You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

On Tesla’s losses, Google’s storage push, and trans-Atlantic atomic consensus

Current conditions: Hurricane Kiko is soaking Hawaii and slashing the archipelago with giant waves • Nearly a foot of rain is forecast to fall on parts of Texas, risking flash floods • Dry, windy weather across broad swaths of South Africa is bringing “extremely high” fire risk.

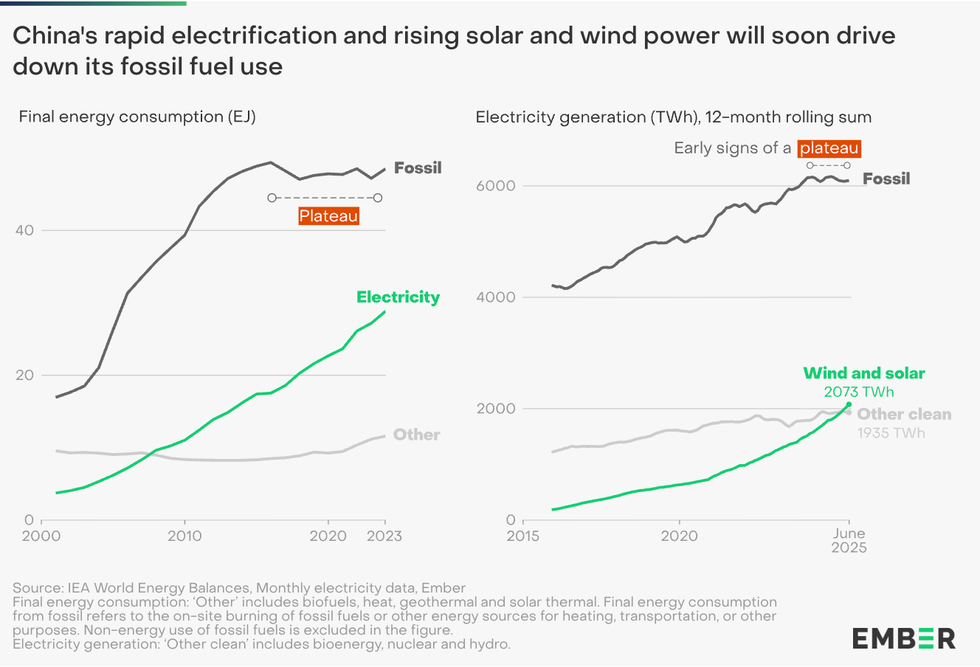

China’s clean energy boom is bringing a global decline in fossil fuel demand into sight amid declines in usage in the buildings, vehicles, and industries of the world’s second-largest economy, according to the think tank Ember’s latest China Energy Transition Review. The report, released Tuesday morning, found that exports of solar panels, batteries, electric vehicles, and heat pumps are soaring, particularly to emerging economies, making the possibility of developing nations making possible an “energy leapfrog” over the coal phase of growth. From 2015 to 2023, China’s end consumption of fossil fuels fell 1.7% across buildings, industry and transport, while electricity use as a replacement rose by 65%. In power generation, fossil output dropped 2% in the first half of 2025 compared to the same period last year, as wind and solar generation soared by 16% and 43%, respectively. Last year alone, Beijing invested $625 billion in clean energy, 31% of the global total.

“China is now the main engine of the global clean energy transition,” Muyi Yang, coordinating lead author of Ember’s 2025 analysis, said in a statement. “Policy and investment decisions made in China over the last two decades are fundamentally changing the basis of China’s own energy system, and enabling other countries to also move swiftly from fossil to clean.”

As Americans scramble to buy electric vehicles ahead of the expiration of the $7,500 consumer tax credit at the end of this month, fewer of those cars are Teslas. The preliminary August data Cox Automotive released on Monday showed the best month for EVs in U.S. history was the worst for Tesla ever recorded. EVs climbed to almost 10% of total car sales last month, but Tesla’s share fell to 38%, with 55,000 cars sold all month. That’s up just 3% compared to July and down 6% from the year prior, while the company’s total market share fell from just over 40% in July and 45% in the first half of the year. By contrast, Heatmap’s Matthew Zeitlin noted, Tesla commanded about 80% of U.S. EV sales in 2020.

