You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

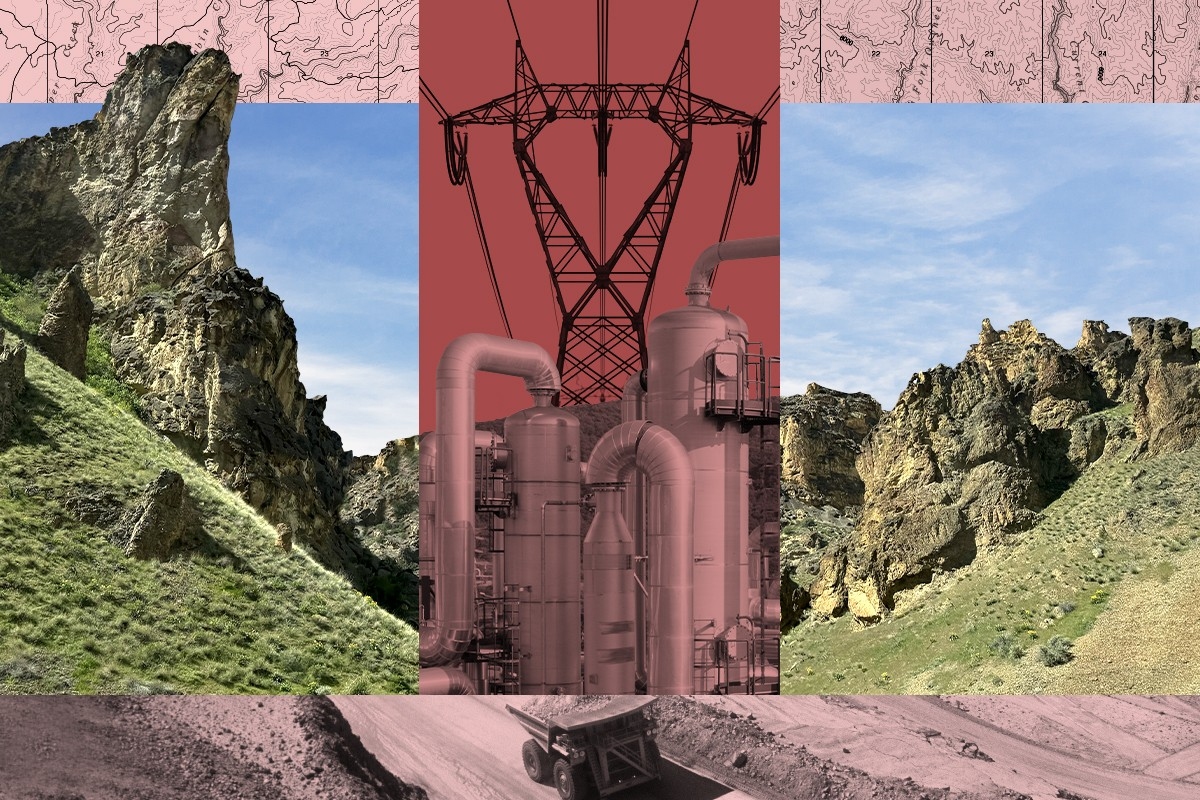

The Owyhee River watershed is among the country’s largest areas of pristine wilderness. It’s also prime for green development.

On a stormy May evening in 1882, approximately 10 gigawatts of electricity split from the sky above southeastern Oregon and struck a cattleman named Hiram Leslie as he approached his camp on the Owyhee River.

Leslie’s horse died instantly; Leslie did not. Legend has it the pioneer survived for six days after the lightning strike — his brain pulsing and visible through his cleaved-open skull — only to finally expire in his bed back in the boomtown of Silver City, Idaho. Dugout Gulch, an 8-mile canyon near the ranchers’ camp that contains some of the most jaw-dropping scenery in all of Oregon state, was renamed in Leslie’s honor. One can’t help but wonder, though, whether the decision to rechristen also came from some nervous sense of deference to the land.

Today, Silver City is a ghost town, and Leslie’s grisly demise is relegated to a single sentence on a Bureau of Land Management sign lining the way down to a boat ramp that passing F-150s don’t bother braking to read. But the tremendous power and possibility of the Owyhee watershed has never been less in dispute — or, perhaps, more in jeopardy.

The Owyhee (pronounced “oh-why-hee,” an old spelling of “Hawaii” in honor of more doomed explorers) is a 7 million-acre ecoregion that runs through Oregon’s southeasternmost county, Malheur, though it spreads as far east as Idaho and as far south as Nevada. On Google Maps, it looks like a big blank space; the core of the Canyonlands is crossed by just three paved roads. In fact, it’s the largest undeveloped region left in the Lower 48. On a resource management map, the area reveals itself to be a complicated patchwork of BLM, tribal, state, Forest Service, and privately owned lands, as well as a smattering of quasi-protected “Wilderness Study Areas” and “Land with Wilderness Characteristics” that exist at the whims of Congress. The region contains many of the materials and geographic features necessary for the clean energy transition, making one of the most pristine regions in the state also potentially one of its most productive.

