus Judith Curry, and Canadian economist Ross McKitrick — violated the Federal Advisory Committee Act’s public disclosure rules by failing to promptly disclose its formation and make its meeting and notes available to the public. The litigation also accused the Trump administration of breaking the law by assembling a government working group deliberately designed to represent a one-sided argument, which is prohibited under the same statute. Secretary of Energy Chris Wright confirmed in a September 3 letter that the group was dissolved. Still, the Energy Department has not retracted its assessment.

Wright’s regular messages on X about climate science and clean energy have drawn blowback and corrections appended by followers as Community Notes. “I can’t claim to know what’s happening in Wright’s mind. But I do know what’s happening with his policy — and this weak messaging, in my view, points to the intractability of Wright’s position,” Heatmap’s Robinson Meyer wrote on Tuesday. Wright is both the chief lieutenant in Trump’s culture war against those who advocate for a transition to clean energy and the mouthpiece of the president’s effort to convince the country he’s fulfilling his promise to curb energy prices. Wright’s social media behavior, however, “is not how someone acts when he is focused on energy affordability above all,” Robinson wrote.

The price of copper hit a record high this summer as the Trump administration slapped 50% tariffs on imports of the globally-traded metal needed for new electrical infrastructure and growth in demand far eclipsed any associated increase in supply. Now a mega-merger of two mining giants is set to capture a larger share of the fortunes generated by the new copper boom. Anglo American and Teck Resources inked a deal to merge, creating a mining behemoth with a combined market value of more than $53 billion. It’s one of the largest-ever deals in the mining industry. If completed, the tie-up will form one of the world’s top-five biggest copper producers, with mines stretching from the bottom of the Western Hemisphere in Chile to the top in Canada producing some 1.2 million metric tons of metal per year. More than 70% of that combined production would be copper.

“The energy industry has been dealing with the copper issue for years,” Heatmap’s Matthew Zeitlin reported in March, when prices were even lower. “More specifically, it’s worrying about how domestic and global production will be able to keep up with what forecasters anticipate could be massive demand.” This deal doesn’t necessarily quell those concerns, since, as The Wall Street Journal noted, it “also illustrates a challenge for bolstering commodity supply: Many miners figure it is easier and cheaper to buy rather than build mines.”

Wright’s posts about climate change and solar energy may be drawing criticism. But his agency’s support for nuclear energy has largely won praise across the political spectrum. That now includes fusion. On Wednesday, the Energy Department announced $134 million in funding for two programs designed to boost U.S. efforts to harness the type of atomic reaction that powers the sun, long considered the holy grail of clean energy. The agency pledged to give out a combined $128 million through the Fusion Innovative Research Engine to seven teams working on fusion energy science and technology. Another $6.1 million is set to flow to 20 projects through the Innovation network for Fusion Energy program to improve research in materials science, laser technologies, and fusion modeling. “DOE is unleashing the next frontier of American energy,” Wright said in a press release. “Fusion power holds the promise of limitless, reliable, American-made energy—and programs like INFUSE and FIRE ensure our innovators have the tools, talent, and partnerships to make it a reality.”

As I reported in this newsletter last month, the Massachusetts Institute of Technology spinout Commonwealth Fusion just raised one of the biggest venture rounds of the year. In July, Heatmap’s Katie Brigham reported on $10 million funding for the Seattle-area startup Avalanche Energy, which promises to build “micro” fusion reactors.

Shadeless land is a constraint on solar power’s expansion, inspiring high-profile projects in Portugal, Brazil, and China to build vast floating panel arrays on dammed bodies of water, a whole sector of the industry called agrovoltaics that marries farming and solar power production, and recent studies forecasting huge potential to line highways with panels. A new 1.6-megawatt solar installation in California that just came online highlights another option involving a manmade waterway: covering canals. Project Nexus, a $20 million state-funded pilot, has transformed stretches of the Turlock Irrigation District's canal system throughout California's Central Valley into what Canary Media’s Maria Gallucci called “hubs of clean electricity generation in a remote area where cotton, tomatoes, almonds, and hundreds of other crops are grown.”

