You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

A new paper from two Harvard researchers shows how these mega-users are disrupting the traditional regulatory structure.

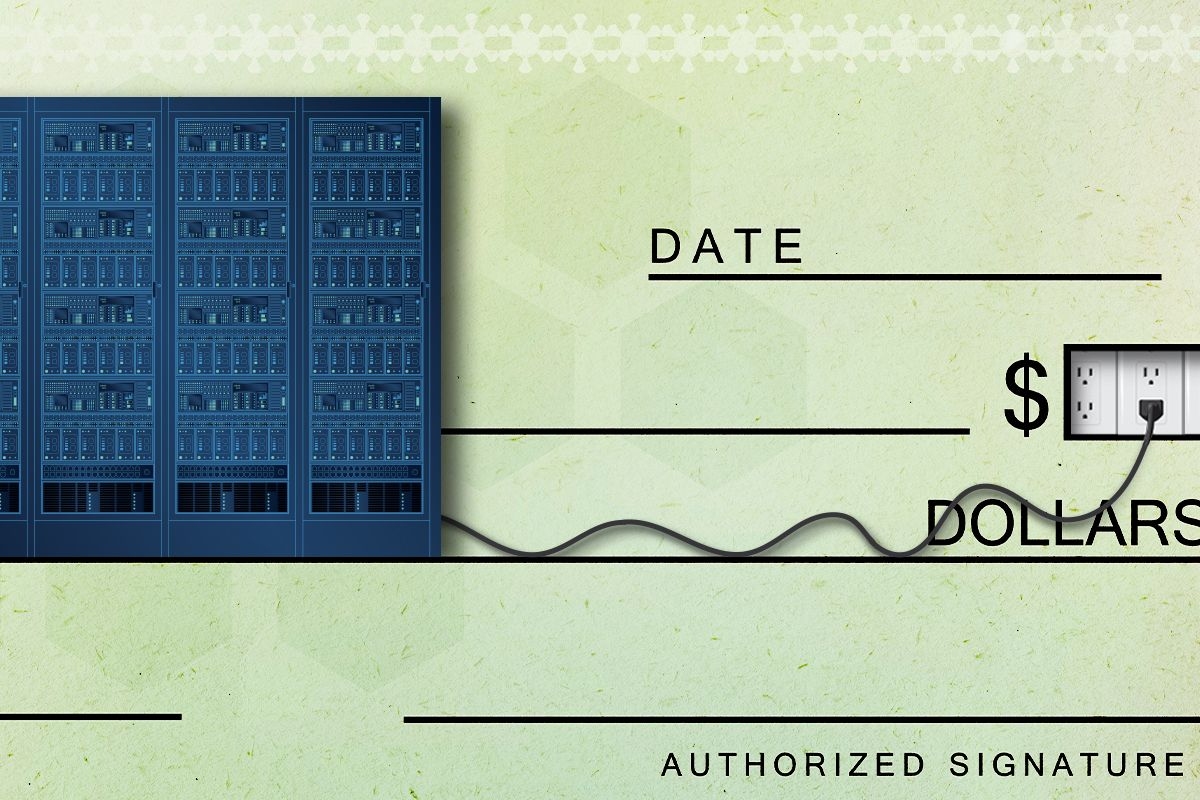

Who pays for a data center? The first answer is the investors and developers who are planning on pouring billions of dollars into building out power-hungry facilities to serve all sorts of internet services, especially artificial intelligence. And how much will it cost them? The numbers thrown around have a kind of casual gigantism that makes levelheaded evaluation difficult. $80 billion? $100 billion? $500 billion?

But while technology companies are paying for the chips and the systems that do the work of artificial intelligence, it may be normal people and businesses — homeowners, barbershops, schools — that end up paying for at least some of the electricity and system upgrades necessary to bring these facilities online.

That’s the argument made by Harvard Law School lecturer Ari Peskoe and Eliza Martin, a fellow at the school’s Environmental and Energy Law Program, of which Peskoe is a part. Their paper, published Thursday, is titled, “Extracting Profits from the Public: How Utility Ratepayers Are Paying for Big Tech’s Power.”

The core argument is this: The cost of maintaining and expanding the electricity distribution system is shared by all ratepayers — retail, business, and industrial — through a process governed by state public utility commissions. Utilities, meanwhile, have a legal mandate to serve everyone in their territory and a captive customer base of ratepayers, but they also compete among themselves for the business of energy-hungry customers, who can pick and choose where they set up shop. These customers often require new investment in grid infrastructure, which utilities pay for by asking state regulators to approve higher electricity rates — for everyone.