But it can’t be both.

In person, it’s easy to see why the area has excited developers. Towering river canyons inspire dreams of pumped storage hydropower. There has been talk of constructing a second geothermal plant in the area, and uranium mining has intermittently returned to the conversation. Gold and silver claims stud the hillsides, a testament to the presence of metals that, amongst other things, are used for making electric vehicle circuit boards and solar panels. Draw a line through the region’s gentler northern sagelands and you’ve plotted the proposed, much-needed Boardman-to-Hemingway transmission route to bring hydropower from Washington state to Boise, one of the fastest-growing cities in the nation. And just outside the Owyhee watershed, to the west, is the upper edge of the McDermitt Caldera, a shockingly remote volcanic depression where there is said to be enough concentrated lithium to build 40 million electric vehicles.

Even Leslie Gulch, with its weekend crowds from Boise and recent Instagram Reels virality, is “quietly open to mining,” Ryan Houston, the Bend-based executive director of the Oregon Natural Desert Association, told me when I met him in the Canyonlands last month.

Amid all this frenzy, Oregon Senators Ron Wyden and Jeff Merkley, local Shoshone-Paiute tribal leaders, and a large coalition of regional and national conservation groups are working to close off 1.1 million acres of the most ecologically important land to the development nipping at its edges. Their hope is that Congress will designate four “units” in Malheur County, including the upper and lower Owyhee, as a single federally protected wilderness area — a pipe dream, given the partisan dysfunction of the current House of Representatives. The more realistic alternative is for President Biden to swoop in with the Antiquities Act and make it a new national monument.

Such an action would be in keeping with Biden’s 30x30 executive order to conserve 30% of U.S. land and water by 2030. It could also be perceived as clipping the wings of the kinds of clean energy projects his administration has proudly touted and funded.

Potential land-use conflicts like these are part of why conservation goals and the current green building movement are often portrayed as incompatible, or at least in tension. But “conservation and clean energy build-out aren’t necessarily opposing forces,” Veronica Ung-Kono, an attorney and clean energy transmission policy specialist at the National Wilderness Federation, told me. “They’re just forces that have to figure out how to interact with each other in a way that makes sense.”

No one is more aware of this than the campaigners I spoke with in Oregon. “For us as an organization, something we’re pushing ourselves on is, ‘How do we say yes to where solar and wind should be?’ Rather than just, ‘No, not there, not there, not there,’” Houston, the organizer at ONDA, which is helping to manage the monument campaign, said by way of example. Later, he told me that by setting aside 1.1 million acres for an Owyhee Monument, the conservationists essentially say that the remaining 75% of the local BLM district is open for all other possible uses.

“We’re not closing off vast swaths of the high desert to renewable energy,” he said. “What we’re doing is protecting the best of the best, so we can focus on other types of development — like renewable energy or off-road-vehicle play areas — in places where it’s most appropriate.”

To better understand the land-use issues in Malheur County, I traveled to Boise last month to attend what’s called a lek, when sage grouse gather to perform their mating rituals. The visit was organized by the NWF, which is supporting the monument push with ONDA. On the appointed day, I left my airport hotel at 3:30 a.m., crossed the state line on a two-lane highway during what I later learned was the height of mule deer migration season, and followed a poorly marked gravel road literally off the map on my phone (which, for good measure, had no reception).

It was so dark in the Owyhee that I felt more like I was rattling across the bottom of the ocean than an actual terrestrial landscape. I repeatedly mistook the full moon for oncoming headlights whenever it briefly appeared from behind the hills, and at random intervals, my car would drop into shallow streams I didn’t see coming until I was already in them. As I approached Succor Creek Campground, the designated meeting spot, I became aware that I was being hemmed in by canyon walls — perceptible only as a blackness even blacker than that of the night sky. When I finally spotted the headlamp of Aaron Kindle, NWF’s director of sporting advocacy, my overriding sense of the Owyhee Canyonlands was that they were bumpy.

Needless to say, I had absolutely no idea at the time that I had driven directly beneath what might one day become the Boardman-to-Hemingway transmission line.

The B2H, as it’s known, would be a nearly 300-mile, 500-kilovolt interstate line to send hydroelectric power generated in Washington State down to Boise. The project has become a textbook example of the permitting woes facing transmission projects in America, however. “By the time we build this, B2H is not only going to be old enough to vote, it’s going to be old enough to go to a bar and have a drink,” Adam Richins, the senior vice president and chief operating officer of Idaho Power, the electric utility that serves southern Idaho and eastern Oregon, told me.

