You’re out of free articles.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Sign In or Create an Account.

By continuing, you agree to the Terms of Service and acknowledge our Privacy Policy

Welcome to Heatmap

Thank you for registering with Heatmap. Climate change is one of the greatest challenges of our lives, a force reshaping our economy, our politics, and our culture. We hope to be your trusted, friendly, and insightful guide to that transformation. Please enjoy your free articles. You can check your profile here .

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Subscribe to get unlimited Access

Hey, you are out of free articles but you are only a few clicks away from full access. Subscribe below and take advantage of our introductory offer.

subscribe to get Unlimited access

Offer for a Heatmap News Unlimited Access subscription; please note that your subscription will renew automatically unless you cancel prior to renewal. Cancellation takes effect at the end of your current billing period. We will let you know in advance of any price changes. Taxes may apply. Offer terms are subject to change.

Create Your Account

Please Enter Your Password

Forgot your password?

Please enter the email address you use for your account so we can send you a link to reset your password:

New analysis from the Environmental Defense Fund shows that domestic production is on track to meet demand.

Back in April, the Environmental Protection Agency announced new vehicle emissions standards that seem poised to transform how our roads look. They’re so strict, according to NPR, that up to 67% of new vehicles sold in 2032 would have to be electric to meet them.

Immediately, it looked like that would be a problem. The Inflation Reduction Act stipulates that, in order to be eligible for tax credits, electric vehicle components — including, crucially, the batteries — can’t be made by a country on the U.S.’s “foreign entities of concern” list. That rules out batteries made in China, which is, unfortunately, the world’s leader in battery manufacturing. As my colleague Emily Pontecorvo recently pointed out, that can lead to situations where nobody knows exactly which EVs qualify for tax credits to begin with. Without an increase in American battery manufacturing, we run the risk of Americans being either unwilling or unable to pay for the EVs that we’d need to hit those EPA standards.

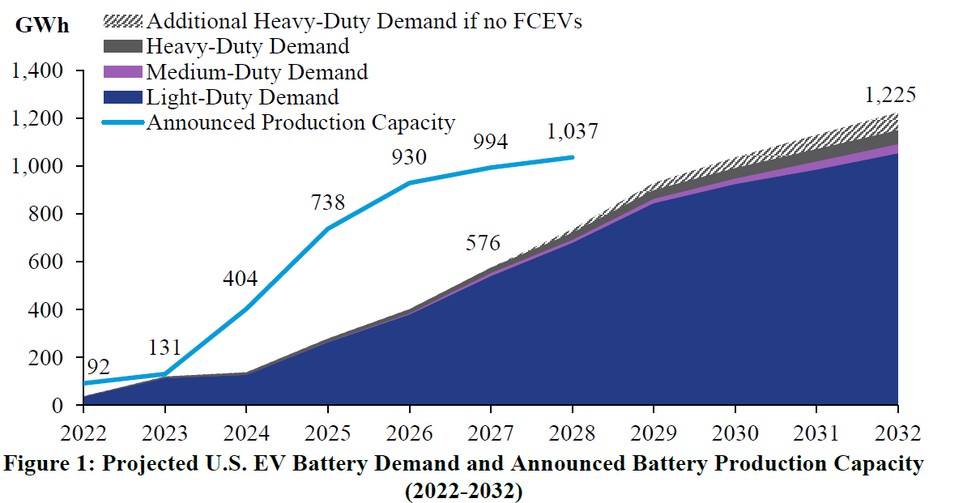

But a new analysis from the Environmental Defense Fund, provided exclusively to Heatmap, shows that things might actually be quite bright on that front. Battery manufacturers around the country — many of them automakers themselves — have announced over 1,000 gigawatt hours of U.S. battery production that’s slated to come online by 2028, far outpacing projected demand.

“A really large investment has been made in the U.S. for domestic battery manufacturing, and many of these [announcements] came before the EPA announced their standards,” Ellen Robo, the author of the report, told me. “This is a transition that is following market trends and is not necessarily being driven by EPA standards, so I think that shows that the EPA’s standards are feasible.”

These findings are in line with a recent report from RMI, which found that demand for EVs rose as battery technology improved, and that investments in battery factories outstrip investments in both solar and wind factories combined. Robo also points out that the announced production capacity line in the above chart will likely change; it usually takes about two years for a battery factory to go from announcement to production in the U.S., and Robo expects to see many more factories announced in the next few years, many of which could be churning out batteries by 2028. The caveat, of course, is that these are mostly just announcements; there could be delays or cancellations that change the timeline.

Still, this all bodes well for both automakers and customers. If automakers are able to source their critical minerals from places that aren’t foreign entities of concern — a requirement that kicks in for 2025 — the IRA tax credits will likely apply to their vehicles. Rather than us writing yet another story about the confusing state of EV tax credits a year from now, that means you could walk into a car dealership safe in the knowledge that you will get a hefty discount on the EV you’ve had your eye on.