From there the conflict is clear: Utilities will want to attract big customers, and may sacrifice their retail customers in order to do so. And lately, with the AI boom booming, there are more of these big customers than at any other time in recent memory.

“Utilities’ narrow focus on expanding to serve a handful of big tech companies … breaks the mold of traditional utility rates that are premised on spreading the costs of beneficial system expansion to all ratepayers,” Peskoe and Martin write.

The traditional model of utility regulation is built on the premise that all ratepayers should pay for grid improvements, such as new transmission lines or substations, because all will benefit from them. This dynamic is disrupted, however, when it comes to customers demanding a gigawatt or more of power, the authors write. “The very same rate structures that have socialized the costs of reliable power delivery are now forcing the public to pay for infrastructure designed to supply a handful of exceedingly wealthy corporations,” the paper says.

“The assumption behind all this is that these are broadly beneficial projects that are going to benefit energy users generally,” Peskoe told me. “But I think that assumption is a bit out of date,” pointing to an example in Virginia of a $23 million grid infrastructure project retail customers paid for half of despite it being solely necessitated by the data center.

Peskoe and Martin set out an “alternative approach,” whereby data centers will power themselves — that is, outside of the utility system — and become a “formidable counterweight to utilities’ monopoly power.” In addition to being a more fair structure for the average customer, the authors also hope it will mark a “return to the pro-market advocacy that characterized the Big Tech’s power-sector lobbying efforts prior to the ChatGPT-inspired AI boom.”

While this approach would be a major challenge to almost a century of utility regulation, Peskoe and Martin also set out some more modest options, such as having state regulators “condition service to new data centers on a commitment to flexible operations.” That proposal cites research from Duke University — and featured previously in Heatmap — showing that a commitment by data centers to power down for a small portion of every year could allow utilities to avoid having to build billions of dollars worth of new infrastructure to serve the peak demand of the system.

The barrier to this approach is that utilities “have historically been hostile to regulatory attempts to require measures that would defer or avoid the need for costly infrastructure upgrades that drive utilities’ profits,” Peskoe and Martin argue. While the enormous investment in data centers is novel, Peskoe told me that the core issue of utilities using their captive ratepayers as a checkbook in order to pursue big fish customers is right at the heart of the utility playbook.

“A lot of this is baked into the utility business model,” Peskoe said. “The incentives to deploy capital and the ability to shift costs among consumer groups are unique to utilities.”

But just as utilities have a unique business model whereby investor-owned businesses are granted monopolies, they also have a unique regulatory structure. (Apple doesn’t have to go to a board appointed by a governor to get approval to hike the price of the iPhone.) This setup gives regulators unique powers — and unique responsibilities — to patrol and restrict utilities taking advantage of ratepayers, Peskoe said.

“Regulators can try to police this stuff. It's hard. But that's one of the goals of utility regulation, is to try to police these poorly designed incentives,” Peskoe said.

“None of the consequences are baked in, but some of the basic mechanisms and incentives are just inherent and not unique to data centers.” What is unique to data centers in this moment, Peskoe added, “is just the scale of this growth, and therefore the potential scale of these cost shifts.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Except for those related to the FIFA World Cup.

The Federal Emergency Management Agency has suspended all of its training and education programs for emergency managers across the country — except for those “directly supporting the 2026 FIFA World Cup.”

FEMA’s National Training and Education Division offers nearly 300 courses for local first responders and emergency managers, while FEMA’s National Disaster and Emergency Management University (formerly called the Emergency Management Institute) acts as the central training organization for emergency management in the United States. Since funding for the Department of Homeland Security lapsed on February 14, FEMA has instructed NTED partners to “cease course delivery operations,” according to communication reviewed by Heatmap. The NDEMU website and independent study materials have also been taken down.

The decision to remove NDEMU materials and freeze NTED courses not related to the World Cup has left emergency management students around the country in the lurch, with some just a few credits shy of certifications that would allow them to seek jobs. Mid-career employees have likewise been unable to meet their continuing training requirements, with courses pending “rescheduling” at a later date.

In states like California, where all public employees are sworn in as disaster service workers, jurisdictions have been left without the resources to train their employees. Additionally, certain preparedness grants require proof that emergency departments are compliant with frameworks such as the National Incident Management System and the Incident Command System. “The federal government says we need to be compliant with this, and they give us a way to do that, and then they take it away,” Laura Maskell, the emergency training and exercise coordinator for the city of San Jose, told me.