Richins likes to joke, but the B2H’s halting progress makes him weary. More than 18 years of environmental reviews, permitting revisions, archeological and cultural studies, siting headaches, and landowner protests have plagued the planning and implementation of the transmission line, which Idaho Power owns jointly with another northwest utility, PacifiCorp. (Set to break ground this fall, B2H recently stalled again due to a scandal involving an affiliated consulting firm’s work on an unrelated project.) Originally conceived as a way to help Idaho Power meet its clean-energy goals during the summer and winter peaks that follow the region’s agricultural calendar, “I will say now that if we don’t get some of these transmission lines permitted on time, it’s possible we’re going to have to look at other resources such as natural gas,” Richins said.

Though some early plans for the B2H would have seen it cut straight through the boundaries of a future Owyhee monument, the current proposal keeps the transmission path safely outside the existing Wilderness Study Areas that surround Lake Owyhee, the reservoir at the center of what could become the “Lower Owyhee Unit.” (Somewhat confusingly, the Owyhee River flows north into the Snake River, meaning its “upper” watershed is actually to the south.)

That’s not a coincidence. The monument proposal almost entirely consists of parcels pre-designated as Lands with Wilderness Characteristics and Wilderness Study Areas, both of which are managed by the BLM and exist in a kind of limbo until Congress decides what to do with them. “If you’re a developer of solar, wind, pump storage, whatever, you’re not going to put your project in an area that’s in a quasi-protected status because that makes it extremely hard to develop,” Houston said. In other words, it’s not that the monument boundaries were drawn to avoid projects like the B2H; they were drawn to “protect the most important areas, and the most important areas have been in this quasi-slash-temporary protected status for a long time.”

Still, the transmission lines wouldn’t be entirely out of sight. The planned B2H route crosses close to the scenic northern mouth of the Owyhee Canyon before it makes its southeast turn toward Succor Creek and the Idaho border, where I’d driven across its path. More to the point, any future monument designation would mean that if permitting reform actually happens and America begins a transmission-building boom, power lines connecting the various substations of the Northwest would have to go around it, requiring diversions of 50 miles or more. Richins told me that as far as Idaho Power goes, though, “I haven’t seen anything [in the monument proposal] that has made me overly concerned.”

So far, Biden’s team hasn’t given any indication of its thinking about an Owyhee Monument, even as it has picked up the pace on conservation efforts elsewhere. Eight other national monument campaigns are also competing for attention from a friendly administration that is by no means guaranteed to remain in office next year; these include efforts to conserve California’s Chuckwalla, which would create a contiguous wildlife corridor between Joshua Tree National Park and the Kofa National Wildlife Refuge, and Colorado’s Dolores Canyons, which have both ecological and Indigenous cultural importance. “We have shared with [the administration] our binder of support and all of our petition signatures — we’ve got like 50,000 petition signatures, and hundreds and hundreds of letters — and they have said, ‘Thank you, the Owyhee is on our radar, we’ve known about it for a long time, we are tracking it, we are following it,’” said Houston.

There were rumors in the conservation community before Biden expanded two California monuments just a couple of weeks ago, meaning Owyhee organizers might get a tip-off if or when the administration makes up its mind. But November draws closer every day, and the grapevine has stayed silent. Still, after previously thwarted attempts to protect the Owyhee in 2016, 2019, and 2022, organizers think they’ve negotiated a workable compromise: The monument proposal as it currently stands is less than half the size of an earlier, more contiguous 2.5-million-acre proposal Houston and other conservationists preferred. But it also means that much more land is available for green development.

Even some of the more controversial renewable energy projects in the area have been able to move forward. On the lone stretch of shoreline on Lake Owyhee that doesn’t fall within the monument proposal, Utah-based developers are exploring the construction of a pumped storage hydropower facility. Proponents say the technology is a solution for the intermittency concerns of solar and wind since the facilities pump water from a lower reservoir to a higher one during off-peak hours, then release the water to spin turbines and generate electricity during times of high demand — effectively, a kind of massive hydroelectric battery.

Pumped storage projects require very particular geographic conditions, namely steep slopes of 1,000 feet or more, to give the water enough gravitational potential energy to work. “You have to choose your sites carefully — there are bad places to propose doing pumped storage and there are great places,” Matthew Shapiro, the CEO of rPlus Hydro, the company behind the exploration project, told me.

Lake Owyhee, with its high plateaus, is one of 11 promising sites across the country rPlus Hydro has picked out. “We were looking at a site with about 1,600 feet of vertical drop and a very large existing lower reservoir, meaning we would only have to build an upper,” Shapiro said. The proximity to the existing Midpoint-Hemingway-Summer Line and the future Boardman-Hemingway line is also appealing since it would mean rPlus Hydro would only have to build a short transmission line from the site.