But if you’re impatient, as Emily mentioned, you could always take advantage of the tax credit by leasing an EV in the meantime.

Log in

To continue reading, log in to your account.

Create a Free Account

To unlock more free articles, please create a free account.

Read our guide to making better, more informed choices in the fight against climate change here.

Here at Heatmap, we write a lot about decarbonization — that is, the process of transitioning the global economy away from fossil fuels and toward long-term sustainable technologies for generating energy. What we don’t usually write about is what those technologies actually do. Sure, solar panels convert energy from the sun into electricity — but how, exactly? Why do wind turbines have to be that tall? What’s the difference between carbon capture, carbon offsets, and carbon removal, and why does it matter?

So today, we’re bringing you Climate 101, a primer on some of the key technologies of the energy transition. In this series, we’ll cover everything from what makes silicon a perfect material for solar panels (and computer chips), to what’s going on inside a lithium-ion battery, to the difference between advanced and enhanced geothermal.

There’s something here for everyone, whether you’re already an industry expert or merely climate curious. For instance, did you know that contemporary 17th century readers might have understood Don Quixote’s famous “tilting at windmills” to be an expression of NIMYBism? I sure didn’t! But I do now that I’ve read Jeva Lange’s 101 guide to wind energy.

That said, I’d like to extend an especial welcome to those who’ve come here feeling lost in the climate conversation and looking for a way to make sense of it. All of us at Heatmap have been there at some point or another, and we know how confusing — even scary — it can be. The constant drumbeat of news about heatwaves and floods and net-zero this and parts per million that is a lot to take in. We hope this information will help you start to see the bigger picture — because the sooner you do, the sooner you can join the transition, yourself.

Without further ado, here’s your Climate 101 syllabus:

Once you feel ready to go deeper, here are some more Heatmap stories to check out:

The basics on the world’s fastest-growing source of renewable energy.

Solar power is already the backbone of the energy transition. But while the basic technology has been around for decades, in more recent years, installations have proceeded at a record pace. In the United States, solar capacity has grown at an average annual rate of 28% over the past decade. Over a longer timeline, the growth is even more extraordinary — from an stalled capacity base of under 1 gigawatt with virtually no utility-scale solar in 2010, to over 60 gigawatts of utility-scale solar in 2020, and almost 175 gigawatts today. Solar is the fastest-growing source of renewable energy in both the U.S. and the world.

There are some drawbacks to solar, of course. The sun, famously, does not always shine, nor does it illuminate all places on Earth to an equal extent. Placing solar where it’s sunniest can sometimes mean more expense and complexity to connect to the grid. But combined with batteries — especially as energy storage systems develop beyond the four hours of storage offered by existing lithium-ion technology — solar power could be the core of a decarbonized grid.

Solar power can be thought of as a kind of cousin of the semiconductors that power all digital technology. As Princeton energy systems professor and Heatmap contributor Jesse Jenkins has explained, certain materials allow for electrons to flow more easily between molecules, carrying an electrical charge. On one end of the spectrum are your classic conductors, like copper, which are used in transmission lines; on the other end are insulators, like rubber, which limit electrical charges.

In between on that spectrum are semiconductors, which require some amount of energy to be used as a conductor. In the computing context these are used to make transistors, and in the energy context they’re used to make — you guessed it — solar panels.

In a solar panel, the semiconductor material absorbs heat and light from the sun, allowing electrons to flow. The best materials for solar panels, explained Jenkins, have just the right properties so that when they absorb light, all of that energy is used to get the electrons flowing and not turned into wasteful heat. Silicon fits the bill.

When you layer silicon with other materials, you can force the electrons to flow in a single direction consistently; add on a conductive material to siphon off those subatomic particles, and voilà, you’ve got direct current. Combine a bunch of these layers, and you’ve got a photovoltaic panel.

Globally, solar generation capacity stood at over 2,100 terawatt-hours in 2024, according to Our World in Data and the Energy Institute, growing by more than a quarter from the previous year. A huge portion of that growth has been in China, which has almost half of the world’s total installed solar capacity. Installations there have grown at around 40% per year in the past decade.

Solar is still a relatively small share of total electricity generation, however, let alone all energy usage, which includes sectors like transportation and industry. Solar is the sixth largest producer of electricity in the world, behind coal, gas, hydropower, nuclear power, and wind. It’s the fourth largest non-carbon-emitting generation source and the third largest renewable power source, after wind and hydropower.

Solar has taken off in the United States, too, where utility-scale installations make up almost 4% of all electricity generated.

While that doesn’t seem like much, overall growth in generation has been tremendous. In 2024, solar hit just over 300 terawatt-hours of generation in the U.S., compared to about 240 terawatt-hours in 2023 and just under 30 in 2014.