Depending on how long the DHS shutdown lasts, the training freeze is likely to exacerbate already dire staffing shortages at many municipal offices around the country. Emergency managers often juggle multiple jobs, ranging from local hazard and mitigation planning to public communication and IT. They also serve as the point people for everything from cybersecurity attacks to spectator safety to extreme-weather disaster response, and staying up to date on the latest procedures and technologies is critical enough to require ongoing education to maintain certification.

Training can be extensive. Becoming a certified emergency manager requires 100 hours of general management and 100 hours of emergency management courses — many of which students complete independently, online, while working other jobs — nearly all of which are currently suspended. The courses are utilized by many other first responders and law enforcement groups, too, from firefighters to university campus safety officers.

Emergency management officials and students I spoke with told me they see FEMA’s decision as capricious — “an intentional choice the government has made to further disrupt emergency management,” as a student who wanted to remain anonymous to protect their FEMA-funded employer from backlash told me — given that FEMA materials were not removed or trainings canceled during previous shutdowns. (Materials were unavailable during the most recent full-government shutdown in 2025.) In the past, FEMA has processed certifications once its offices have reopened; the exception for World Cup-related training adds to the feeling that the decision to remove materials is punitive.

“My understanding is these websites are pretty low maintenance,” Maskell said. She added, “Outside of a specific review cycle, I was not aware that there was any active maintenance or upkeep on these websites. So for them to take these down, allegedly because of the DHS shutdown, that doesn’t make sense to me.”

San Jose’s 6,800 city employees are required to take two to four designated FEMA courses, which Maskell said her team no longer has access to. “We don’t have another way” to train employees “that is readily available to get them that information in a cost-effective, standardized, most importantly up-to-the-federal-requirements way,” she added. Levi’s Stadium in Santa Clara, which falls within San Jose’s jurisdiction, is a World Cup site, and Maskell confirmed that in-person training specific to sports and special events has proceeded uninterrupted.

Depriving emergency managers and first responders of training seems at odds with the safe streets emphasis of the Trump administration. But FEMA has been in crisis since the DOGE cuts of early 2025, which were executed by a series of administrators who believe the agency shouldn’t exist; another 10,000 employees may be cut this spring. (Sure to deepen the chaos at the agency, Trump fired Secretary of Homeland Security Kristi Noem earlier Thursday. FEMA did not respond to a request for comment on this story.) The White House says it wants to shift responsibility for disaster planning and response back to the states — a goal that nevertheless underscores the importance of keeping training and resources accessible, even if the website isn’t being actively updated during the DHS shutdown.

Trainings that remain caught up in the politics of the shutdown include courses at the Center for Homeland Defense and Security, the Rural Domestic Preparedness Consortium, and others. The National Domestic Preparedness Consortium, which is also affected, offers training for extreme weather disasters — education that is especially critical heading into flood and tornado season, with wildfire and hurricane season around the corner. Courses like the National Disaster Preparedness Training Center’s offering of “Evacuation Planning Strategies and Solutions” in San Francisco, one of the World Cup host cities, fall under the exemption and are expected to be held as planned.

Noem had blamed Democrats for holding up $625 million in FEMA grants for FIFA World Cup host cities, funds that would go toward security and planning. Democrats have pushed back on that line, pointing out that World Cup security funding was approved last summer and the agency missed the anticipated January award date for the grant program ahead of the DHS shutdown. Democrats have said they will not fund the department until they reach an agreement on Immigration and Customs Enforcement’s use of deadly force and detention against U.S. citizens and migrant communities. (The House is scheduled to vote Thursday afternoon on a potential DHS funding package; a scheduled Senate vote earlier in the day failed to advance.)

The federal government estimates that as many as 10 million international visitors will travel to the U.S. for the World Cup, which begins in 98 days. “Training and education scheduled for the 11 U.S. World Cup host cities,” the DHS told its partners, “will continue as planned.”

The administration has begun shuffling projects forward as court challenges against the freeze heat up.

The Trump administration really wants you to think it’s thawing the freeze on renewable energy projects. Whether this is a genuine face turn or a play to curry favor with the courts and Congress, however, is less clear.

In the face of pressures such as surging energy demand from artificial intelligence and lobbying from prominent figures on the right, including the wife of Trump’s deputy chief of staff, the Bureau of Land Management has unlocked environmental permitting processes in recent weeks for a substantial number of renewable energy projects. Public documents, media reports, and official agency correspondence with stakeholders on the ground all show projects that had ground to a halt now lurching forward.