There are environmental concerns about pumped storage, including its possible effect on trout below the Owyhee Dam (which, despite being a Hoover Dam prototype when it was built in 1932, does not produce hydroelectricity but instead stores water for the local irrigation district). While there might be petitions, protests, and siting issues yet, rPlus Hydro’s pumped storage project will “do whatever it does entirely independent” of the Owyhee monument protection efforts, Houston said.

Other strange alliances abound. The local ranching community, for one, is largely on board with the congressional proposal to protect Owyhee — a minor miracle given that this corner of Oregon is also home to the wildlife refuge that was infamously occupied for 41 days by the Bundy brothers in 2016. Both that and the current monument proposal intentionally exclude any lands that would have overflowed into the more combative neighboring jurisdiction, where conservation efforts might have ignited a national-headline-making backlash.

“We don’t want the ranchers to be so pissed off that the first thing they do is go to the Trump administration” to appeal for a reversal, Houston said. The Owyhee monument is designed, in other words, to fly under the radar, lest it become another political tennis ball ricocheting between presidents like Bears Ears.

It’s designed to fly under the radar when it comes to clean energy projects, too. Houston and others were adamant that they don’t oppose the projects encircling the core conservation area — climate change, after all, is one of the biggest threats to the Owyhee, which is one of the fastest warming places in the entire county. Still, it was clear in conversations that the proposals are also spurring some of their urgency. “It’s about protecting what you have left,” is how Kindle, the NWF advocate I met at the Succor Creek Campground, put it to me.

More to the point, Houston told me that the lithium mining abutting what would become the Owyhee Monument’s westernmost unit, Oregon Canyon Mountains, is “a reminder of what can happen” if conservationists don’t act fast enough.

“You can see he is missing like four tail feathers. That one must be a fighter — and got his ass kicked.” Skyler Vold, an Oregon Department of Fish and Wildlife employee with the delightful title of “sage-grouse conservation coordinator,” stepped aside from the scope so I could check out the avian incarnation of Rocky Balboa.

The light was finally coming up over the Owyhee, but it was still so cold that my toes were starting to numb in my boots. That wasn’t what had my attention, though: At one point, Vold counted nearly two dozen sage grouse, all thumping away in the low point between two hills where they’d gathered for the lek. Kindle also spotted a lone elk on a faraway hillside, and we later heard the call of a sandhill crane, but the funny little birds with their spiky agave-leaf tails had us all enraptured.

No single creature better encapsulates the land-use fights in the West than the sage grouse. In 2018, the Trump administration stripped the birds of protections in order to open 9 million acres of the McDermitt Caldera to drilling and mining — mainly for lithium. While the Biden administration is considering new protections for sage grouse, of which there are only about 800,000 left and for whom the caldera is prime habitat, it has also dumped money into building up a domestic lithium supply chain. Sourcing lithium at home, however, will likely require access to McDermitt’s deposits.

Much of the caldera is located in Nevada, but the top rim bumps up into Oregon. It’s in this northernmost crescent that the Australian company Jindalee is considering opening its lithium mine. While the team told me it is still many years (and many environmental reviews) away from actually breaking ground, Jindalee’s executives also stressed that they see themselves as a critical player in America’s clean energy future if or when they do so.

“There’s a huge elephant in the room, which is: Where’s this lithium supply going to come from?” Ian Rodger, the Jindalee Lithium CEO, told me. The answer so far has been mainly from China, where lithium is “processed under really different social and environmental standards,” he said. “Our aspiration for the [Oregon] project is to develop it in the most responsible way.”

Simon Jowitt, an economic geologist at the University of Nevada, Reno, told me Rodger’s argument has a lot of merit. Social and environmental conditions are indeed “a lot better here than they would be in other countries,” he said, meaning that if we don’t extract the metals and minerals we’re going to use anyway locally, “then what we’re doing is we’re shipping problems away elsewhere.” There is ongoing discussion and division in the local Paiute and Shoshone Tribe about the economic and environmental pros and cons of mining near their community, as well.

The fact remains, however, that “as a human race, we need these metals and minerals if we want to do something meaningful about climate change mitigation,” Jowitt added. That requires stomaching a potentially sizeable physical footprint, especially in the case of lithium mining.

“If we are all going to go to electric vehicles by 2050,” Jowitt said, then that’s great — but policymakers and the public also “need to realize that there’s a mineral cost of this.”

Conservationists are quick to point out that mining laws in the U.S. — which have barely changed since Hiriam Leslie’s time — are stacked so in favor of the claimants that there is often no chance to get a word in edgewise. “Mining sure as heck trumps a funny chicken that goes ‘womp womp,’” is how Houston put it — a fair description of the sage grouse mating ritual. In the strange game of land-use rock-paper-scissors, mining also trumps cattle, which is why some local ranchers have approached the Protect the Owyhee organizers to unite against the miners. (There are slight differences in protections depending on whether the Owyhee is made a wilderness area by Congress or a monument by Biden; the latter option can’t be as prescriptive about flexible grazing operations for ranchers, which is why, on the whole, the ranching community strongly prefers a legislative route.)

