You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

On TVA’s new nuclear deal, plastics talks’ ‘abject failure’, and powerless Puerto Rico

Current conditions: After briefly strengthening into a Category 5 storm, Hurricane Erin continues toward Puerto Rico as a Category 4 • China is reeling from flash floods that killed 10 in Inner Mongolia on Sunday • Spain is battling 20 major wildfires as blazes across Europe displace thousands.

The Internal Revenue Service released guidance on Friday for wind and solar projects attempting to access the federal tax credits that start phasing out next year. For more than a decade, renewable developers needed to show only that they’d spent 5% of the total cost of the construction to qualify in a given tax year. Once the new rules kick in next month, almost all new projects will need to actually begin physical construction to be eligible. The change comes in response to an executive order President Donald Trump issued after signing the One Big Beautiful Bill Act, which directed the Treasury Department to raise the hurdles for wind and solar developers to tap what remained of the federal tax credits the new law had dramatically curtailed.

Trade associations representing renewables developers balked at the new rules. But solar stocks soared on Friday in large part because the guidance was less strict than many had anticipated, as I reported for Latitude Media. Prior to its release, some sources had speculated to me that the guidance could lift the investment threshold from 5% to somewhere closer to 51%, effectively requiring that developers spend more than half the total cost upfront or lose out on tax credits. “It’s not good, it’s not helpful, but from my perspective, the guidance could have been a lot worse,” David Burton, a partner at Norton Rose Fulbright who specializes in energy tax credits, told Heatmap’s Emily Pontecorvo. “Utility-scale solar and wind developers should be able to plan around this and not be that harmed.” This past weekend was also the third anniversary of many of these tax credits, which were created by the 2022 Inflation Reduction Act. As Center for Public Enterprise researcher Advait Arun wrote in an essay for Heatmap, going beyond past policy endeavors to “deliver an energy policy that stabilizes Americans’ cost of living while driving an energy transition away from fossil fuels and toward the technologies of the future ― Democrats should embrace this challenge. But they should also be aware that climate ambition runs headlong into the same institutional problems facing American democracy at large.”

For all the hype around building new types of reactors, the only new nuclear deals U.S. utilities have so far finalized involve what’s called third-generation designs. That means the reactors are still cooled with water like the rest of the traditional U.S. nuclear fleet, and include everything from the large-scale Westinghouse AP1000 to the small modular reactors NuScale and GE Vernova-Hitachi Nuclear Energy are promoting. On Monday, the Tennessee Valley Authority became the first U.S. utility to sign onto a power purchase agreement to buy electricity from what’s called a fourth-generation reactor company, whose SMR design uses a coolant other than water. The company, Kairos Power, is building its first reactor in Oak Ridge, Tennessee, with backing from Google. Under the terms of the new deal announced this morning, Google will buy as much power from the TVA grid as Kairos’ debut reactor produces.

If successful, the project could be the first next-generation nuclear plant to hook onto the U.S. grid. Reaching that goal has become a major political priority for the Trump administration since China hooked its first fourth-generation nuclear plant onto its grid last December.

For two weeks, international negotiators gathered in Geneva to hash out a global treaty to curb plastic pollution. More than 100 countries backed a pledge to halt production of new plastic waste. But oil-producing nations whose crude petroleum is transformed into plastics blocked the effort. Those included the United States, Saudi Arabia, and Russia. When talks ended last Friday, the nonprofit Center for International Environmental Law called the process “an abject failure.”

“When faced with a failure of this magnitude, it’s essential to learn from it,” David Azoulay, the head of the center’s delegation to the talks, said in a statement. “It’s impossible to find a common ground between those who are interested in protecting the status quo and the majority who are looking for a functional treaty that can be strengthened over time.”

The Environmental Defense Fund and the Union of Concerned Scientists sued the Department of Energy, accusing the agency of violating the law by secretly recruiting a group of people who reject the scientific consensus on climate change to author a report downplaying the risk of rising temperatures. The lawsuit alleges that Secretary of Energy Chris Wright “quietly arranged for five handpicked skeptics of the effects of climate change” to form a committee called the Climate Working Group. This, the litigation alleges, violates the Federal Advisory Committee Act of 1972,which does not allow federal agencies to recruit or rely on secret groups when engaging in policymaking, according to The New York Times.