What has gone relatively unnoticed in all this is that the Trump administration has used this momentum to argue against a lawsuit filed by renewable energy groups challenging Trump’s permitting freeze. In January, for instance, Heatmap was first to report that the administration had lifted its ban on eagle take permits for wind projects. As we predicted at the time, after easing that restriction, Trump’s Justice Department has argued that the judge in the permitting freeze case should reject calls for an injunction. “Arguments against the so-called Eagle Permit Ban are perhaps the easiest to reject. [The Fish and Wildlife Service] has lifted the temporary pause on the issuance of Eagle take permits,” DOJ lawyers argued in a legal brief in February.

On February 26, E&E News first reported on Interior’s permitting freeze melting, citing three unnamed career agency officials who said that “at least 20 commercial-scale” solar projects would advance forward. Those projects include each of the seven segments of the Esmeralda mega-project that Heatmap was first to report was killed last fall. E&E News also reported that Jove Solar in Arizona, the Redonda and Bajada solar projects in California and three Nevada solar projects – Boulder Solar III, Dry Lake East and Libra Solar – will proceed in some fashion. Libra Solar received its final environmental approval in December but hasn’t gotten its formal right-of-way for construction.

Since then, Heatmap has learned of four other projects on the list, all in Nevada: Mosey Energy Center, Kawich Energy Center, Purple Sage Energy Center and Rock Valley Energy Center.

Things also seem to be moving on the transmission front in ways that will benefit solar. BLM posted the final environmental impact statement for upgrades to NextEra’s GridLance West transmission project in Nevada, which is expected to connect to solar facilities. And NV Energy’s Greenlink North transmission line is now scheduled to receive a final federal decision in June.

On wind, the administration silently advanced the Lucky Star transmission line in Wyoming, which we’ve covered as a bellwether for the state of the permitting process. We were first to report that BLM sent local officials in Wyoming a draft environmental review document a year ago signaling that the transmission line would be approved — then the whole thing inexplicably ground to a halt. Now things are moving forward again. In early February, BLM posted the final environmental review for Lucky Star online without any public notice or press release.

There are certainly reasons why Trump would allow renewables development to move forward at this juncture.

The president is under incredible pressure to get as much energy as possible onto the electric grid to power AI data centers without causing undue harm to consumers’ pocketbooks. According to the Wall Street Journal, the oil industry is urging him to move renewables permitting forward so Democrats come back to the table on a permitting deal.

Then there’s the MAGAverse’s sudden love affair with solar energy. Katie Miller, wife of White House deputy chief of staff Stephen Miller, has suddenly become a pro-solar advocate at the same time as a PR campaign funded by members of American Clean Power claims to be doing paid media partnerships with her. (Miller has denied being paid by ACP or the campaign.) Former Trump senior adviser Kellyanne Conway is now touting polls about solar’s popularity for “energy security” reasons, and Trump pollster Tony Fabrizio just dropped a First Solar-funded survey showing that roughly half of Trump voters support solar farms.

This timing is also conspicuously coincidental. One day before the E&E News story, the Justice Department was granted an extension until March 16 to file updated rebuttals in the freeze case before any oral arguments or rulings on injunctions. In other court filings submitted by the Justice Department, BLM career staff acknowledge they’ve met with people behind multiple solar projects referenced in the lawsuit since it was filed. It wouldn’t be surprising if a big set of solar projects got their permitting process unlocked right around that March 16 deadline.

Kevin Emmerich, co-founder of Western environmental group Basin & Range Watch, told me it’s important to recognize that not all of these projects are getting final approvals; some of this stuff is more piecemeal or procedural. As an advocate who wants more responsible stewardship of public lands and is opposed to lots of this, Emmerich is actually quite troubled by the way Trump is going back on the pause. That is especially true after the Supreme Court’s 2025 ruling in the Seven Counties case, which limited the scope of environmental reviews, not to mention Trump-era changes in regulation and agency leadership.

“They put a lot of scrutiny on these projects, and for a while there we didn’t think they were going to move, period,” Emmerich told me. “We’re actually a little bit bummed out about this because some of these we identified as having really big environmental impacts. We’re seeing this as a perfect storm for those of us worried about public land being taken over by energy because the weakening of NEPA is going to be good for a lot of these people, a lot of these developers.”

BLM would not tell me why this thaw is happening now. When reached for comment, the agency replied with an unsigned statement that the Interior Department “is actively reviewing permitting for large-scale onshore solar projects” through a “comprehensive” process with “consistent standards” – an allusion to the web of review criteria renewable energy developers called a de facto freeze on permits. “This comprehensive review process ensures that projects — whether on federal, state, or private lands — receive appropriate oversight whenever federal resources, permits, or consultations are involved.”