Most of the would-be monument is outside the McDermitt Caldera, but the fear isn’t so much that any one transmission project or hydro facility or lithium mine would “ruin” the Owyhee. “Everyone says, ‘Well, why do you have to protect it? Is there a threat?’” Houston said. “There are potential threats; people have been talking about different things like interstate highways or transmission or new mines. If we wait until those threats are real, then we’ve got a conflict, and then everyone’s going to say, ‘Well, why didn’t you protect it before?’”

Ironically, some fear that a formal monument designation will draw attention from the crowds that are loving to death other popular parks across the West. Standing in Leslie Gulch, where the red blades of rhyolite rock strongly resemble plates on the back of an enormous Stegosaurus, I sympathized with the impulse to gatekeep the landscape; driving from one remarkable site to the next, we’d barely seen another car all day. That’s changing regardless of whether the Owyhee is signposted as a destination in name or not: Chris Geroro, a local fly fisher who’s been guiding on the Owyhee River for 16 years, said he’s gone from “being the only person on the river to being one of the people on the river.”

The landscape certainly leaves an impression. “You go over this hill and then all of a sudden, boom! You’re in this amazing canyon,” he told me, describing the reaction of his out-of-town clients when they visit. “I just watch their jaws drop and the surprise of ‘Where did this come from? This is an hour outside of Boise?’” Those people then go home and post pictures, and more people understandably want to visit. A monument could help address the currently mostly unmanaged recreation.

But if Biden declines to move forward on protecting the Owyhee and an indifferent or actively hostile administration takes office in January, then the Oregon Natural Desert Association will have to switch strategies. Houston told me his team is already considering alternative approaches like pursuing a wilderness designation through the legislative branch. If, in a worst-case scenario, Trump decides to go after the land in the Owyhee, ONDA is prepared to go to court.

As we were leaving Leslie Gulch, Houston told me that he studied to be an evolutionary biologist. “What evolutionary biology is all about is understanding how species evolve based on what they have at that moment. They go forward with what they’ve got,” he said. “That’s what we’re doing in conservation — we’re going forward with what we’ve got.”

When it finally came time for me to return to Boise, I retraced the route I’d taken that morning into Succor Creek. The light was fading, but there was still enough for me to make out the hoodoo rock towers and the rolling sagebrush hills that I’d missed in the dark on my way into the canyon. To my surprise, enormous high-tension transmission towers also came into view; I’d driven beneath them hours before without even realizing it. Now, the silver power lines — future companions of the B2H — looked gossamer in the setting sun.

I parked to take a photo, and when I got out of the car, I felt a staticky tingle, like how a storm might excite the hairs on your arm. It was probably just a Placebo effect of standing under transmission lines and having spent the day thinking about electricity. But at that moment, I would have believed it was the passing ghost of an old cattleman glaring in my direction or perhaps the presence of something yet to come, something buzzing with potential, slung over my head.

I returned to my car and continued on to the highway. Soon, houses and small towns started to reappear, and I followed their lights through the dark back to Boise.

Editor’s note: This story has been updated to clarify which version of the proposed federal protections for Owyhee the local ranching community approves.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Representatives Jake Auchincloss and Mark Amodei want to boost “superhot” exploration.

Geothermal is about the only energy topic that Republicans and Democrats can agree on.

“Democrats like clean energy. Republicans like drilling. And everyone likes baseload power that is generated with less than 1% of the land and materials of other renewables,” Massachusetts Representative Jake Auchincloss, a Democrat, told me.

Along with Republican Representative Mark Amodei of Nevada, Auchincloss is introducing the Hot Rock Act on Friday, focusing specifically on “superhot” or “supercritical” geothermal resources, i.e. heat deposits 300 degrees Celsius or above. (Temperatures in large traditional geothermal resources are closer to 240 degrees.)

The bill — of which Heatmap got an exclusive early peek — takes a broad approach to supporting research in the sector, which is currently being explored by startups such as Quaise Energy and Mazama Energy, which in October announced a well at 331 degrees.

There’s superhot rock energy potential in around 13% of North America, modeling by the Clean Air Task Force has found — though that’s mostly around 8 miles below ground. The largest traditional geothermal facility in the U.S. is only about 2.5 miles at its deepest.

But the potential is enormous. “Just 1% of North America’s superhot rock resource has the potential to provide 7.5 terawatts of energy capacity,” CATF said. That’s compared to a little over a terawatt of current capacity.

Auchincloss and Amodei’s bill would direct the Department of Energy to establish “milestone-based research grant programs,” under which organizations that hit goals such as drilling to a specific depth, pressure, or temperature would then earn rewards. It would also instruct the DOE to create a facility “to test, experiment with, and demonstrate hot dry rock geothermal projects,” plus start a workforce training program for the geothermal industry.