Looking forward, there’s even more solar installation planned. Developers plan to add some 63 gigawatts of capacity to the grid this year, following an additional 30 gigawatts in 2024, making up just over half of the total planned capacity additions, according to Energy information Administration.

Solar is cheap compared to other energy sources, and especially other renewable sources. The world has a lot of practice dealing with silicon at industrial scale, and China especially has rapidly advanced manufacturing processes for photovoltaic cells. Once the solar panel is manufactured, it’s relatively simple to install compared to a wind turbine. And compared to a gas- or coal-fired power plant, the fuel is free.

From 1975 to 2022, solar module costs fell from over $100 per watt to below $0.50, according to Our World In Data. From 2012 to 2022 alone, costs fell by about 90%, and have fallen by “around 20% every time the global cumulative capacity doubles,” writes OWID analyst Hannah Ritchie. Much of the decline in cost has been attributed to “Wright’s Law,” which says that unit costs fall as production increases.

While construction costs have flat-lined or slightly increased recently due to supply chain issues and overall inflation, the overall trend is one of cost declines, with solar construction costs declining from around $3,700 per kilowatt-hour in 2013, to around $1,600 in 2023.

There are solar panels at extreme latitudes — Alaska, for instance, has seen solar growth in the past few years. But there are obvious challenges with the low amount of sunlight for large stretches of the year. At higher latitudes, irradiance, a measure of how much power is transmitted from the sun to a specific area, is lower (although that also varies based on climate and elevation). Then there are also more day-to-day issues, such as the effect of snow and ice on panels, which can cause issues in turning sunlight into power (they literally block the panel from the sun). High latitudes can see wild swings in solar generation: In Tromso, in northern Norway, solar generation in summer months can be three times as high as the annual average, with a stretch of literally zero production in December and January.

While many Nordic countries have been leaders in decarbonizing their electricity grids, they tend not to rely on solar in that project. In Sweden, nuclear and hydropower are its largest non-carbon-emitting fuel sources for electricity; in Norway, electricity comes almost exclusively from hydropower.

There has been some kind of policy support for solar power since 1978, when the Energy Tax Act provided tax credits for solar power investment. Since then, the investment tax credit has been the workhorse of American solar policy. The tax credit as it was first established was worth 10% of the system’s upfront cost “for business energy property and equipment using energy resources other than oil or natural gas,” according to the Congressional Research Service.

But above that baseline consistency has been a fair amount of higher-level turmoil, especially recently. The Energy Policy Act of 2005 kicked up the value of that credit to 30% through 2007; Congress kept extending that timeline, with the ITC eventually scheduled to come down to 10% for utility-scale and zero for residential projects by 2024.

Then came the 2022 Inflation Reduction Act, which re-instituted the 30% investment tax credit, with bonuses for domestic manufacturing and installing solar in designated “energy communities,” which were supposed to be areas traditionally economically dependent on fossil fuels. The tax then transitioned into a “technology neutral” investment tax credit that applied across non-carbon-emitting energy sources, including solar, beginning in 2024.

This year, Congress overhauled the tax incentives for solar (and wind) yet again. Under the One Big Beautiful Bill Act, signed in July, solar projects have to start construction by July 2026, or complete construction by the end of 2027 to qualify for the tax credit. The Internal Revenue Service later tightened up its definition of what it means for a project to start construction, emphasizing continuing actual physical construction activities as opposed to upfront expenditures, which could imperil future solar development.

At the same time, the Trump administration is applying a vise to renewables projects on public lands and for which the federal government plays a role in permitting. Renewable industry trade groups have said that the highest levels of the Department of Interior are obstructing permitting for solar projects on public lands, which are now subject to a much closer level of review than non-renewable energy projects.

Massachusetts Institute of Technology Researchers attributed the falling cost of solar this century to “scale economies.” Much of this scale has been achieved in China, which dominates the market for solar panel production, especially for export, even though much of the technology was developed in the United States.

At this point, however, the cost of an actual solar system is increasingly made up of “soft costs” like labor and permitting, at least in the United States. According to data from the National Renewables Energy Laboratory, a utility-scale system costs $1.20 per watt, of which soft costs make up a third, $0.40. Ten years ago, a utility-scale system cost $2.90 per watt, of which soft costs was $1.20, or less than half.

Beyond working to make existing technology even cheaper, there are other materials-based advances that promise higher efficiency for solar panels.

The most prominent is “perovskite,” the name for a group of compounds with similar structures that absorb certain frequencies of light particularly well and, when stacked with silicon, can enable more output for a given amount of solar radiation. Perovskite cells have seen measured efficiencies upwards of 34% when combined with silicon, whereas typical solar cells top out around 20%.

The issue with perovskite is that it’s not particularly durable, partially due to weaker chemical bonds within the layers of the cell. It’s also more expensive than existing solar, although much of that comes down inefficient manufacturing processes. If those problems can be solved, perovskite could promise more output for the same level of soft costs as silicon-based solar panels.