Current conditions: May-like warmth is sending temperatures across the Midwest and Northeast up to 25 degrees Fahrenheit above historical averages • Dangerous rip currents are yanking at Florida’s Atlantic coast • South Africa’s Northern Cape is bracing for what’s locally known as an orange-level 5 storm bringing intense flooding.

The Nuclear Regulatory Commission granted a construction permit for the Bill Gates-backed small modular reactor startup TerraPower’s flagship project to convert an old coal plant in Kemmerer, Wyoming, to a next-generation nuclear station. The approval marked the first time a commercial-scale fourth-generation nuclear reactor — the TerraPower design uses liquid sodium metal as a coolant instead of water, as all other commercial reactors in the United States use — has received the green light from regulators this century. “Today is a historic day for the United States’ nuclear industry,” Chris Levesque, TerraPower’s chief executive, said in a statement. “We are beyond proud to receive a positive vote from the Nuclear Regulatory Commissioners to grant us our construction permit for Kemmerer Unit One.”

While the permit is a milestone for the U.S., it’s also a sign of how far ahead China is in the race to dominate the global nuclear industry. TerraPower had initially planned to build its first reactors in China back in the 2010s before relations between Washington and Beijing soured. In the meantime, China deployed the world’s only commercial-scale fourth-generation reactor, using a high-temperature gas-cooled design, all while building out more traditional light water reactors than the rest of the world combined. Just this week, construction crews lifted the reactor pressure vessel into place for the latest natively-designed Hualong One at the Lufeng nuclear plant in Guangdong province.

Sodium-ion batteries and novel technologies to store energy for long durations are loosening lithium’s grasp on the storage market — but not by that much. Global lithium demand is on track to surpass 13 million metric tons by 2050, the consultancy Wood Mackenzie estimated in its latest forecast covered in Mining.com. That’s according to an accelerated energy transition scenario that more than doubles the base-case projections. Under those conditions, supply shortages could start to show as early as 2028 if the industry doesn’t pony up $276 billion in new capacity, the report warned. Under a less ambitious decarbonization scenario, the estimates fall to about 5.6 million tons of lithium.

The Department of Energy ordered the last coal-fired power plant in Washington State to remain open past its planned retirement last year on the grounds that losing the generation would put the grid at risk. At least for the near future, however, the station’s owners say they have little need to fire up the coal furnaces. On an earnings call last week, TransAlta CEO John Kousinioris said that, given “how flush” Washington is with hydropower, the cost of firing up the coal plant wasn’t worth it most of the time. Instead, the utility said it wanted to convert the station into a gas-fired plant. In the meantime, Kousinioris said, “our primary focus is more on getting clarity on the existing order,” according to Utility Dive.

Sign up to receive Heatmap AM in your inbox every morning:

The European Union has proposed setting a quota for publicly funded projects to source 25% of their steel from low-carbon sources. The bloc’s long-delayed Industrial Acceleration Act came out this week with formal pitches to fulfill Brussels’ goal to revive Europe’s steelmaking industry with cleaner technology. Still, the trade group Hydrogen Europe warned that the rules neither accounted for limited direct subsidies for key technologies to develop clean fuel supply chains nor the absence of similar quotas in other industries such as housing construction or automotive construction. “We call on co-legislators to strengthen the Act and close the gaps on ambition, scope, and clarity. Europe must ensure that its industry can grow, compete, and lead globally in strategic clean technologies like hydrogen,” Jorgo Chatzimarkakis, chief executive of Hydrogen Europe, said in a statement. “Hydrogen Europe and its members stand ready to support policymakers to ensure the Industrial Accelerator Act delivers on its initial promises.”

A week ago, Google backed a deal to build what Heatmap’s Katie Brigham said “would be the largest battery in the world by energy capacity. Now China is building by far the world’s largest commercial experiment yet in using compressed air to store energy. The $520 million project, called the Huai’an Salt Cavern CAES demonstration plant, includes two 300-megawatt units. The first unit came online in December, and the second switched on in recent weeks, according to Renewables Now. At peak output, the facility could power 600,000 homes. The Trump administration initially dithered on giving out funding to compressed air energy storage projects in the U.S. But as of December, a major project in California appeared to be moving forward.

Breaking China’s monopolies over key metals needed for modern energy technology and weapons is, as ever, a bipartisan endeavor. A top Democrat just backed the Senate’s push to support a critical minerals stockpile. In a post on X, Michigan Senator Elissa Slotkin pitched legislation she said “ensures we have a plant to stockpile critical minerals and protect our economy. This is an important step to ensure hostile nations like China never have a veto over our national security or economy.”