Also on Tuesday, the company unveiled two new energy storage products that could boost its utility division. At the RE+ conference in Las Vegas, Tesla presented the Megapack 3, the latest generation of its utility-scale battery system, and the Megablock, which integrates the Megapack 3 with transformers and switchgear. Batteries were Tesla’s fastest growing business in the first quarter of this year, as Matthew reported in April, but the company feared that tariffs would affect the business. “The energy segment — which includes the company’s battery energy storage businesses for residences (Powerwall) and for utility-scale generation (Megapack) — has recently been a bright spot for the company, even as its car sales have leveled off and declined.”

Google inked a deal with the Salt River Project, the utility serving much of Arizona’s largest metropolis, to test the performance of long-duration energy storage projects. The first-of-a-kind research collaboration aims to “better understand the real-world performance of emerging non-lithium ion long duration energy storage technologies” in the Phoenix area, the power company said in a press release. Google will fund a portion of the costs and evaluate data on the pilot projects’ operational success. “We believe that long duration energy storage will play an essential role in meeting SRP’s sustainability goals and ensuring grid reliability,” Chico Hunter, the nonprofit Salt River Project’s manager of innovation and development, said in a statement.

As I reported in this newsletter in July, Google also backed the Italian carbon dioxide-based storage startup Energy Dome as the tech giant pushes to expand its portfolio of technologies to power its data centers 24/7.

The European Union has been a solid backer of fusion energy research. But the anti-nuclear trifecta of Germany, Austria, and Luxembourg has long thwarted bloc-wide efforts to bolster fission, which provides the bulk of the continent’s electricity. With Berlin finally joining Paris in backing traditional nuclear power, that blockade is no longer holding. The European Commission has proposed spending $11.5 billion on bolstering research in both fusion and fission, the trade publication NucNet reported Monday.

Meanwhile in the United States, where nuclear power remains broadly supported across the political spectrum, the biggest question is how quickly new reactors can come online. The data center industry has now called on the Nuclear Regulatory Commission to streamline licensing of new reactors to help meet its surging demand for electricity. In a letter to NRC Chair David Wright shared with E&E News, the Data Center Coalition, a trade group representing server farms, urged the agency to update its regulations to ensure quicker deployment of advanced reactors. “Increasingly, DCC members are forming strategic partnerships and committing to offtake agreements with utilities and nuclear technology developers, injecting new momentum into this strategic sector,” wrote Cy McNeill, the group’s director of federal affairs. “We are approaching the cusp of a truly revitalized nuclear sector.”

The push comes amid what Heatmap’s Katie Brigham called a “nuclear power dealmaking boom.”

Patagonia’s billionaire founder helped popularize the greenest trend in apparel — buying less of higher quality, longer-lasting clothing. Now the retailer is pushing to bring that same ethos to the food business. The company’s edible offerings of tinned fish and crackers designed for hiking is now expanding into baby foods, oils, and sauces, The New York Times reported in a new profile of the retailer. Fifty years from now, founder Yvon Chouinard told the newsletter, “I could see the food business being bigger than the apparel business.”

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

U.S. EV sales have been way up — just not for the domestic champion, which sank to its worst-ever market share in August.

Americans are rushing to buy electric vehicles ahead of the expiration of the $7,500 consumer tax credit at the end of this month.

And fewer of those cars are Teslas.

Preliminary data from Cox Automotive for August, first shared with Reuters, shows that the month was the best for EVs in U.S. history, with just over 146,000 units sold, comprising almost 10% of total car sales that month. At the same time, Tesla’s share of the EV market hit its lowest recorded level, down to a (still sizable) 38%.

Cox’s data puts Tesla sales at 55,000 for the month, which is up a little more than 3% from July but down over 6% from a year prior, while the company’s total market share fell from just over 40% in July and 45% in the first half of the year. In 2020, by contrast, Tesla’s share of U.S. EV sales was about 80%. Overall, Cox estimated that Tesla sales in the U.S. are down about 9% so far this year.

“The U.S. EV market is in a far more dynamic place than a few years ago,” Corey Cantor, the research director at the Zero Emission Transportation Association, told me in an email. “Most automakers now offer electric vehicle models in multiple segments. There are multiple electric vehicles available below the average price point of a new car at $48,000.”

Entering this new phase means that the EV market is getting less Tesla-centric, almost by definition. Morgan Stanley reported that electric vehicle sales were up 23% in August from a year ago, while overall car sales were up 7.5% — although even amidst this industry-wide growth, Tesla sales fell more than 3% year over year, while electric vehicle sales were up 42%.