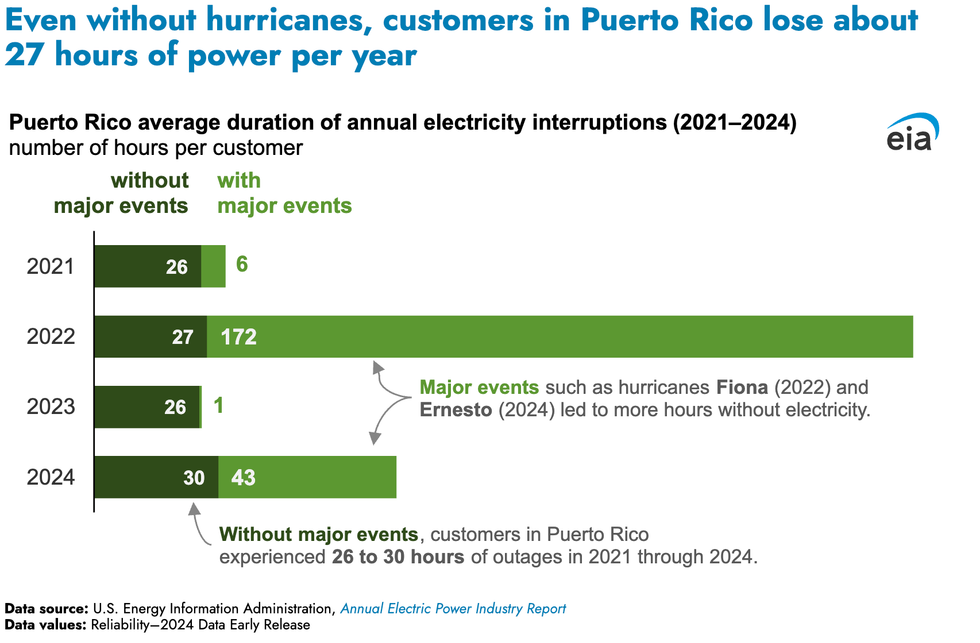

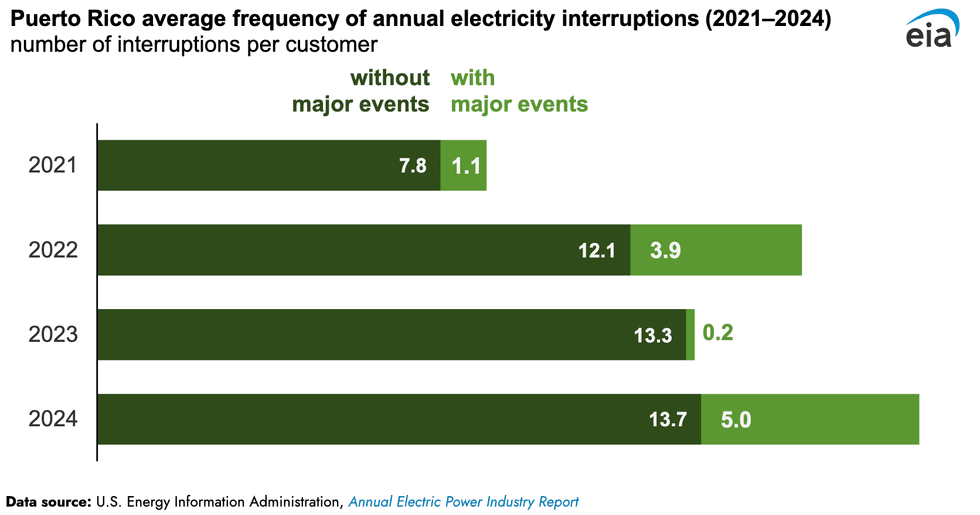

Puerto Ricans experienced an average of 27 hours of combined power grid interruptions each year between 2021 and 2024, according to new data from the U.S. Energy Information Administration. And that’s without counting major events such as hurricanes. By comparison, ratepayers in the mainland United States experienced about two hours of outages per year without major events. The frequency of blackouts increased throughout the three-year period. On average, Puerto Ricans faced 19 service interruptions in 2024: 14 without major events and 5 from major events.

Earlier this month, Trump fired nearly the entire fiscal control board that Congress put in charge of the U.S. territory’s finances. His administration has said the terminations are part of an overhaul meant to reindustrialize the bankrupt island.