President Donald Trump stirred a global controversy this year with his executive order directing the U.S. to stockpile minerals obtained through deep-sea mining, an as-yet nonexistent industry still awaiting a global agreement on international regulations that would create a global legal framework for commercially harvesting nodules from as deep as 20,000 feet down. As I previously reported in this newsletter, countries that opposed Trump’s push to unilaterally kick off mining without worldwide agreement on how to regulate the activities ended up siding with China, which opposed the U.S. move, along with conservationists, who say it risked damaging one of the last wildernesses untouched by humans. Yet this week Bahrain placed a big bet on the future of U.S. efforts, the Financial Times reported. The Gulf kingdom and U.S ally backed the California startup Impossible Metals’ plan to explore an area of ocean largely controlled by Beijing. Bahrain is also the first Middle Eastern country to sponsor the measure to legalize deep-sea mining at the obscure United Nations-linked agency, the Jamaica-headquartered International Seabed Authority. The investment is more proof that, as Katie wrote this week, “everybody wants to invest in critical mineral startups.”

Anyone who has been to northern Greenland can tell you how eerily lifeless the ice cap can seem when you’re looking out to a boundless horizon of treeless frozen expanse. But in what looks like dirt spotted in ice cores taken from the outer edges of the polar cap are diatoms — single-celled algae with outer walls made of glass. Far from a new presence, these non-plant photosynthetic organisms were long believed to be entombed and dormant in ice. But researchers from Stanford University extracted diatoms from ice cores and recreated their environments in a lab. The scientists discovered that diatoms travel through the ice via narrow channels as thin as a strand of hair. “This is not 1980s-movie cryobiology,” Manu Prakash, associate professor of bioengineering in the Schools of Engineering and Medicine and senior author of the paper, said in a press release. “The diatoms are as active as we can imagine until temperatures drop all the way down to -15 [degrees Celsius], which is super surprising.”

On Rick Perry’s loan push, firefighters’ mask rules, and Europe’s heat pump problems

Current conditions: The Garnet Fire has scorched nearly 55,000 acres in Sierra National Forest, east of Fresno, California, and now threatens 2,000-year-old sequoia trees • Hurricane Kiko is losing intensity as it reaches Hawaii • Tropical Storm Tapah has made landfall over China, forcing evacuations and school closures.