Much of that EV market growth comes down to timing. “Early indications are that EV sales are in fact surging over the past two months, following the changes that will phase the credit out at the end of this month. We’ve seen record sales for EV models last month, such as the Honda Prologue,” Cantor said. This likely means some portion of these sales are being “pulled forward” from buyers trying to beat the deadline and these sales numbers will not persist through the rest of the year.

As Tesla’s stranglehold over the U.S. EV market may be weakening, so too is its hold on the international market. Thanks to CEO Elon Musk’s association with right wing politics in the U.S. and abroad, and to fierce competition from Chinese EV leader BYD, Tesla’s sales have fallen dramatically in Europe. Globally, BYD overtook Tesla in sales last year.

None of that seems to matter much to Tesla’s leadership, or to its shareholders. On Friday, the company’s board of directors put forward a new compensation plan for Musk that would boost his ownership of the company to around 25% and put him in line for a $1 trillion payday if he meets growth and performance targets over the next decade.

A Delaware court last year threw out an earlier Musk pay package, arguing that Musk was too close to the board of directors for them to objectively determine his pay in the interest of all the company’s shareholders. (He subsequently relocated Tesla’s official headquarters to Austin, Texas, explicitly to avoid Delaware jurisdiction.) Musk has said that he wants to own about 25% of the company, a significant upgrade from the roughly 15% he owns currently.

Tesla’s board said in a recent regulatory disclosure that Musk had “reiterated that, if he were to remain at Tesla, it was a critical consideration that he have at least a 25% voting interest in Tesla,” and that “Mr. Musk also raised the possibility that he may pursue other interests that may afford him greater influence if he did not receive such assurances.”

The board’s disclosure also confirmed that Musk sees the future of Tesla as going far beyond selling cars to people. The filing said that “through its discussions with Mr. Musk,” the special committee in charge of coming up with his compensation had “identified four core product lines that would drive Tesla’s future transformation”: Tesla’s vehicle fleet, automation (i.e. Full Self-Driving) software, its robotaxi product, and humanoid robots. Tesla’s robotaxi service is available on a select basis in Austin, with no date yet indicated for a wider rollout, while its humanoid robots — which Musk has said will one day make up 80% of the company’s value — are due to reach “scale production” next year, Musk said on a recent earnings call.

Tesla stock actually rose on the news of the proposed compensation package, likely because Tesla shareholders viewed it as a way to retain Musk and keep his attention on the company.

Longtime Tesla bull Adam Jonas, an analyst at Morgan Stanley, said in note to investors that the compensation deal now means that Musk “has an incentive to focus on Tesla more than ever.” Jonas also, like many Tesla bulls, sees its business of selling cars to people as just a small portion of its overall value — in his case, $76 a share, compared to his $410 a share price target or the roughly $346 a share price the stock was trading at on Monday afternoon.

Still, the company today is largely a pretty normal car company, at least according to its income statement. In the second quarter of its current fiscal year, some $16.6 billion of Tesla’s $22.5 billion in revenue came from cars, with $2.8 billion coming from its energy business and $3 billion coming from “services and other revenues.”

Declining market share in its biggest product line isn’t completely meaningless, even if many Tesla shareholders see a glorious future for the company beyond the automobile trade.

Looking ahead, Cantor said to expect the EV market to get even more diverse.

“Moving forward, we will continue to see automakers innovate in the EV space. Timelines may change and models will vary by automaker, but high-profile launches expected over the next year include the Rivian R2, a new version of the Chevrolet Bolt EV, as well as more affordable models by Lucid and Kia,” Cantor said in his email.

“While the 30D [consumer electric vehicle tax] credit’s phase out will have a real impact on sales the next quarter or two here in the U.S.,” he added, “the long-term trend of excitement and innovation continues to be in the launch of new electric vehicles.”

On PJM pressure, Orsted’s approval, and a carbon storage well milestone

Current conditions: Hurricane Kiko, now a Category 3 storm, is expected to bring heavy rainfall to Hawaii this week as wind speeds roar up to 125 miles per hour • Dry air in the Caribbean is stymying any tropical storm from gaining wind intensity • Tropical Storm Tapah strengthened to a typhoon over China on Monday morning.