Massachusetts Institute of Technology researchers uncovered a link between the properties of graphite and how the material behaves in response to radiation. The findings could lead to more accurate, less destructive ways of predicting the lifespan of graphite materials in nuclear reactors. “The paper proposes an attractive idea for industry: that you might not need to break hundreds of irradiated samples to understand their failure point,” Boris Khaykovich, the MIT research scientist who authored the study, said in a statement.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

The long-duration energy storage startup is scaling up fast, but as Form CEO Mateo Jaramillo told Heatmap, “There aren’t any shortcuts.”

Long-duration energy storage startup Form Energy on Tuesday announced plans to deploy what would be the largest battery in the world by energy capacity: an iron-air system capable of delivering 300 megawatts of power at once while storing 30 gigawatt-hours of energy, enabling continuous discharge for 100 hours straight. The project, developed in partnership with the utility Xcel Energy, will help power a new Google data center in Minnesota that will also be supplied by 1,400 megawatts of wind generation and 200 megawatts of solar power.

Form expects to begin delivering batteries to the data center in 2028. The systems will be manufactured at the company’s West Virginia factory, which is expected to reach an annual production capacity of 500 megawatts by the end of that year.

The Google deal represents a significant play for scale from the startup, which has raised about $1.2 billion to date. By comparison, Form’s first commercial deployment with Great River Energy — slated to become fully operational this year — is designed to store just 150 megawatt-hours of energy.

Google will cover all the costs of the clean energy generation, battery storage, and related grid infrastructure for the new data center through a contract structure it developed called a Clean Energy Accelerator Charge, which ensures that regional ratepayers aren’t left footing the bill. While Form isn’t disclosing the expected cost of this battery deployment, CEO Mateo Jaramillo told me that the company remains committed to achieving a fully installed system cost below $20 per kilowatt-hour by the end of the decade.

I spoke with Jaramillo about Form’s latest announcement, what it’s been up to over the past several years, and the operational and technical improvements that have allowed it to pursue a project of this scale despite the fact that it’s yet to deploy commercial projects anywhere near this size. This interview has been lightly edited and condensed for clarity.

Tell me about your history with Xcel Energy?

They know us extremely well. They’ve been inside our operation for, I think, five years now. So they’ve tracked us every single step of the way. They’re very familiar with the technology, with the team, with the progress, so they were ready to sign a deal that is the next scale larger even though we’ve yet to deliver on the very first [smaller scale] ones. Those are coming shortly, but they wanted to get going on hitting the scale-up as soon as possible.

What have you been working on over the past year that’s allowed you to move to this larger scale so quickly?

We’ve been fairly quiet about it, but we did deploy a first generation of the product last year with Great River Energy, albeit in relatively limited volumes. To get there we had to produce 100,000 electrodes, roughly. So it’s like 60 miles worth of material going through the factory, to prove to ourselves — and obviously to our customers — that we had process control. One of the major trap doors for any battery company is manufacturing at scale — until you do that, you can’t really say you understand your chemistry, frankly. And so that’s what we did over the last 18 months. It was arduous and challenging sometimes, but there aren’t any shortcuts. Prototypes are easy, and scale is hard.

So that was the work that we had to get through, which then informed a second generation design that we kicked off last summer and we’re now building today in the factory, doing the first phase of testing — design validation testing, production validation testing — before we start to really ramp up later this summer.

How are your second-generation battery cells an improvement over the first?

They both come in a 40-foot shipping container. So from the outside, it looks the same. You do get more power out of the second generation than the first generation — maybe 20% more. The electrodes do not change. In fact, the only way they have changed is to make them easier to manufacture. Electrochemically, material-wise, they’re exactly the same.

Google plans to cover all electricity costs for this data center. Could this accelerate its grid interconnection?

Yeah. I think that’s true of the whole portfolio that [Google] put together, to enable the project to be interconnected as quickly as possible. And obviously the consideration from the utility and the regulatory commission is going to be, what is the reliability profile of the resource? And so that’s the function that we provide. The 100 hours allows you to say we have clean, firm capacity on-site or provided to the site that’s going to help with the reliability concerns that one may have by bringing on this much new load this quickly.

This 30-gigawatt-hour battery is the largest ever announced. Can you put this number into perspective for me?

For all of 2025, I believe the installed capacity [added to the grid] in the entire U.S. was 57 gigawatt-hours. And in one project, we’re going to install 30 gigawatt-hours.

What it highlights is, once you get to the 100-hour duration, you can really stop thinking about energy to some extent. It sounds a little counterintuitive, but it’s like saying, how much energy do you get with a gas plant? To some extent you just care about the power, because you know you have the energy. And the same thing starts to become true once you’re in this multi-day duration regime. It’s a reliability asset. It’s a capacity asset. The 100 hours we know covers the key durations that really matter for those things. And so it’s sort of a 300-megawatt system that gives you all the energy you need.