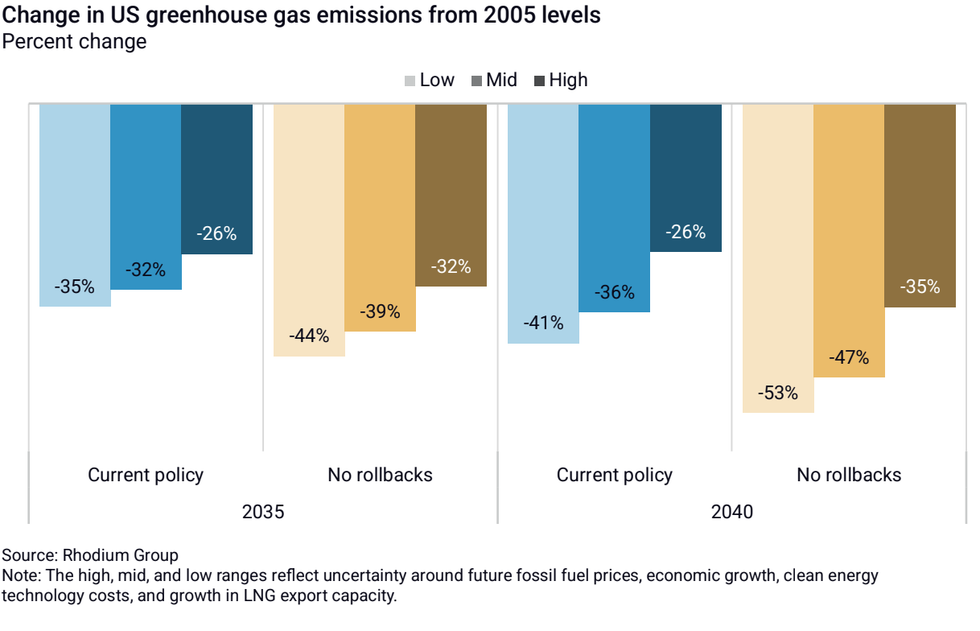

The United States’ output of planet-heating pollution is on track to continue double-digit declines through 2040, even if the Trump administration successfully eliminates all the policies it’s targeting to cut greenhouse gas emissions. That’s according to the latest assessment from the Rhodium Group consultancy. A new report published Wednesday morning found that U.S. emissions are set to decline by 26% to 43% relative to 2005 levels in 2040. While that sounds like a significant drop, it’s a “meaningful shift” away from Rhodium’s estimates last year, which showed a steeper decline of 38% to 56%. In all, as Heatmap’s Emily Pontecorvo wrote, the Trump administration’s policies could halve U.S. emissions cuts.

“Perhaps the only bright side in the report is a section on household energy costs,” Emily added. “The loss of tax credits for renewables and home efficiency upgrades will raise electricity bills compared to the projections in last year’s report. But despite that, Rhodium expects overall household energy costs to decrease in the coming decades — in all scenarios. That’s primarily due to the switch to electric vehicles, which lowers transportation costs for EV drivers and puts downward pressure on the cost of gasoline for everyone else.”

Fermi America, the company former Secretary of Energy Rick Perry founded to build one of the world’s biggest data center complexes in Texas, plans to push the Department of Energy for loans to finance its project, E&E News reported. In a filing to the Securities and Exchange Commission for its initial public offering on Monday, the developer laid out its vision for a 5,263-acre gas and nuclear complex in Armadillo, Texas, on land owned by the Texas Tech University. The company said it was in “pre-approval” process with the Energy Department’s loan office, which it hoped would “finance key components” of its energy infrastructure. The company has filed an application for up to four Westinghouse nuclear reactors at the site, which federal regulators confirmed they’re reviewing. In his executive orders on nuclear power in May, Trump directed the Energy Department to approve at least 10 new large-scale reactors. “We believe the Trump Administration’s renewed focus on expedited permitting and the expansion of nuclear infrastructure in the United States presents a favorable backdrop for Fermi to replicate its business model,” the filing said.

Get Heatmap AM directly in your inbox every morning:

Solar developer Pine Gate Renewables has started consulting advisers to deal with liquidity constraints amid the Trump administration’s push to derail the clean energy industry, Bloomberg reported. The company is working with Lazard Inc. and Latham & Watkins. It has some high-profile backers with loans from Brookfield Asset Management and Carlyle Group, while Blackstone provided preferred equity.

The move to enlist advisers is a sign of the challenges ahead for renewables. With new restrictions on imported solar panels coming into force, solar prices could soon rise. As Heatmap’s Matthew Zeitlin reported in April, that could erode solar’s price advantage over gas. With tariffs staying in place and tax credits going away, Morgan Stanley analysts warned that power purchase agreement prices for solar could go up as high as $73. That’s just a few dollars off from the cost of natural gas.

For decades, the U.S. government banned wildfire fighters from wearing masks that officials deemed too cumbersome, allowing only bandannas that offer no protection against toxins in wildfire smoke. But the Forest Service proposed new guidance Monday acknowledging for the first time that masks can protect firefighters against harmful particles in the smoke, The New York Times reported. The move came as part of a series of safety reforms meant to improve conditions for firefighters. In its reversal, the agency said it has now stockpiled some 80,000 N95 masks and will include them in standard equipment packs for all large fires.

Keeping firefighters employed has been difficult as blazes grow with each passing year. As Heatmap’s Jeva Lange wrote last year, “retirements and defections from skill-based work like firefighting are especially damaging because with every senior departure goes the kind of on-the-job expertise that green new hires can’t replace. But that’s if there are new hires in the first place. Rumors abound that the agencies are struggling to fill their openings even this late in the training cycle, with a known vacancy rate of 20% in the Forest Service force alone.” As I reported last week in this newsletter, the Trump administration’s arrest of immigrant firefighters battling the largest blaze in Washington last month has spurred blowback from lawyers who say the move jeopardized the effort to contain the disaster.