Finally, it would grant a categorical exclusion from the National Environmental Policy Act for drilling to explore or confirm geothermal resources, which could turn a process that takes over a year into one that takes just a couple of months.

Geothermal policy is typically a bipartisan activity pursued by senators and House members from the Intermountain West. Auchincloss, however, is a New Englander. He told me that he was introduced to geothermal when he hosted an event in 2022 attended by executives from Quaise, which was born out of the Massachusetts Institute of Technology.

It turned out the company’s pilot project was in Nevada, and “I saw it was in Mark Amodei’s district. And I saw that Mark is on Natural Resources, which is the other committee of jurisdiction. And so I went up to him on the floor, and I was like, Hey there, you know, there's this company announcing this pilot,” Auchincloss told me.

In a statement, Amodei said that “Nevada has the potential to unlock this resource and lead the nation in reliable, clean energy. From powering rural communities and strengthening critical mineral production to meeting the growing demands of data centers, geothermal energy delivers dependable 24/7 power.”

Auchincloss told me that the bill “started from the simple premise of, How do we promote this technology?” They consulted climate and technology experts before reaching consensus on the milestone-based payments, workforce development, and regulatory relief components.

“I didn't have an ideological bent about the right way to do it,” Auchincloss said.

The bill has won plaudits from a range of industry groups, including the Clean Energy Buyers Association and Quaise itself, as well as environmental and policy organizations focused on technological development, like the Institute for Progress, Third Way, and the Breakthrough Institute.

“Our grassroots volunteers nationwide are eager to see more clean energy options in the United States, and many of them are excited by the promise of reliable, around-the-clock clean power from next-generation geothermal energy,” Jennifer Tyler, VP government affairs at the Citizens' Climate Lobby, said in a statement the lawmakers provided to Heatmap. “The Hot Rock Act takes a positive step toward realizing that promise by making critical investments in research, demonstration, and workforce development that can unlock superhot geothermal resources safely and responsibly.”

With even the Trump administration generally pro-geothermal, Auchincloss told me he’s optimistic about the bill’s prospects. “I expect this could command broad bipartisan support,” he said.

Plus a pre-seed round for a moon tech company from Latvia.

The nuclear headlines just keep stacking up. This week, Inertial Enterprises landed one of the largest Series A rounds I’ve ever seen, making it an instant contender in the race to commercialize fusion energy. Meanwhile, there was a smaller raise for a company aiming to squeeze more juice out of the reactors we already have.

Elsewhere over in Latvia, investors are backing an early stage bid to bring power infrastructure to the moon, while in France, yet another ultra-long-duration battery energy storage company has successfully piloted their tech.

Inertia Enterprises, yet another fusion energy startup, raised an eye-popping $450 million Series A round this week, led by Bessemer Venture Partners with participation from Alphabet’s venture arm GV, among others. Founded in 2024 and officially launched last summer, the company aims to develop a commercial fusion reactor based on the only experiment yet to achieve scientific breakeven, the point at which a fusion reaction generates more energy than it took to initiate it.

This milestone was first reached in 2022 at Lawrence Livermore National Laboratory’s National Ignition Facility, using an approach known as inertial confinement fusion. In this method, powerful lasers fire at a small pellet of fusion fuel, compressing it until the extremely high temperature and pressure cause the atoms inside to fuse and release energy. Annie Kritcher, who leads LLNL’s inertial confinement fusion program, is one of the cofounders of Inertia, alongside Twilio co-founder Jeff Lawson and Stanford professor Mike Dunne, who formerly led a program at the lab to design a power plant based on its approach to fusion.

The Inertia team plans to commercialize LLNL’s breakthrough by developing a new fusion laser system it’s calling Thunderwall, which it says will be 50 times more powerful than any laser of its type to date. Inertia isn’t the only player trying to commercialize laser-driven fusion energy — Xcimer Energy, for example, raised a $100 million Series A in 2024 — but with its recent financing, it’s now by far the best capitalized of the bunch.

As Lawson, the CEO of the new endeavor said in the company’s press release, “Our plan is clear: build on proven science to develop the technology and supply chain required to deliver the world’s highest average power laser, the first fusion target assembly plant, and the first gigawatt, utility-scale fusion power plant to the grid.” Great, but how soon can they do it? The goal, he says, is to “make this real within the next decade.”

In more nuclear news, the startup Alva Energy launched from stealth on Thursday with $33 million in funding and a proposal to squeeze more capacity out of the existing nuclear fleet by retrofitting pressurized-water reactors. The round was led by the venture firm Playground Global.

The startup plans to boost capacity by building new steam turbines and electricity generators adjacent to existing facilities, such that plants can stay online during the upgrade. Then when a plant shuts down for scheduled maintenance, Alva will upgrade its steam generator within the nuclear containment dome. That will allow the system to make 20% to 30% more steam, to be handled by the newly built turbine-generator system.