What changes to the current electricity market structure are needed to fully capture the value of Form Energy’s 100-plus-hour grid battery?

The capacity markets certainly are evolving, and they’re evolving in a way that is beneficial for us. Generally gas gets the highest accreditation for capacity value in the system, and the shorter duration resources or the intermittent resources get much lower accreditation. What we have found is that our 100-hour system gets fully accredited at the same level as gas everywhere that we have gone through that process, and we expect that to be true in every other jurisdiction.

Ultimately, there needs to be a price for reliability. Right now there is no price for reliability, per se — it’s all proxies through capacities and the [levelized capacity contributes] and durations associated with that.

Given the numbers you’ve cited, it’s pretty clear that grid-scale battery storage is poised for exponential growth. When do you expect this expansion to really accelerate?

We feel pretty sure just based on demand that we already have — and that we see coming very quickly — that the market is as big as we can manufacture it. So 1,000 gigawatt-hours would be a terawatt-hour, which is a lot of energy. I think we’ll get there early next decade.

Current conditions: The sun is coming out as New York City digs out of nearly two feet of snow, but temperatures are set to drop by 5 degrees Fahrenheit and more snow is forecast later this week • Floodwaters destroyed a major bridge in Migori, near Kenya’s shore of Lake Victoria, as rain continues every day this week across the country • The Solomon Islands are hunkering down in thunderstorms all week.

Electricity went out in more than 600,000 U.S. homes and businesses during the blizzard that pummeled the Northeast with two feet of snow. Massachusetts suffered the worst of the blackout, with nearly 300,000 customers still disconnected as of Monday night. New Jersey and Delaware trailed behind with more than 50,000 households each. In a show of the bicoastal nature of America’s grid fragility, intense winds in California also knocked out power lines and plunged tens of thousands more homes into darkness. Heavy snows put travel bans in effect across five states, but temperatures remained just above freezing in broad swaths of the country’s most densely populated region.

Winter Storm Fern, the Arctic weather that hit the Northeast at the end of last month, took out power for more than 1 million U.S. households, as I reported at the time. That’s due in part to the frigid air. As Heatmap’s Jeva Lange and Matthew Zeitlin wrote recently: “Put simply, cold temperatures stress the grid. That’s because cold can affect the performance of electricity generators as well as the distribution and production of natural gas, the most commonly used grid fuel. And the longer the grid has to operate under these difficult conditions, the more fragile it gets. And this is all happening while demand for electricity and natural gas is rising.”

The Supreme Court added just one new case to its oral argument docket upon returning Monday from its winter recess. The nation’s highest court has agreed to review a ruling by the Colorado Supreme Court in a case in which the oil and gas industry challenged Boulder County’s legal right to sue fossil fuel producers for damages from the effects of climate change under state law on the grounds that the companies knowingly destabilized the planet’s weather systems. In a lawsuit backed by Exxon Mobil, the Canadian fuel refiner Suncor Energy argued that the issues Boulder’s county commission cited in its suit fall under the federal government’s jurisdiction, thereby invalidating the basis for the litigation. While Colorado’s highest court said it aimed to “express no opinion on the ultimate viability of the merits of” Boulder’s claims when it rejected oil companies’ argument in 2023, the justices wrote that they believed the industry case boiled down to an argument that “a vague federal interest over interstate pollution, climate change, and energy policy must preempt Boulder’s claims.”

Heatmap’s Emily Pontecorvo laid out the stakes like this: “The case is arriving at the nation’s highest court in a particularly fraught moment for climate regulation. The Supreme Court ruled back in 2007 that the EPA had authority to regulate greenhouse gases under the Clean Air Act, preventing states from creating a patchwork of their own emissions rules.” The case has come before the Supreme Court five times already, according to SCOTUSblog.

Once derided as a “false solution” that posed grave risks across human endeavors — even to the scientific process itself — environmental advocates have begun quietly to embrace the need at least study what technologies to artificially cool the planet might do now that a private geoengineering industry is rapidly emerging. (To brush up, re-read all the context my colleague Robinson Meyer wove into his scoop last year on a leading geoengineering startup raising its first major financing round.) Now the Natural Resources Defense Council is officially taking geoengineering seriously. Alongside three other partners, the green group launched a new project Tuesday morning to coordinate research governance on solar radiation management, the controversial suite of technologies that largely involve spraying reflective aerosols into the atmosphere to reflect the sun’s energy back into space.