U.S. immigration authorities arrested hundreds of South Korean workers at a Hyundai battery plant in Georgia, in a move already prompting geopolitical blowback that could threaten efforts to reestablish manufacturing in the United States. After U.S. Immigration and Customs Enforcement officers conducted their biggest workplace raid since President Donald Trump took office again on Thursday, the South Korean government chartered planes to ferry detained workers back home. At an emergency meeting in Seoul, South Korean Foreign Minister Cho Hyun said his government was “deeply concerned,” and that he would consider flying to the U.S. to meet with the Trump administration. Most of the 475 people arrested at the electric vehicle battery plant — a joint venture between automaker Hyundai and the battery company LG Energy Solution – were South Korean nationals. Videos of the arrests showed the workers’ wrists and ankles wrapped in chains as they were led away.

“You are already poorer because of this idiocy, you just don’t know it yet,” Heatmap’s Robinson Meyer wrote in a post on X, in response to a video of ICE agents chaining workers at the wrists and ankles. “This will crush American manufacturing know-how.”

Political pressure is mounting on the nation’s largest grid operator to make hooking up new power sources easier amid surging demand. In remarks made as part of a public process for overhauling the grid’s rules, the governors of Pennsylvania, New Jersey, Maryland, and Illinois called on the PJM Interconnection to streamline the process to connect new resources to the grid, citing ERCOT, the independent power system in Texas, as an example of a successful model. “We must open all feasible pathways to bring additional electrons to our grid,” the governors said in a public comment highlighted on X by energy researcher Tyler Norris.

The push comes as PJM is fending off criticism from big tech companies and data centers over a proposal that would allow the grid to encourage big power users to pare back consumption when demand is particularly high. The backlash isn’t surprising to Abraham Silverman, a former lawyer for the New Jersey Board of Public Utilities and an assistant research scholar at Johns Hopkins. As he explained to Heatmap’s Matthew Zeitlin: “The existing rules are financially very favorable to the data centers.” The focus on adding new generation rather than curtailing new load is consistent with that more traditional approach.

Trump once called the Infrastructure Investment and Jobs Act former President Joe Biden signed in 2021, better known as the Bipartisan Infrastructure Law, “a loser for the U.S.A.” that “patriots will never forget.” Now he’s taking credit for the projects it’s funding. In recent months, signs have gone up around the U.S. bearing the president’s name on bridge projects in Connecticut and Maryland, rail-yard improvements in Seattle, Boston, and Philadelphia, and the replacement tunnel on an Amtrak route between Baltimore and Washington, according to The New York Times. “PRESIDENT DONALD J. TRUMP” a sign by the road in southern Connecticut reads. “REBUILDING AMERICA’S INFRASTRUCTURE.”

Republicans had previously balked at similar signs bearing Biden’s name. As Heatmap’s Emily Pontecorvo wrote, “Senator Ted Cruz of Texas lodged a grievance with the Office of Special Counsel alleging Biden had violated the Hatch Act by using taxpayer dollars to pay for ‘nothing more than campaign yard signs.’” Republican Senator Joni Ernst of Iowa (who recently announced her intention not to seek reelection after becoming a target of Trump supporters) gave the signs one of her monthly “squeal awards” last year, demanding to know how much they cost.

Orsted’s shareholders on Friday backed the company’s plans to shore up its finances by raising $9.4 billion on the stock market to fend off attacks from the Trump administration. The approval came even as the world’s largest offshore wind developer cut its profit guidance for the year as lower-than-expected wind speeds dinged the company’s planned power output for the year. At an investor meeting in Copenhagen that the Financial Times described as “extraordinary,” at least 98.5% of shareholders voted in favor of authorizing the issuance of new shares.

The Sweetwater Carbon Storage Hub completed drilling for the nation’s deepest carbon storage well in Wyoming. The project, a collaboration between the University of Wyoming’s School of Energy Resources and the company Frontier Infrastructure holdings, reached a vertical depth of 18,437 feet. Preliminary data from the well “is highly encouraging,” according to the nonprofit newsroom Oil City News. “This deeper well gives us a more complete picture of the subsurface, reinforcing our commitment to building scalable, practical carbon solutions for Wyoming’s key industries,” said Robby Rockey, president and co-CEO of Frontier.

Still, as I reported in this newsletter last week, the new research from the International Institute for Applied Systems Analysis and Imperial College London found “a prudent global limit” of around 1.46 trillion tons of CO2 that can be safely stored in geologic formations. That’s “almost 10 times smaller than estimates proposed by industry that have not considered risks to people and the environment.”