The company estimates that these retrofits will boost each reactor’s output by 200 megawatts to 300 megawatts. Applied across the dozens of existing facilities that could be similarly upgraded, Alva says this strategy could yield roughly 10 new gigawatts of additional nuclear capacity through the 2030s — the equivalent of building about 10 new large reactors.

Biden’s Department of Energy identified this strategy, known as “uprating”, as capable of adding 2 gigawatts to 8 gigawatts of new capacity to the grid. Alva thinks it can go further. The company promises to manage the entire uprate process from ensuring regulatory compliance to the procurement and installation of new reactor components. The company says its upgrades could be deployed as quickly as gas turbines are today — a five- to six-year timeline — at a comparable cost of around $1 billion per gigawatt.

Deep Space Energy, a Latvian space tech startup, has closed a pre-seed funding round to advance its goal of becoming a commercial supplier of electricity for space missions on the moon, Mars, or even deeper into space where sunlight is scarce. The company is developing power systems that convert heat from the natural decay of radioisotopes — unstable atoms that emit radiation as they decay — into electricity.

While it’s still very early-stage, this tech’s first application will likely be backup power for defense satellites. Long term, Deep Space Energy says it “aims to focus on the moon economy” by powering rovers and other lunar installations, supporting Europe’s goal of increasing its space sovereignty by reducing its reliance on U.S. defense assets such as satellites. While radioisotope generators are already used in some space missions, the company says its system requires five times less fuel than existing designs.

Roughly $400,000 of the funding came from equity investments from the Baltic-focused VC Outlast Fund and a Lithuanian angel investor. The company also secured nearly $700,000 from public contracts and grants from the European Space Agency, the Latvian Government, and a NATO program to accelerate innovation with dual-use potential for both defense and commercial applications.

As I wrote a few weeks ago, Form Energy’s iron-air battery isn’t the only player targeting 100-plus hours of low-cost energy storage. In that piece, I highlighted Noon Energy, a startup that recently demoed its solid-oxide fuel cell system. But there’s another company aiming to compete even more directly with Form by bringing its own iron-air battery to the European market: Ore Energy. And it just completed a grid-connected pilot, something Form has yet to do.

Ore piloted its 100-hour battery at an R&D center in France run by EDF, the state-owned electric utility company. While the company didn’t disclose the battery’s size, it said the pilot demonstrated its ability to discharge energy continuously for about four days while integrating with real-world grid operations. The test was supported by the European Union’s Storage Research Infrastructure Eco-System, which aims to accelerate the development of innovative storage solutions, and builds on the startup’s earlier grid-connected installation at a climate tech testbed in the Netherlands last summer.

Founded in 2023, Ore plans to scale quickly. As Bas Kil, the company’s business development lead, told Latitude Media after its first pilot went live, “We’re not planning to do years and years of pilot-scale [projects]; we believe that our system is now ready for commercial deployment.” According to Latitude, Ore aims to reach 50 gigawatt-hours of storage per year by 2030, an ambitious goal considering its initial grid-connected battery had less than one megawatt-hour of capacity. So far, the company has raised just shy of $30 million to date, compared to Form’s $1.2 billion.

Battery storage manufacturer and virtual power plant operator Sonnen, together with the clean energy financing company Solrite, have launched a Texas-based VPP composed exclusively of home batteries. They’re offering customers a Solrite-owned 60-kilowatt-hour battery for a $20 monthly fee, in exchange for a fixed retail electricity rate of 12 cents per kilowatt-hour — a few cents lower than the market’s average — and the backup power capability inherent to the system. Over 3,000 customers have already enrolled, and the companies are expecting up to 10,000 customers to join by year’s end.

The program is targeting Texans with residential solar who previously sold their excess electricity back to the grid. But now that there’s so much cheap, utility-scale solar available in Texas, electricity retailers simply aren’t as incentivized to offer homeowners favorable rates. This has left many residents with “stranded” solar assets, turning them into what the companies call “solar orphans” in need of a new way to make money on their solar investment. Customers without rooftop solar can participate in the program as well, though they don’t get a catchy moniker.

Current conditions: New Orleans is expecting light rain with temperatures climbing near 90 degrees Fahrenheit as the city marks the 20th anniversary of Hurricane Katrina • Torrential rains could dump anywhere from 8 to 12 inches on the Mississippi Valley and the Ozarks • Japan is sweltering in temperatures as high as 104 degrees.

President Donald Trump has done what he didn’t dare attempt during his first term, repealing the finding that provided the legal basis for virtually all federal regulations to curb greenhouse gas emissions. By rescinding the 2009 “endangerment finding,” which established that planet-heating emissions harm human health and therefore qualify for restrictions under the Clean Air Act, the Trump administration hopes to unwind all rules on pollution from tailpipes, trucks, power plants, pipelines, and drilling sites all in one fell swoop. “This is about as big as it gets,” Trump said alongside Environmental Protection Agency Administrator Lee Zeldin at a White House event Thursday.