Dubbed the Solar Geoengineering Research Governnance Platform, the project “will provide shared, voluntary tools that help research institutions demonstrate how decisions are made, risks are managed, and public concerns are addressed.” The NRDC said laboratory and university partners would be unveiled in upcoming announcements. “Solar geoengineering research is advancing faster than governance systems can keep pace,” Alliance for Just Deliberation on Solar Geoengineering executive director Shuchi Talati, a nonprofit that’s part of the new effort, said in a statement. “The goal is to carefully co-develop thoughtful, practical governance tools before research expansion narrows public choice.”

Sign up to receive Heatmap AM in your inbox every morning:

Despite a storm of tariffs and seachanges in federal policy, clean energy finance in 2025 “proved less fragile than the year’s headlines suggested.” That’s the conclusion of a new year-end report Heatmap’s Matthew Zeitlin wrote up this morning by Crux Climate, the low-carbon fintech startup. “AI investment, data center development, delayed interconnection, and energy affordability reinforced the underlying investment case in 2025 for projects that could deliver power and reliability quickly and predictably,” the report found. “In this environment, clean energy and capital markets were remarkably resilient.” Investors gave out more capital than ever, but the market split. One on side, you had smaller developers, manufacturers, and biofuels companies that saw overall declining investment. On the other, you had soaring power investment.

The green steel startup Boston Metal, meanwhile, is cutting jobs after suffering what Canary Media called “a major setback.” The company said it had experienced an “unforeseen critical equipment failure” at its manufacturing plant in Brazil. While the incident was “fully contained, with no injuries or environmental impact,” the equipment damage prevented the startup from hitting an operational milestone needed to unlock a pending financial deal. As a result, “we lost access to committed capital essential to supporting our operations in both Brazil and the U.S.” Boston Metal is now laying off 71 employees in the U.S., amounting to nearly a quarter of its global workforce.

Amazon plans to pump $12 billion into new data center campuses in Louisiana, the company announced Monday. The push will create 540 full-time data center jobs and the tech giant will invest “up to $400 million in local water infrastructure” for the facilities. In a press release, the company pledged to pay for its own energy and utility infrastructure, and provide a $250,000 community fund to help support science education.

At least 25 data centers were abandoned last year following local opposition, according to a Heatmap Pro review that Rob wrote about last month. Data center fights, our colleague Jael Holzman wrote in November, are “swallowing American politics.”

Leave it to France to punch above its weight in nuclear energy. Last week, the WEST tokamak reactor at the French Commission of Atomic and Alternative Energies’ Cadarache laboratory broke a record in fusion energy. The reactor held a hot plasma for 1,337 seconds, slightly over 22 minutes. That beat the previous record set by a Chinese fusion facility weeks earlier by 25%. “WEST has achieved a new key technological milestone,” Anne-Isabelle Etienvre, the commission’s director of fundamental research, said in a statement. “Experiments will continue with increased power. This excellent result allows both WEST and the French community to lead the way for the future” large-scale experiments at the ITER international fusion research project.

Editor’s note: This story has been updated to correct the description of the Solar Geoengineering Research Governnance Platform, including the group’s name and purpose.

There are two titanic forces in the clean energy market, and whichever one is stronger will determine the path of the post-One Big Beautiful Bill Act industry.

First there’s federal policy, which, thanks to OBBBA and the Trump administration’s war on renewable permitting, is making things more difficult for developers. Then there’s the technology: Soaring electricity demand from data centers, providing the business case for everything from co-located batteries and solar to small modular nuclear reactors.

“2025 is the storm at night, and there were all these cross-cutting winds that hit the boat. The ones that came from the front are the tariffs and the tax changes and wind cancellations or pauses,” Alfred Johnson, cofounder and chief executive of the clean energy finance platform Crux, told me. “Then the tailwinds at the back were interest rates, the continuation of many [other tax credits] in the OBBBA — including storage credits, nuclear credits, manufacturing credits — and substantial demand coming for the electricity and the components. And when the storm cleared in the morning, the boat is further ahead in the water than you would have anticipated.”

That’s the bifurcated story Crux — a marketplace for tax equity, tax credits, and debt financing — is telling in its 2025 market intelligence report, released Tuesday. There were splits in when investment happened and in which sectors were favored. There were better and worse times for investment. And there were countervailing forces pushing on the clean energy market.