After booming in the wake of Russia’s invasion of Ukraine, European heat pump sales are slumping. It’s part of what one of the world’s largest manufacturers of the appliances called a “structural problem,” as demand dropped to a third of previous projections. In an interview with the Financial Times, Daikin president Naofumi Takenaka said orders for heat pumps have fallen as the economy has weakened and subsidies have decreased. “When we compare the market demand we had projected for 2025 at the time to the current market, it has stopped at roughly one-third of that, so it will take three to five years to return to such levels,” Takenaka said, speaking at Daikin’s headquarters in Osaka. “This is a structural problem.”

Beaked whales are considered one of the least understood mammals in the world due to their cryptic behavior and distribution in offshore waters, diving deeper than any other mammals on record and going below the surface for more than two hours. But scientists at Brazil’s Instituto Aqualie, Juiz de Fora Federal University, Mineral Engenharia e Meio Ambiente, and Santa Catarina State University set out to record the elusive whales. By doing so, they identified at least three different beaked whale species. “The motivation for this research arose from the need to expand knowledge on cetacean biodiversity in Brazilian waters, with particular attention to deep-diving species such as beaked whales,” author Raphael Barbosa Machado said in a press release.

Rob and Jesse riff on the state of utility regulation in America — and how to fix it.

Electricity is getting more expensive — and the culprit, in much of the country, is the poles and wires. Since the pandemic, utility spending on the “last mile” part of the power grid has surged, and it seems likely to get worse before it gets better.

How can we fix it? Well, we can start by fixing utility regulation.

On today’s episode of Shift Key, Rob and Jesse talk about why utility regulation sucks and how to make it better. In Europe and other parts of the world, utilities are better at controlling their cost overruns. What can the U.S. learn from their experience? Why is it so hard to regulate electricity companies? And how should the coming strains of electrification, and climate change affect how we think about the power grid? Shift Key is hosted by Robinson Meyer, the founding executive editor of Heatmap, and Jesse Jenkins, a professor of energy systems engineering at Princeton University.

Subscribe to “Shift Key” and find this episode on Apple Podcasts, Spotify, Amazon, YouTube, or wherever you get your podcasts.

You can also add the show’s RSS feed to your podcast app to follow us directly.

Here is an excerpt from our conversation:

Robinson Meyer: This is, I think, exactly where the wonky habit of referring to this as “T&D,” or transmission and distribution —

Jesse Jenkins: Yeah, we should split those.

Meyer: — simply because it’s a part of people’s bills, is actually driving the misnomer, because it allows renewable opponents — like the current administration, like officials in the current administration to say, Oh, well, the transmission and distribution section, the wire is part of the grid, is the surging part of electricity costs, this is driven by renewables. And that kind of does cohere to a mental model people might have of, oh, you have to build a lot of solar farms everywhere, or, oh, you have to build a lot of wind farms everywhere. They’re distributed over the landscape, unlike a single big power plant or something, and therefore that is driving up transmission spending.

And indeed, for renewables, as Jesse was saying, you do have to build more transmission. But where you look at the actual increase in prices is coming from in that T&D section of the bill, it is not at all that story. It’s all coming from distribution.

Jenkins: It’s certainly not coming from long-distance transmission because we’re not building any long-distance transmission, right?

And that’s the other big problem, is we have not been building transmission at anywhere near the pace that we have historically during periods when demand was growing rapidly to tap into the best resources around the country. But also, then, we should be, if we were to try to tap into American renewable energy resources that could lower consumer costs. The transmission we are building is mostly also local, short-distance, reliability-related upgrades that the transmission utilities are able to build with much less regulatory oversight.

Mentioned:

Rob on how electricity got so expensive

Matthew Zeitlin on Trump’s electricity price problem

Ofgem’s price cap

Previously on Shift Key: How to Talk to Your Friendly Neighborhood Public Utility Regulator

Jesse’s upshift (plus one more); Rob’s upshift.

This episode of Shift Key is sponsored by …

Hydrostor is building the future of energy with Advanced Compressed Air Energy Storage. Delivering clean, reliable power with 500-megawatt facilities sited on 100 acres, Hydrostor’s energy storage projects are transforming the grid and creating thousands of American jobs. Learn more at hydrostor.ca.

Music for Shift Key is by Adam Kromelow.