A long-term study spanning more than 50 years found that beavers that have returned to the Evo region in southern Finland increased habitat biodiversity as a result of how they engineer the ecosystem with dams. “While the positive effects of the changes brought about by beavers in the boreal region are significant, their long-term effects on biodiversity dynamics remain partly unknown. This is why long time series are needed to understand the far-reaching ecological effects of these changes,” Petri Nummi, a senior lecturer at the University of Helsinki and an author of the paper, said in a press release.

Using more electricity when it’s cheap can pay dividends later.

One of the best arguments for electric vehicles is the promise of lower costs for the owner. Yes, EVs cost more upfront than comparable gas-powered cars, but electric cars are cheaper to fuel and should require less routine maintenance, too. (Say goodbye to the 3,000-mile oil change.)

What about the societal scale, though? As the number of EVs on the road continues to rise, more analysts are putting forth the argument that EV ownership could lead to lower energy bills for everyone, even the people who don’t buy them.

The idea may be counterintuitive, given the prevailing narrative about voracious appetite for electricity. EVs do require a lot of energy. Electricity demand for EVs in the U.S. jumped 50% from 2023 to 2024 alone as more Americans bought electric, and the research group Ev.energy says demand could triple by 2030. Studies suggest that replacing every internal combustion vehicle in the country with an EV would eat up as much as 29% of American electricity.

Meanwhile, the grid is struggling to keep up — it is, after all, much more difficult to add more megawatts to the capacity of our power system than it is to put a few more EVs on the road. The obvious inference would then seem to be that a battery-powered car fleet could cause an energy crunch and spike in prices.

A new report from Ev.energy, however, argues that if we got smarter about how and when we charge our cars, their presence could actually cut costs for the average American by 10%. The gains could be even better if EVs reach their true potential as a way to give the grid a unique kind of flexibility and resilience.

Compare an electric car to a data center, the other application painted as a ticking time bomb for electricity prices. Worries about the energy-gobbling habits of AI-powering servers are well-founded, given their 24/7 appetite. An EV, however, needs to charge only once in a while. In fact, most people don’t need to charge every day, given the range of modern EVs and the driving habits of the typical American.

As we've covered before, it’s when you charge that matters. Optimizing EV charging can be a helpful way to ease pressure on the power grid and align EV charging with the availability of clean energy.

Here in California, which has far and away the most EVs in America, TV commercials remind us to use less energy between 4 p.m. and 9 p.m., when the state is dealing with rising residential energy use just as solar power is tapering off for the day. It would cause a grid crisis if every EV owner charged as soon as they got home from work. Having EV owners charge their cars overnight, a period of low demand, helps ease the pressure. So does charging during midday, when California sometimes has more solar energy than it knows what to do with.

When EVs charge in this mindful manner, using energy during times of day when it’s cheap for utilities to provide it, data suggests they can effectively push down electricity prices for everyone. Says one recent report from Synapse Energy: “In California, EVs have increased utility revenues more than they have increased utility costs, leading to downward pressure on electric rates for EV-owners and non-EV owners alike.” As the NRDC points out, California has revenue decoupling in place for its utilities, so “any additional revenue in excess of what was anticipated is returned to all utility customers — not just EV drivers — in the form of lower rates.”

Those rosy figures depend upon drivers following this model and charging during off-peak hours, of course. But with time-of-use rates giving them the financial motivation to charge overnight rather than in the early evening, it’s not an outrageous presumption.

And there’s something else that differentiates EVs from other applications that consume lots of electricity: Thanks to their ability to store a large number of kilowatt-hours over a lengthy period of time, electric vehicles can give back. EVs can be a cornerstone of the virtual power plant model because the cars — those equipped with bidirectional charging capabilities, at least — could feed the energy in their batteries back onto the grid to prevent blackouts, for example. In Australia, the Electric Vehicle Council recently crunched the numbers to argue in favor of incentivizing residents to install vehicle-to-grid infrastructure. Their math indicates Australia would reap more than the government invests because these connected EV would cut everyone’s electricity price.

It’s getting more expensive for the individual to own an EV — the federal tax credit for buying one disappears at month’s end, and punitive yearly fees for EV ownership are coming. Yet it seems that driving electric might be doing your neighbors a favor, and not just by clearing the air.