Here’s how Crux views the clean energy financing market as it enters an uncertain time.

Crux found a split in activity between the first and second halves of last year across a number of markets. A lot of that could be chalked up to investors trying to front-run a partial or full repeal of the Inflation Reduction Act, which became all but inevitable following the 2024 election.

Overall there was $120 billion worth of lending to “clean power, fuels, and manufacturing projects” in 2025. That’s more than in 2024, but still a “materially lower growth rate” — 5.8% year over year, compared to 22% in 2024.

“Investment activity was front-loaded during the first half of 2025,” the report found, peaking in the first three months of the year and then declining through “the second and third quarters “as some investors waited to see how debate over the OBBB would resolve itself.” There was capital to be raised throughout 2025, but it “became increasingly selective over the course of the year,” Crux found.

Some $63 billion of tax credits changed hands — but again, there was a slowdown in the second half of the year due to uncertainty around how the OBBBA affected the market. Similarly, pricing for tax credits softened in the second half of the year, and deals got smaller.

Solar and storage “continued to represent a dominant share of current-year spot tax credit activity in 2025,” the Crux report says, making up just over half of the tax credit market. While solar on its own made up just over a third of the market, “storage-linked categories expanded most rapidly on a percentage basis, led by standalone storage, followed by solar and storage,” the team found.

Citing data from the U.S. Energy Information Administration showing that utility-scale storage deployment grew 72% over the course of 2025, from 11 gigawatts to 19 gigawatts, Johnson told me that storage is “categorically booming.”

“Storage was a major outlier and source of growth,” he said. “We continue as a country to provide a lot of support on top of a lot of demand for batteries, and that, in our view, is going to lead to a lot of continued deployment in the battery sector.”

But what about EVs? The large batteries in electric cars are a major source of demand that help catalyze the battery supply chain from the lithium and cobalt to the battery cells and packs. While the EV market may be getting hammered by inconsistent policy, battery manufacturing is still going strong, Johnson said, thanks to the demand for energy storage.

“There was a lot of pearl-clutching about what would happen to the battery supply chain with less policy support and EVs being less in favor,” he told me. “What you have seen is some number of those battery manufacturers have rotated their delivery and their product into grid-connected battery storage because that market has so much demand in it. So you’re still seeing a lot of that demand flow through into the need for capacity.”

Crux found that nearly a quarter of the Fortune 1000 companies are participating in the tax credit market. Their rising participation “drove the aggregate growth in the market and supported pricing despite rising market uncertainty following passage of the OBBB,” the report found.

When the market was just tax equity deals, in which investors partner directly with developers on a project in exchange for the value of the tax credits, it had only “a few dozen participants,” Johnson said. By 2023, a year after the Inflation Reduction Act allowed for those credits to be traded on third-party platform, it had around 50, he told me. Now that number is closer to 250.

“It’s becoming a more common part of the tax planning and cash management strategies that large companies are deploying,” Johnson said, pointing to data showing that tax credit buyers had effective tax rates three percentage points lower than non-buyers.

The Internal Revenue Service rolled out final rules for a new set of production and investment tax credits — the so-called tech neutral tax credits that applied to “any clean energy facility that achieves net-zero greenhouse gas emissions,” not just specific technologies chosen by Congress — in early 2025, just before the Biden administration left office.

Since then, these credits “have entered a choppy market,” the Crux report says.

“Crux’s survey of tax equity sponsors shows that most have limited investment in projects claiming the tech-neutral … credits,” which it attributed to concerns around stringent source requirements companies related to so-called foreign entities of concern must meet to claim these newer credits compared to the legacy investment and production tax credits.

Crux found modest but still measurable discounts for the tech-neutral tax credits compared to their predecessors of about 1 to 2 cents on the dollar for newer projects. (Projects that started construction before the end of 2024 were still eligible for the legacy credits.)

When talking to tax equity investors, Crux found that just 10%“reported actively pursuing tech-neutral tax credits,” while 90% said they would “only look at these credits under certain circumstances.”

“It’s mostly a comfort thing,” Johnson said. That may yet abate — he pointed out that “you saw preference in the early market for wind and solar credits versus advanced manufacturing and fuels and nuclear,” as new credits were developed, but eventually the market became more comfortable with funding new technologies and working with new credits, Johnson said.

“The new guidance that came out from the department on FEOC answers some of those questions,” Johnson said. “We think that that will drive some amount of additional market volume.”