The repeal, which is sure to face legal challenges, opens up what Reuters called a new front in the legal wars over climate change. Until now, the Supreme Court had declined to hear so-called public nuisance cases brought by activists against fossil fuel companies on the grounds that the legal question of emissions was being sorted out through federal regulations. By eliminating those rules outright, litigants could once again have new standing to sue over greenhouse gas emissions. To catch up on the endangerment finding in general, Heatmap’s Robinson Meyer and Emily Pontecorvo put together a handy explainer here.

A bill winding its way through Ohio’s Republican-controlled state legislature would put new restrictions on development of wind and solar projects. The state already makes solar and wind developers jump over what Canary Media called extra hurdles that “don’t apply to fossil-fueled or nuclear power plants, including counties’ ability to ban projects.” For example, siting authorities defer to local opposition on renewable energy but “grant opponents little say over where drilling rigs and fracking waste can go.”

The new legislation would make it state policy “in all cases” for new power plants to “employ affordable, reliable, and clean energy sources.” What qualifies as “affordable, reliable, and clean”? Pretty much everything except wind and solar, potentially creating a total embargo on the energy sources at any utility scale. The legislation mirrors a generic bill promoted to states by the American Legislative Exchange Council, a right-wing policy shop.

Get Heatmap AM directly in your inbox every morning:

China’s carbon dioxide emissions fell by 1% in the last three months of 2025, amounting to a 0.3% drop for the full year. That’s according to a new analysis by Carbon Brief. The decline extends the “flat or falling” trend in China’s emissions that started in March 2024 and has now lasted nearly two years. Emissions from fossil fuels actually increased by 0.1%, but pollution from cement plunged 7%. While the grid remains heavily reliant on coal, solar output soared by 43% last year compared to 2024. Wind grew by 14% and nuclear by 8%. All of that allowed coal generation to fall by 1.9%.

At least one sector saw a spike in emissions: Chemicals, which saw emissions grow 12%. Most experts interviewed in Heatmap’s Insiders Survey said they viewed China has a climate “hero” for its emissions cuts. But an overhaul to the country’s electricity markets yielded a decline in solar growth last year that’s expected to stretch into this year.

Sign up to receive Heatmap AM in your inbox every morning:

Rivian Automotive’s shares surged nearly 15% in after-hours trading Thursday when the electric automaker announced earnings that beat Wall Street’s expectations. While it cautioned that it would continue losing money ahead of the launch of its next-generation R2 mid-size SUV, the company said it would deliver 62,000 to 67,000 vehicles in 2026, up 47% to 59% compared with 2025. Rivian CEO RJ Scaringe told CNBC that the R2 would make up the “majority of the volume” of the business by the end of next year. He told investors 2025 was a “foundational year” for the company, but that 2026 would be “an inflection point.”

Another clean energy company is now hot on the stock market. SOLV Energy, a solar and battery storage construction contractor, secured market capitalization eclipsing $6 billion in the two days since it started trading on the Nasdaq. The company, according to Latitude Media, is “the first pure-play solar and storage” company in the engineering, procurement, and construction sector of the industry to go public since 2008.

Israel has never confirmed that it has nuclear weapons, but it’s widely believed to have completed its first operating warhead in the 1960s. Rather than give up its strategic ambiguity over its arsenal, Israel instead forfeited the development of civilian nuclear energy, which would have required opening up its weapons program to the scrutiny of regulators at the United Nations’ International Atomic Energy Agency. That apparently won’t stop the U.S. from building a reactor in Israel to power a joint industrial complex. Washington plans to develop a campus with an advanced microchip factory and data centers that would be powered by a small modular reactor, NucNet reported. So-called SMRs have yet to be built at a commercial scale anywhere in the world. But the U.S. government is betting that smaller, less powerful reactors purchased in packs can bring down the cost of building nuclear plants and appeal to fearful skeptics as a novel spin on the older technology.

In reality, SMRs are based on a range of designs, some of which closely mirror traditional, large-scale reactors but for the power output, and a growing chorus of critics say the economies of scale are needed to make nuclear projects pencil out. But the true value of SMRs is for off-grid power. As I wrote last week for Heatmap, if the U.S. government wants it for some national security concern, the price doesn’t matter as much.

Of all the fusion companies racing to build the first power plant, Helion’s promise of commercial electricity before the end of the decade has raised eyebrows for its ambition. But the company has hit a milestone. On Friday morning, Helion’s Polaris prototype became the first privately developed fusion reactor to use a deuterium-tritium fuel source. The machine also set a record with plasma temperatures 150 million degrees Celsius, smashing its own previous record of 100 million degrees with an earlier iteration of Helion’s reactor.